- myFICO® Forums

- Types of Credit

- Credit Cards

- Best methods to increase credit score?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Best methods to increase credit score?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Best methods to increase credit score?

Hi. I'm new here and recently got a Discover credit card. I'm confused about a few things. I have used ~$100 of my $1000 CL. I want to make sure the credit card companies (the big three) see that I have utilized my credit card. That's why I don't pay if off immediately and I wait until my due date, which is the first of every month. Is it a wise strategy to pay it right on the due date, before the due date, or a little after the due date..? Thanks a lot and happy thanksgiving!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best methods to increase credit score?

If you want to make sure that it reports a balance, I'd pay it whenever you get the email that says "You have a statement available" or after. As long as there was a balance on the statement, it'll report that to the CRAs, and it'll show that you use it. Other than that, it doesn't matter when you pay (as long as it's before the due date).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best methods to increase credit score?

From what I have read several times, it's best to pay down your balance before the statrment cuts, and to have ideally less than 9% to report.

Example... I have a card with a $1k limit... I use thru the month, and may rack up $600 on it, but a week-week and a half before the statement cuts, I pay it down to 2%. I'm rebuilding, so I keep my reported util lower.

You will have the experts chime in here though soon, and will tell more....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best methods to increase credit score?

If you are concerned about maximum FICO scoring, then have your reported balance be less than 10%. If you have more than one rev cc, then only have one cc report a balance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best methods to increase credit score?

@megaman1 wrote:Hi. I'm new here and recently got a Discover credit card. I'm confused about a few things. I have used ~$100 of my $1000 CL. I want to make sure the credit card companies (the big three) see that I have utilized my credit card. That's why I don't pay if off immediately and I wait until my due date, which is the first of every month. Is it a wise strategy to pay it right on the due date, before the due date, or a little after the due date..? Thanks a lot and happy thanksgiving!!

That is one of the BIGGEST myths. Credit card companies look at your daily transactions, and the amount in total that you have spent over a period of time, not the balance on the account when the cycle ends. I was talking to a Discover person the other day and I asked him similar questions and he said that is not how it is handled. They see that you have utilized your card by the daily transactions, not the balance sitting on your card. I pay my card in complete full once a week, sometimes even more frequent. I pay the balance off before it even shows up as due. And I asked the guy if that is bad or makes a difference between letting it show up as due, and he said there is no difference at all and that they don't look at it as a macro standpoint, they look at it as a micro standpoint and follow your day to day transactions.

Either way, whether it is a day after you made an transaction or a day before the cycle ends, you should pay your card in complete full. Having a balance carry over does nothing for you. 0% utilization on a card you use very frequently is what you should be aiming for. That improves your credit and also greatly improves your chances of that company giving you a very large credit increase.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best methods to increase credit score?

While they certainly pay a lot of attention to your daily transactions on their card, that doesn't mean they report the total of them as your utilization.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best methods to increase credit score?

It's true lender A would know the daily transactions for their card but lender B would not have any idea about lender A's daily transactions. High balances and recent balances are listed on the CRs ...not daily balances.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best methods to increase credit score?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best methods to increase credit score?

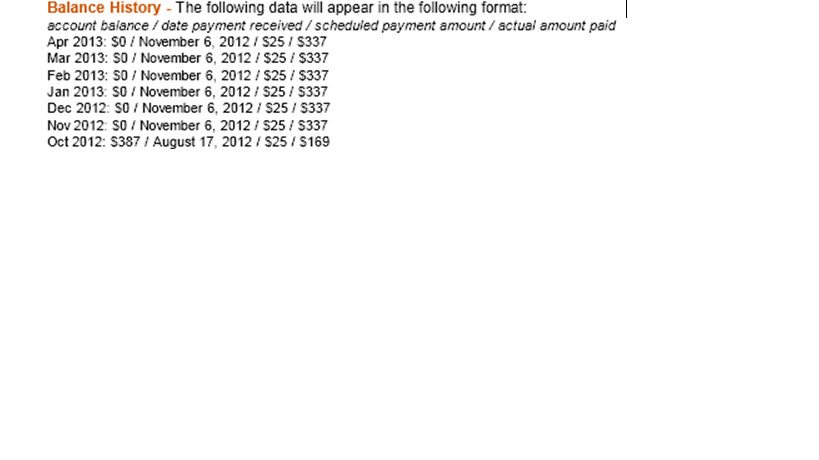

Not exactly true, depending on report that is used, EX for example reports Balance, payment, and date of payment, other lenders can see your usage even if no balance is left on the card, below is from an old EX report I pulled last year.

Landmarkcu Personal Loan 10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best methods to increase credit score?

@jamesdwi wrote:Not exactly true, depending on report that is used, EX for example reports Balance, payment, and date of payment, other lenders can see your usage even if no balance is left on the card,]

OK, but the point of this thread was to give advice on how to show usage for the purpose of credit scoring in order to be in a better position with lenders to apply for future tradelines. Stating that it doesn't matter, since some reports show previous payment amounts, is not a helpful response. Having a small amount of usage report on the statement does matter, it has been proven to increase the FICO (as opposed to having all accounts at $0 balance), and most lenders are going to partly be basing their decision to extend credit on the score that they pull.