- myFICO® Forums

- Types of Credit

- Credit Cards

- Best Food > Gas > Other rewards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Best Food > Gas > Other rewards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Food > Gas > Other rewards

@TiggerDat wrote:BCP, Cash +, and Sallie Mae, and multiple cards of one or each would probably work even if you had to space out the applications process. Try now for one of each and then in six months try for another of each. I think that would work out. Maybe only one BCP if you only used it for groceries, then use the Cash + cards on restaurants, then use the SMs on gas and you would probably max out for the food and gas categories. I mean Discover does offer 3 months on restaurants and Chase Freedom a different three months, so alternately you get each of those and the Cash+. Get the Cas+ now since Discover is first quarter for restaurants and Freedom is second. (Or just stick to getting 2 Cash Plus, but at least some of the revolving categories are nice with Disc and Freedom.) $250 a month on gas alone would justify the SM card if that is all you used it for. If you spend more than that, then a second card or the Discover and Freedom option still has some benefits.

The restaurants and gas are on different quarters. The Freedom has two different quarters of gas, but one of them is the same as Discover. Depending on what else you might have a need for then it comes down to deciding basically to these 5 cards and how many of each you want. You could possible trick the system in some way by buying gas gift cards in the quarters where Freedom and Discover have the 5% on gas and do the same on restaurant gift cards, if it allowed. I don't know if the system would detect just the gas/restaurant food separately as the gift cards. After all it works out to $1500 a quarter for the rotating or about $500 a month. This beats out SM. So you could get one Sallie Mae and use the gift cards in the quarters that gas is not an option for the rotators.

If gas and grocery spend is big enough, and cashback is good enough, the Amex Blue Cash is the way to go, without having to worry about multiple cards. And then you can buy gift cards to restaurants (if you go to those type of restaurants) at drug stores and supermarkets and get 5% off

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Food > Gas > Other rewards

@TiggerDat wrote:BCP, Cash +, and Sallie Mae, and multiple cards of one or each would probably work even if you had to space out the applications process. Try now for one of each and then in six months try for another of each.

Just curious why you recommend waiting six months between, since it's only four cards and I'm seeing a lot of sprees have success with that many at once.

EX 822

TU 834

EQ 820

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Food > Gas > Other rewards

@Bman70 wrote:

@TiggerDat wrote:BCP, Cash +, and Sallie Mae, and multiple cards of one or each would probably work even if you had to space out the applications process. Try now for one of each and then in six months try for another of each.

Just curious why you recommend waiting six months between, since it's only four cards and I'm seeing a lot of sprees have success with that many at once.

TiggerDat is referring to waiting for 6 months before applying for the same card. Apply for one of each now (i.e. all 3 cards), and 6 months from now another one of each (another 3 cards, well , the same 3!)

However, you really cannot get two BCP or BCE, you can get one of each.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Food > Gas > Other rewards

Oh that makes sense, thanks. I did some calculations and I think I'll be fine with one SM and one BCP. Just wish SM had a Visa - currently 2/3 of my cards are MasterCard, wouldn't mind having a sig line.

EX 822

TU 834

EQ 820

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Food > Gas > Other rewards

@Bman70 wrote:Oh that makes sense, thanks. I did some calculations and I think I'll be fine with one SM and one BCP. Just wish SM had a Visa - currently 2/3 of my cards are MasterCard, wouldn't mind having a sig line.

you can go for an flat 1.5 % QS for everyday spend thats an nice visa to get :-)

EX Fico 804 11/16/16 Fako 800 Credit.com 11/16/16

EQ SW bank enhanced 11/16/16 839 CK fako 822 11/16/16

TU Fico discover 10/19/16 814 Fako 819 Creditkarma 11/16/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Food > Gas > Other rewards

@mongstradamus wrote:

@Bman70 wrote:Oh that makes sense, thanks. I did some calculations and I think I'll be fine with one SM and one BCP. Just wish SM had a Visa - currently 2/3 of my cards are MasterCard, wouldn't mind having a sig line.

you can go for an flat 1.5 % QS for everyday spend thats an nice visa to get :-)

I'm crawling in Quicksilvers lol. Two, that is - since my old HSBC was bought by Cap. I've been trying to pc one of them to a Visa sig line, since it's now at $5900 cl. So far no luck

EX 822

TU 834

EQ 820

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Food > Gas > Other rewards

@j_casteel wrote:

@Themanwhocan wrote:

@evil_ducky wrote:

@longtimelurker wrote:

@evil_ducky wrote:

Groceries/gas --> Amex BCE or BCP; BankAmericard 321 Rewards if you do a lot of grocery shopping at Target or Walmart; Sallie Mae Barclaycard if you spend limited amounts on groceries/gas

Restaurants/Fast Food --> Amex Costco TrueEarnings; US Bank Cash+; quarterly cards like Discover or Chase

Utilities --> US Bank Cash+; Huntington Voice

Amazon --> !Sallie Mae Barclaycard!Well, BCE is never the solution, Sallie Mae is always better for this. Isn't 321 Rewards limited as well, why is that preferable to Sallie Mae

Not everyone spends less than $250 a month on grocery and discount stores, so BCE is a good mid-line alternative for someone who doesn't spend enough to justify the BCP's AF. BCE does give 3% on groceries as opposed to the BofA's 2% and vice versa on the gas, and people have different priorities. But the advantage of the BofA and the Sallie Mae over Amex is the grocery discount as discount stores like Target and Wally World. I just got the Sallie Mae myself as well, but it *is* a small cap for gas and groceries, so I don't assume it will work for everyone.

You and the other posters have excellent answers as well; I just posted mine before I refreshed.

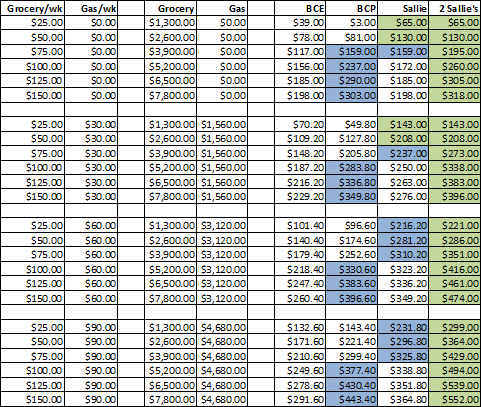

My preferred solution, if you need to spend more than $250 on grocery, is to obtain 2 Sallie Mae cards (apply 6 months apart). The BCP has an annual fee that really cuts down on the cash back percentage.

nice spreadsheet....on the SM's did you apply for the WMC or the Platinum first?

You don't get to choose. I was given the Platinum with a $1600 limit, then when I applied 6 months later I was given the World with a $10,000 limit.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Food > Gas > Other rewards

@takeshi74 wrote:

@Themanwhocan wrote:My preferred solution, if you need to spend more than $250 on grocery, is to obtain 2 Sallie Mae cards (apply 6 months apart).

That is a handy chart but even 2 Sallie's isn't enough for our spend and not quite enough spend for the BC.

Well, you can get at least 2 per person. And I've read about someone who once had 4 of the same card from Barclays, so more is (or at least was) possible. I read it on the Internet, so it has to be true. It has to be...

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Food > Gas > Other rewards

@trumpet-205 wrote:

@clocktick wrote:So is it true that there's absolutely no card that would help specifically with insurance payments?

If you have AAA insurance you can apply BofA AAA Visa, which gives 3% cashback on AAA insurance (except AAA in Northern CA, Utah, and Nevada).

Other than that, no. No card that helps insurance payments.

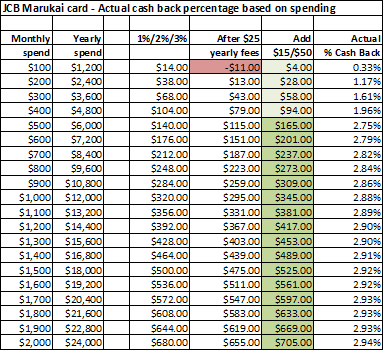

If you are in HI, CA, NV, OR or WA you could get the JCB Marukai card. It claims 3% cash back on all purchases, but like the BCP you never actually get what is claimed. Oh what is this, another chart?

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Food > Gas > Other rewards

TMWC: As the definitive spreadsheet, could you add two columns, Blue Cash (1% up to combined $6,500, then 5%) and BCE+BCP, and add rows for Groceries up to say $400 per week and gas up to $200. You know it will be time well spent!