- myFICO® Forums

- Types of Credit

- Credit Cards

- Best airline miles cards - not the ones backed by ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Best airline miles cards - not the ones backed by airlines

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Best airline miles cards - not the ones backed by airlines

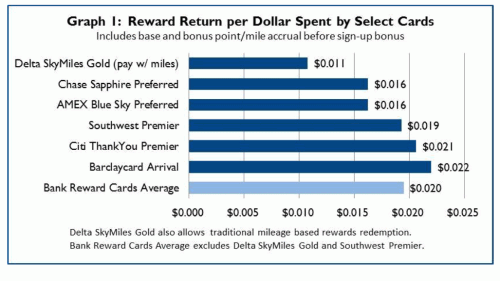

Story on flyertalk and thought I would pass it along.

http://www.frequentflier.com/blog/study-airline-credit-cards-no-longer-the-most-rewarding/

Starting Score: EQ 551 TU 548 CK 607on 6/8/12, EX 542(AMEX pull 3/4/12)

Current Score: EQ 808 TU --- EX --- CK 804(FAKO-EX 821, EQ 823, TU 803)

Goal Score: 750

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best airline miles cards - not the ones backed by airlines

Two thoughts and a snarky comment:

1) They chose the wrong cards to compare. If you're going to compare the Blue Sky and Arrival cards, Discover Miles and Cap One Venture should be on there. Redeeming points for statement credit against travel purchased is completely different than transferring points directly to a travel operator. Might as well throw a Flex Perks card in there, too.

2) They compare point accrual rates, which I guess is somewhat valid. However, they should have included redemption rates as well. Redemption value is a better measure of reward rate, even if it is more highly variable. If I can redeem UR points for 3 cents of value and Barclay miles for only 1.5 cents of value, it doesn't matter that I accrue Barclay miles 1.5 times faster.

3) J.P. Morgan was a funny looking dude.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best airline miles cards - not the ones backed by airlines

@djrez4 wrote:Two thoughts and a snarky comment:

1) They chose the wrong cards to compare. If you're going to compare the Blue Sky and Arrival cards, Discover Miles and Cap One Venture should be on there. Redeeming points for statement credit against travel purchased is completely different than transferring points directly to a travel operator. Might as well throw a Flex Perks card in there, too.

2) They compare point accrual rates, which I guess is somewhat valid. However, they should have included redemption rates as well. Redemption value is a better measure of reward rate, even if it is more highly variable. If I can redeem UR points for 3 cents of value and Barclay miles for only 1.5 cents of value, it doesn't matter that I accrue Barclay miles 1.5 times faster.

3) J.P. Morgan was a funny looking dude.

+1 this is a pretty weird group of cards to compare.

I have both the CSP and the Amex Delta. There are so many different ways to use the rewards on each there is no way to compart them numerically

I have gotten 3 cents per dollar spent on some reward tickets and less than 1 cent on others using the Delta, I know I'm going to get at least 1.25 or 2.50 cents per dollar spent plus 7% on the CSP and could get even more transfering to travel partners

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best airline miles cards - not the ones backed by airlines

This group of cards is random. I don't put much weight on this chart.

Plane tickets: CSP

Groceries: AMEX BCP, Penfed Platinum Rewards,Citi TYP

Clothes: Express, Amex BCP, Discover IT

Amazon: Citi Forward, Cash +

Restaurants: Citi Forward, Chase Freedom, Discover IT, CSP

Hotels and other travel: Discover Escape, CSP

Movies: BofA travel rewards visa signature(fandango), Discover IT, Citi Forward, Freedom

Bars, clubs, tomfoolery: CSP, Citi Forward, Discover IT, Freedom

Balance transfers: Kroger 123 rewards

Bill Pay: Chase Ink Plus, Citi Forward,

Everyday spending: Bofa Accelerated cash rewards amex, Discover Escape

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best airline miles cards - not the ones backed by airlines

@djrez4 wrote:Two thoughts and a snarky comment:

1) They chose the wrong cards to compare. If you're going to compare the Blue Sky and Arrival cards, Discover Miles and Cap One Venture should be on there. Redeeming points for statement credit against travel purchased is completely different than transferring points directly to a travel operator. Might as well throw a Flex Perks card in there, too.

2) They compare point accrual rates, which I guess is somewhat valid. However, they should have included redemption rates as well. Redemption value is a better measure of reward rate, even if it is more highly variable. If I can redeem UR points for 3 cents of value and Barclay miles for only 1.5 cents of value, it doesn't matter that I accrue Barclay miles 1.5 times faster.

3) J.P. Morgan was a funny looking dude.

My apologies for hijacking the thread, but I noticed that you have an Ink Bold, djrez4, in your alignment of cards. I'm in the process of starting a buisness, and I curious as to why did you choose the ink bold over the ink cash?

Thanks,

Amex BCE $13K | Amex Costco TE $10.4K | Amex SPG $5K | Chase Freedom Visa Signature $15K | Chase Sapphire Preferred Visa Signature $15K | Chase Ink Plus World Elite MC $5K | Citi TY Preferred World MC $10.1K | Citi Forward $10K | Citi Diamond Pref $7.6K | Discover IT $9.9K | JP Morgan Chase Select Visa Signature $9.2K | NFCU CashRew Visa Sig $25K | NFCU LOC $15K | NFL Visa Signature (Saints) $8.1K | USAA Amex $11.3K | USAA World MC $11.5K