- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Best app strategy?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Best app strategy?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best app strategy?

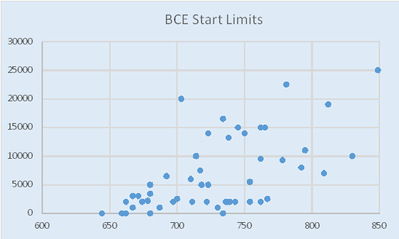

I would absolutely positively say go for Navy- esp if you want good limits. The worst thing that'll happen with them is a 2-5000 SL that could very easily grow to $20k in 4 months!!

Total CL $398600, plus car and RV loan.

Ooh. Ooh. Getting closer to that $500K mark!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best app strategy?

Remember that these are all just opinions and suggestions. Once you hit apply you're stuck with the product.

I would grab 1 card now with a 700 EQ. PenFed or whatever (If it's a card I would use). Then when Chase shows me any pre-qual I would try for the travel card of my choice (CSR or RC 10k min).

1 or 2 cards at a time. Slow and steady... meeting spends and building green marks on my reports.

I like that you are discussing it here before you make your move. Study Every card and be sure it is something you will use or combine in the future.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best app strategy?

Make sure you optimize the reported utilization of the cards you have. check wallethub.com daily to make sure you have all $0 reporting except for one card reporting a small amount.

You might be able to get a good limit with a US Bank Platinum card. It has no rewards, but the platinum will have lower apr and higher limits, and you can always convert it to a card that has cash back at a later time. US bank uses FICO 04 bankcard scores, so its important to have no new cards on your credit reports for at least the past 6 months. So this is something you could try for as a first application.

A second card to apply for might be the American Express Blue Cash Everyday. You might qualify for a $2000 starting limit if they approve you.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best app strategy?

@Anonymous wrote:

Thanks as well for the post. I don't think waiting 6 more months will being scored up 50+ points. The capital one secured at 3300 is already over 2 years and I do t have any balance on any of the cards. It's either garden for years more or try to establish some decent cards and work on cli on those wouldn't it? Shouldn't I try to get at least 2-3 better cards and work on building those? If so would it be best to app them all at once? I appreciate the feedback!

If you have $0 balances reported on all of your cards you are losing probably 20-25 points off of your scores right there. You always want one CC to report a small (say $10) balance to maximize your FICO scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best app strategy?

FYI the secured Amex is also 1.5 years old.

Also I have gone to chase, bofa etc pre-qualification sites and it doesn't show anything available I believe because my credit score has just raised so much recently when I paid everything off.

With all that said what do I do now? If I'm hearing what's been said so far:

Penfed

Amex

Chase

Navy fed

Still back the original question of what order do I app and how do I go about doing it?

I think waiting 6 more months is not the option. The 2 collections are over 2 years old so their impact isn't going to really get much better. All cards are paid, yes I can put 5% on one card but this won't raise scores another 20-25 points as my scores are all at the very highest they have been.

Any advise on which cards to app in what order as my Leigh al question was is much appreciated!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best app strategy?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best app strategy?

1. Chase EX/TU to be 5/24 compliant. App tends to go pending on many folks so don't be discouraged if it does. CSP Freedom or unlimited are all good. CSP and freedom are pretty sweet together.

2. Penfed EQ, the lower the inqs and new acts the better. Membership required (make sure you have proof of ID and paystubs beforehand just in case)

3. Amex EX. BCE is a good one. Looks like you've already got a foot in the door too.

4. USAA EQ, membership required?

5. Navy ??, membership required.

Google credit pulls database for the usaa platinum. Scores and SL are all over the place. Just please think about this one more time: Are you SURE you don't wanna pick up just one or two for now, then grow them and what you've already got?

OP I wish you much luck and look forward to seeing some approval posts soon.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best app strategy?

@Anonymous wrote:

Thanks everyone for all the replies and feedback. So to answer some more questions, my cards wer all near limit for over a year while I saved enough to pay them off. I have just recently cleared the balance on all of them. The $3300 capital one will never graduate which is my longest aged card (2years) so getting rid of this card is not an option until I apply and get better cards. The discover and Amex secured should unsecure but because balances wer just paid off recently it could be several more months. It doesn't matter though as all 3 secured cards are not reporting to any of the 3 as a secured card. This just leaves the quicksilver capital one that is not secured which I didn't want to hit the cli button until I got better cards with higher limit to help increase the odds of getting a higher limit with it.

You've got this backwards. A higher limit on your current card will help you get a higher limit on your apps. Go for the CLI now, then app.

FYI the secured Amex is also 1.5 years old.

Also I have gone to chase, bofa etc pre-qualification sites and it doesn't show anything available I believe because my credit score has just raised so much recently when I paid everything off.

With all that said what do I do now? If I'm hearing what's been said so far:

Penfed

Amex

Chase

Navy fed

Still back the original question of what order do I app and how do I go about doing it?

I think waiting 6 more months is not the option. The 2 collections are over 2 years old so their impact isn't going to really get much better. All cards are paid, yes I can put 5% on one card but this won't raise scores another 20-25 points as my scores are all at the very highest they have been.

Well, maybe not 20-25 points for your particular profile, but you absolutely will get a score boost by having a balance report on one card. It is a VERY well known fact around here that to optimize your score you need to have 1 card report a balance that is 1-9% of your CL and all others 0 balance. Reporting 0 balances hurts your score because they want to see that you can manage your credit, and that requires actual use.

Any advise on which cards to app in what order as my Leigh al question was is much appreciated!