- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Best all-in-one high purchase 1k mo Gas and Gr...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Best all-in-one high purchase 1k mo Gas and Grocery Card

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best all-in-one high purchase 1k mo Gas and Grocery Card

@kdm31091 wrote:The Barclay Rewards is good for average credit (whether that's the case here or not I don't know), and many are not able to get a decent, useable limit on the Double Cash. While 2% on everything is better than 2% on some things, if you cannot obtain a Double Cash or can't get a good limit on it, you have to look at other options too even if they are somewhat lesser.

Right. but those caveats weren't in the post, it was a recmmendation for the card. Equally, you might need to get a secured card if your scores are too low, or you might be blacklisted by Barclays or ..... etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best all-in-one high purchase 1k mo Gas and Grocery Card

@FrancoB wrote:I know he wants 1 card but to maximize value back as much as possible you need more than one.

Freedom is a no anual fee card and you get 5% on gas up to $1500 in the bonus months. Also on Groceries.

Amex Everyday Preferred gets you 4.5 MR in groceries and 3 MR on gas year round on up to 6k. (assuming you make 30 transactions every month which is very easy)

Discover IT 5% on gas too, but it looks like they are matching Freedom for the same period, he could buy gas giftcards to use later on.

Does your friend cares about travel benefits at all or jut cash back?

He delivers across country and sleeps in his van so I really don't think he spends on "travel".

I would say gas and any snack/food he buys there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best all-in-one high purchase 1k mo Gas and Grocery Card

If that's the case he won't get much value of the MR or UR programs. Straight cash back then

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best all-in-one high purchase 1k mo Gas and Grocery Card

@Anonymous wrote:

@FrancoB wrote:I know he wants 1 card but to maximize value back as much as possible you need more than one.

Freedom is a no anual fee card and you get 5% on gas up to $1500 in the bonus months. Also on Groceries.

Amex Everyday Preferred gets you 4.5 MR in groceries and 3 MR on gas year round on up to 6k. (assuming you make 30 transactions every month which is very easy)

Discover IT 5% on gas too, but it looks like they are matching Freedom for the same period, he could buy gas giftcards to use later on.

Does your friend cares about travel benefits at all or jut cash back?

He delivers across country and sleeps in his van so I really don't think he spends on "travel".

I would say gas and any snack/food he buys there.

He probably eats at restaurants (fast food or otherwise). Does he buy his own gas, or is that provided by the company?

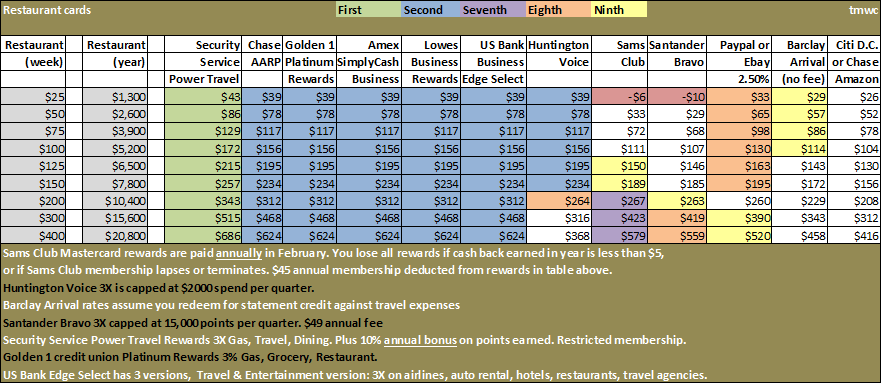

If he can get Security Service Power Travel Rewards card, that gives 3X on Gas, Travel, Dining, plus 10% Annual bonus that boosts that to 3.3X, otherwise Chase AARP or Golden 1 Platinum rewards. Though it sounds liek he might be running his own delivery business, if so he coudl aly for Business cards, which expands the possibilities.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best all-in-one high purchase 1k mo Gas and Grocery Card

@Anonymous wrote:

@FrancoB wrote:I know he wants 1 card but to maximize value back as much as possible you need more than one.

Freedom is a no anual fee card and you get 5% on gas up to $1500 in the bonus months. Also on Groceries.

Amex Everyday Preferred gets you 4.5 MR in groceries and 3 MR on gas year round on up to 6k. (assuming you make 30 transactions every month which is very easy)

Discover IT 5% on gas too, but it looks like they are matching Freedom for the same period, he could buy gas giftcards to use later on.

Does your friend cares about travel benefits at all or jut cash back?

He delivers across country and sleeps in his van so I really don't think he spends on "travel".

I would say gas and any snack/food he buys there.

Go for the "Old" Blue Cash from AMEX.

One card to rule them all, as longtimelurker said. Not BCE, not BCP.

Must try from incognito browser. Don't open in a browser which you use to access AMEX regularly.

https://www304.americanexpress.com/credit-card/blue-cash/25330

If annual spend is $30k, fits very well. Mostly gas, groceries and snacks bought at gas stations. BCE or BCP (or even Sallie Mae) won't give half the cashback that this card will give.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best all-in-one high purchase 1k mo Gas and Grocery Card

@Anonymous wrote:1k a month in gas= 12000 a year.

30k-12k would leave about 18k.

I'm going about 1/2 is groceries

but alot is food/snacks at gas stations/truck stops?

You need to verify the numbers and the category breakdown for "food" and "groceries". It's how merchants are coded that matters. IIRC most gas rewards have an at the pump stipulation and gas stations and truck stops aren't likely to be coded as groceries. Once you have the numbers you just need to run them. Without the details I'm guessing it's the OBC and/or a 2% card.

@Anonymous wrote:but he would have to be old enough to join AARP right.. and be a member ($)

Nope. You can always check the site for the card to verify yourself.