- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Balance transfer question… what would you do ?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Balance transfer question… what would you do ?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance transfer question… what would you do ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance transfer question… what would you do ?

@Anonymous wrote:I skimmed since last post, OP, you need to move 3k or 6k now? You might not get approved on a new card that can handle it. You might just have to move 1500 at a time off that thing to multiple cards. Whatever it takes to not get hit, I know the pain well. I ended up getting a personal loan because i couldn't get a new card with a limit worth even typing last year. The crazy thing was the avant loan I took out (5000) to pay off the motorcycle and one high balance card lagged so bad reporting i had negligible utilization for almost 2 months...and then all the BT deals came in. So what did i do? Yes i paid off the remaining 2500 of the avant right back onto a NFL 0% card. It was stupid luck but saved me hundreds and hundreds. It was a shuffle with all aces on top.

And no, you cant transfer balances from within the same bank. I have been able to mess with terms when a new offer lit up not 2 weeks after the agreement on a different account, but thats not what youre asking.,

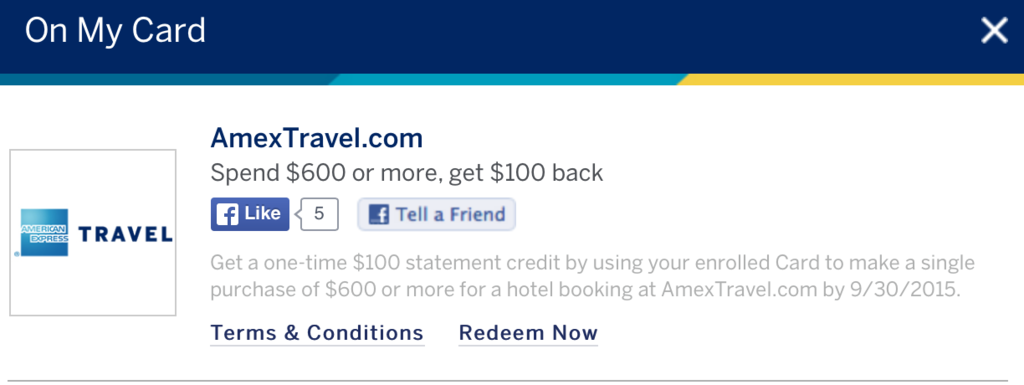

no just $3,000. I probaly just use the 4.99% 18 months Discover NO balance transfer fee.,. I was asking if i can transfer $3,000 from american express platinum onto the american express everyday card ... this way i can get the 100,000 bonus on the platinum and take my time paying that on my everday card 15 months 0%. and 25,000 bonus on everydaycard. But you said you can't transfer balances with the same bank so maybe i can transfer $3,000 from American Express Platinum onto a NO FEE balance transfer card (discover, capitol one or Chase) no balance fee, Then transfer it back to american express (everydaycard) paying a 3% fee. ![]() (if they give me a higher limit than Discover to support it.)

(if they give me a higher limit than Discover to support it.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance transfer question… what would you do ?

Hey OP!

You've been given some good advice. Personally, I like the Citibank Simplicity for balance transfer offers. However, September is right around the corner and I don't know if you have enough time to apply and complete a BT. You probably should do what's best for right now and worry about applying for new credit cards later.

It seems like you may be carrying too much debt and should focus on paying it off. What is your strategy? A BT is not a cure, just a bandage. Please let us know what you decide to do.

Best of luck!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance transfer question… what would you do ?

@beautifulblaquepearl wrote:Hey OP!

You've been given some good advice. Personally, I like the Citibank Simplicity for balance transfer offers. However, September is right around the corner and I don't know if you have enough time to apply and complete a BT. You probably should do what's best for right now and worry about applying for new credit cards later.

It seems like you may be carrying too much debt and should focus on paying it off. What is your strategy? A BT is not a cure, just a bandage. Please let us know what you decide to do.

Best of luck!!!

Exactly. A BT is a bandaid. It's better to focus on just paying the existing debt vs obtaining a new card, in this situation. IMO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance transfer question… what would you do ?

@kdm31091 wrote:

@beautifulblaquepearl wrote:Hey OP!

You've been given some good advice. Personally, I like the Citibank Simplicity for balance transfer offers. However, September is right around the corner and I don't know if you have enough time to apply and complete a BT. You probably should do what's best for right now and worry about applying for new credit cards later.

It seems like you may be carrying too much debt and should focus on paying it off. What is your strategy? A BT is not a cure, just a bandage. Please let us know what you decide to do.

Best of luck!!!

Exactly. A BT is a bandaid. It's better to focus on just paying the existing debt vs obtaining a new card, in this situation. IMO.

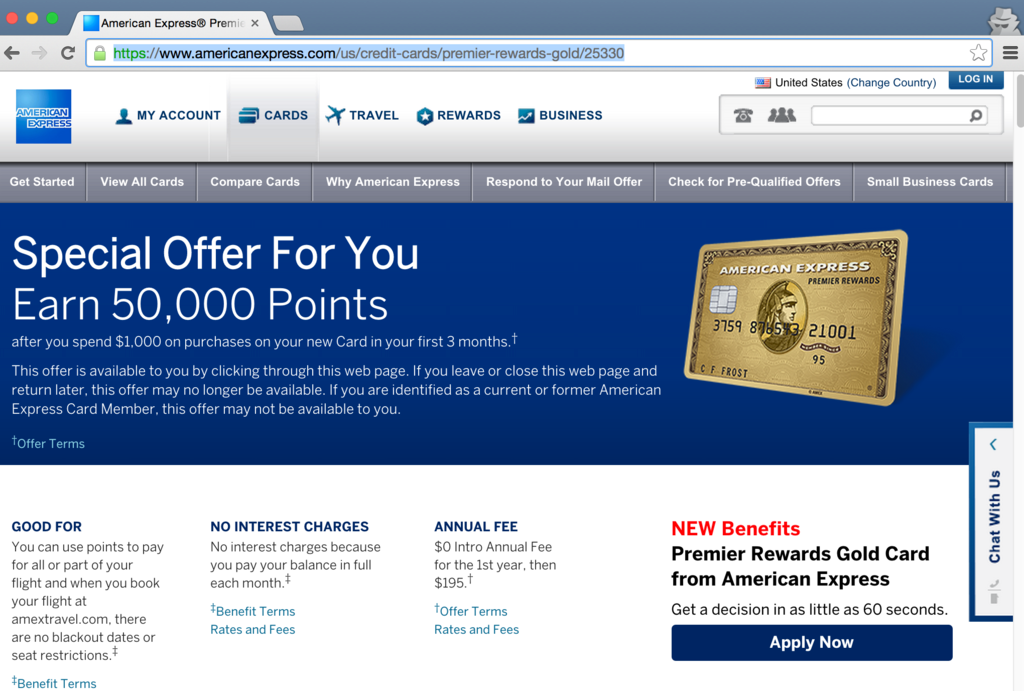

thank you. black friday is coming up and so a new iPad. Iphone i think i will wait for next year (iphone 7) so if i can get a nice bonus or some cash back that's some savings in addiiton to the 0% Intro on new cards. One thing i love about Paypal credit is it's a hidden trade line. Credit line not reported so i try put everything there before using my credit cards. Will see what happens. For now i think i will either leave it alone or take $4,000 from discover 4.99% 18 months. Pay off paypal credit and use the other $1,000 to get 50,000 bonus on gold premier but i have not decided yet. I may just take the waived annual fee american express platinum instead from Ameriprise Financial. Which ever one earns more using amextravel.com and connect it to amexconnect/mycardbenefits and earn even more just in time for the holidays.