- myFICO® Forums

- Types of Credit

- Credit Cards

- Barclay Rewards Card - "Utilities"

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Barclay Rewards Card - "Utilities"

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay Rewards Card - "Utilities"

You're lucky that you're utility providers don't charge a fee for credit card processing! I've been wanting to put my electric bill on the Barclays Rewards but ConEd charges a 3% fee. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay Rewards Card - "Utilities"

@Anonymous wrote:You're lucky that you're utility providers don't charge a fee for credit card processing! I've been wanting to put my electric bill on the Barclays Rewards but ConEd charges a 3% fee.

yep.....my utility company charges a flat fee for using CC to pay...........should not be allowed! I use my card for cell phone though without any problem

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay Rewards Card - "Utilities"

@JSS3 wrote:

@Themanwhocan wrote:

@JSS3 wrote:I put my light bill, Tmobile, and cable bill on there. Got 2 points for each. I also put my water bill but I went through Evolve so only got 1 point. I am going to put my Water"Evolve" bill on Double Cash from now on.

As far as why I don't use Double cash, 2% and 2 points is the same difference. I am trying to build a relationship with Barclays so my limits grow. I currently help my sister and aunt out with their bills and they bring in close to 2,000 per month on my Citi so multiple cards are getting used and paid in full. I'm racking up crazy rewards in the process. There isn't a rewards card now that doesn't have some cashback/Amazon credit sitting there waiting for me. Not to mention cashback from portals(Ebates and TopCash).

I tried the same thing with Barclays. But once I got a $10,000 initial limit on my 3rd Barclay card, I couldnt get another increase on the others no matter how much I used them or how many HP I burned. I'm considering applying for a 4th card and eventually reallocating limits, since I cant do worse than burning HP for no gain whatsoever.

I'm sure the usage lead to getting that $10K limit card on 4/7/2014, but even so, you would think they would eventually give me a little bit more of a total limit. ;0

They did offer to let me reallocate, so worst case I'll end up doing that. $2800 on my 2% card is annoying.

10,000 is good enough for me! Hopefully my plan gets me to that much then I'd be done. So your other card has 2,800. How about the third one? What's the limit on that?

$1600. So Barclays gave me my 2 lowest limits, and I havent gotten them to budge...

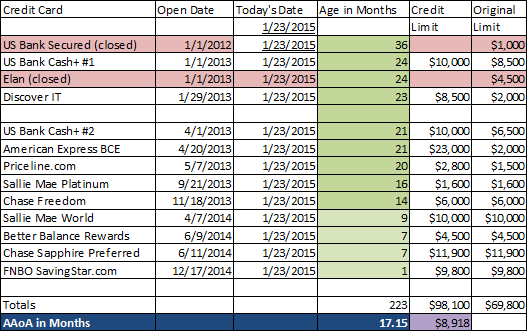

This chart is over 3 months old, so add 3 to the Age in Months.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay Rewards Card - "Utilities"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay Rewards Card - "Utilities"

I get charged a 2.35 convenience fee on light bill and another fee for water. I break even with rewards using a CC now that Serve is no longer fee free. It's still worth it as I'm putting use on cards and building relationships. Plus I don't use cash for anything other than to pay back credit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay Rewards Card - "Utilities"

@JSS3 wrote:I get charged a 2.35 convenience fee on light bill and another fee for water. I break even with rewards using a CC now that Serve is no longer fee free. It's still worth it as I'm putting use on cards and building relationships. Plus I don't use cash for anything other than to pay back credit.

It's funny you say that because last night I was looking at my checking account at the deposits and payments, and it was so easy to look over the past month - 2 deposits from my paychecks, one withdrawal for cash and the rest were paying on the credit cards. Certainly a lot easier to read. The only reason there was a cash withdrawal is because my friend serviced my lawnmower and I gave him cash.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay Rewards Card - "Utilities"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay Rewards Card - "Utilities"

@JSS3 wrote:I get charged a 2.35 convenience fee on light bill and another fee for water. I break even with rewards using a CC now that Serve is no longer fee free. It's still worth it as I'm putting use on cards and building relationships. Plus I don't use cash for anything other than to pay back credit.

If you believe that "building relationships" has any real value! (I don't)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay Rewards Card - "Utilities"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay Rewards Card - "Utilities"

@longtimelurker wrote:If you believe that "building relationships" has any real value! (I don't)

100% agree. I used by Barclay Apple for auto pay of several bills. I asked for a CLI and they responded, "prior use of credit does not support a CLI". I would always PIF monthly and rarely hit 75% of the CL. So basically Barclay was saying, "You do not pay us any interest and we are not making any money on you. So therefore we are not going to give you a CLI because you suck"

@Anonymous I am changing my auto pays over to my NFCU cashRewards where they VALUE you as a customer even if they are not making any money. I typically PIF my NFCU visa. I refinanced a car loan with NFCU @ 2.49%. So my total interest on the car loan is about $500 and they gave me a $250 cash-money bonus for the car loan in my account. So my effective interest rate is .75%. NOW THAT IS VALUING A RELATIONSHIP.

So I will sock drawer my Barclays until they cancel it for lack of activity.