- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Balance or Zero?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Balance or Zero?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Balance or Zero?

Is it better to have a small balance show on your credit cards each month, or have them paid in full for boosting your score?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance or Zero?

From what I've heard, it's good to have a small balance on one card to demonstrate usage, but keep everything else at zero to show responsibility.

Current Score: TU: 741 (Discover FICO); EQ: 755 (MyFico) EX: 774 (FAKO)

Goal Score: 800

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance or Zero?

Depends on your objective. But, generally if you can even keep your util under let's say 4% that's more than adequate. If you plan on making some big purchases (house, car loan, etc) might be better to report $0 for a couple cycles, then maybe small balance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance or Zero?

We are looking to start building a new home (mortgage of $200,000) but need to get out scores up first.

Just last week we were able to get (combined with my husband) 19 medical collections deleted from our reports-so we are waiting for that to be updated.

Some posts say to have zero balance on cards for a score increase and others I read said just to keep your util. under a certain percentage.

thanks for your help!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance or Zero?

@Anonymous wrote:We are looking to start building a new home (mortgage of $200,000) but need to get out scores up first.

Just last week we were able to get (combined with my husband) 19 medical collections deleted from our reports-so we are waiting for that to be updated.

Some posts say to have zero balance on cards for a score increase and others I read said just to keep your util. under a certain percentage.

thanks for your help!

Anecdotally, there appears to be some calculation on number of accounts reporting a balance (any balance).

How much this affects a score is near impossible to say, but most agree if you're trying to maximize your FICO for a given period of time because you have an application coming up, then getting all or most of your cards to $0, and letting some small amount report is optimal. This doesn't quite work for all users, but it seems to be consistent for the majority of them.

Also Lithium: not sure if the usage is right or not, payments over the course of the month get reported to the bureaus, and that presumably is in the information a lender receives on a pull... so they can generally see usage from that alone regardless of the balances reported. FICO has no memory of that for it's score calculation though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance or Zero?

@Revelate wrote:Anecdotally, there appears to be some calculation on number of accounts reporting a balance (any balance).

How much this affects a score is near impossible to say, but most agree if you're trying to maximize your FICO for a given period of time because you have an application coming up, then getting all or most of your cards to $0, and letting some small amount report is optimal. This doesn't quite work for all users, but it seems to be consistent for the majority of them.

Also Lithium: not sure if the usage is right or not, payments over the course of the month get reported to the bureaus, and that presumably is in the information a lender receives on a pull... so they can generally see usage from that alone regardless of the balances reported. FICO has no memory of that for it's score calculation though.

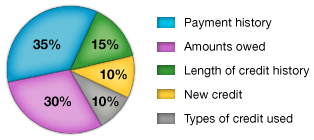

It's not anecdotally at all. What's In Your FICO Score tells us that part of the calculation for Amounts Owed is Number of accounts with balances.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance or Zero?

@Anonymous wrote:We are looking to start building a new home (mortgage of $200,000) but need to get out scores up first.

Just last week we were able to get (combined with my husband) 19 medical collections deleted from our reports-so we are waiting for that to be updated.

Some posts say to have zero balance on cards for a score increase and others I read said just to keep your util. under a certain percentage.

thanks for your help!

According to FICO® this is what they look for in your score:

There is a utilization FICO® spiking game that those looking for credit can use to their advantage. You leave a small balance (like $10, or so), on ONE credit card and all your other cards report a zero balance. This will maximize and ring the most points out of your FICO® score. I've been doing this every month since I learned about it here on myFICO® and it has become a habit. Just don't forget to pay off the $10 before that card's due date!

But yes, its best to have ONE credit card report that small balance while all the rest report zero.

Your history of excellent on time payments counts FOR you but, your number of accounts with balances and, (God forbid) past due balances counts AGAINST you.

Hope this helps!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance or Zero?

@MarineVietVet wrote:

It's not anecdotally at all. What's In Your FICO Score tells us that part of the calculation for Amounts Owed is Number of accounts with balances.

![]() MarineVietVet and I are on the same page!

MarineVietVet and I are on the same page!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance or Zero?

MarineVietVet wrote:It's not anecdotally at all. What's In Your FICO Score tells us that part of the calculation for Amounts Owed is Number of accounts with balances.

Ah, I didn't know that was gospel honestly ![]() .

.