- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Balance Transfer Advice

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Balance Transfer Advice

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfer Advice

Amex and Discover's APR can be lowered via Chat, so that's good. (I know you said the Discover was a 0% APR -not sure if that was a BT offer or a intro 0% apr or not.)

Try to not let so many balances report if you can. (Like pay the Best buy and USAA off and don't let a balance report to those for a while.) Maybe pay off NFCU cash card then work on the Discover utilization? That way you have 3 cards with zero balances then. What do you think of that?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfer Advice

Perfect! I already lowered my Amex a few days ago, didn't know could chat discover so thank you! Doing that now since the 0% was a BT offer I got.

how can I tell if it will be the same HP? Is it worth it for me to app now for LOC since I've already taken a HP.

Definitely will let the low ones report 0 balance, paying them off now

Edit: Chatted with Discover, and no APR reduction but I did get 0% on purchases for 1 year, so I have 0% on purchases and 0% on BT.

I tried to do SP CLI but it wanted me to authorize HP, should I?

NFCU Platinum, Cash Rewards, Amex More Rewards,

CSP, CFF,

Barclay Arrival,

BoA Cash Rewards, Travel Rewards, Alaska Airlines,

Capital One Venture

Citi Costco

Paypal MC

Best Buy

Discover

Military Star

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfer Advice

@ayeecorreia wrote:Perfect! I already lowered my Amex a few days ago, didn't know could chat discover so thank you! Doing that now since the 0% was a BT offer I got.

how can I tell if it will be the same HP? Is it worth it for me to app now for LOC since I've already taken a HP.

Definitely will let the low ones report 0 balance, paying them off now

Edit: Chatted with Discover, and no APR reduction but I did get 0% on purchases for 1 year, so I have 0% on purchases and 0% on BT.

I tried to do SP CLI but it wanted me to authorize HP, should I?

Unfortunately NFCU will HP you twice if you don't cancel the CLI request on your CC and still apply for the LOC, sadly they don't combine HPs, and they're different departments, CC and LOC.

I can tell you this first hand as I applied for a LOC and CC the same day, two HPs. A couple months later I requested a CLI on my CC, got the 3-5 day message, and also requested a CLI on my LOC, two more HPs...

Oz

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfer Advice

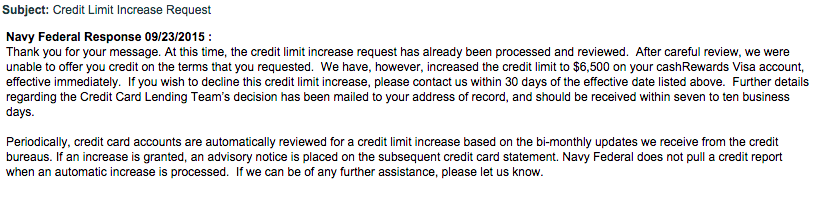

they granted my increase, not what I wanted (I asked for 10k) but an increase is an increase.

Is this time to app for LOC now? ONly reason is I want to have it, and since it appears they let my Cashrewards up now it will be a visa siggy ![]()

NFCU Platinum, Cash Rewards, Amex More Rewards,

CSP, CFF,

Barclay Arrival,

BoA Cash Rewards, Travel Rewards, Alaska Airlines,

Capital One Venture

Citi Costco

Paypal MC

Best Buy

Discover

Military Star