- myFICO® Forums

- Types of Credit

- Credit Cards

- Bye, Bye Target card...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Bye, Bye Target card...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bye, Bye Target card...

I stopped into my local Target store to pick up an online order and do some shopping. Didn't have any problem with the online order being charged the charge for the other itmes was declined. I called while standing there and was told that the account had been closed. I didn't want to hold up the line so I used a different card then called back after I got home. I was told the account was closed because I had a few payments that were returned. I did have a few that were returned in the past because I had the wrong account info listed for payments. I think it was a digit off but I didn't take the time to figure it out. Just deleted the old info an slowly entered everything in again. This month's payment was bounced back before I didn't transfer enough money into that account to cover the Target payment along with my insurance payment. Forgot about the insurance. I found that the payment had been bounced back when I logged into the account this morning and saw a balance. Thought it was going to say $0.00. Can't totally fault them because I did make the mistake. Would have been nice to get a heads up though. Oh well... they did say that I could reapply. I'm not going to waste an inquiry to possibly get another Target card. And if I did get one, it might not have a $3K limit like the one that was closed.

Current Scores - EQ - 687 / TU - 663/ EX - 677

TD Bank - $5000 / Mercury - $5000 / Capital One Savor One- $5000 / SDFCU Secured - $4990 / Capital One QuickSiver - $4500 / Ally Master Card - $2800/ Walmart Mastercard - $2250

Andrews FCU SSL $1500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bye, Bye Target card...

Sorry this happened, but you understand why. You must pay as much attention to your credit as you would keeping your eyes on the road while driving. This is coming from one who used to get in all kinds of trouble like this, and most of it was just from being busy, laxidaisical and just not paying attention. Fortunately, I've gotten myself to the point where I pay a bill as soon as I see the statement. In doing so, I am able to check in a couple days and make sure the funds were properly credited and the money actually left my bank account. When you pay well before due, you have plenty of time to catch errors. When I set up a payment method in a new account I go slow, check and recheck my numbers and info. This cannot be a hurried process. Best of luck to you in the future and let this be a learning experience.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bye, Bye Target card...

Yeah, I definately learned from this and will admit when I'm wrong. Funny thing about each payment is they were all made before the statement cut. Little speed bumps with this account caused a crash.

Current Scores - EQ - 687 / TU - 663/ EX - 677

TD Bank - $5000 / Mercury - $5000 / Capital One Savor One- $5000 / SDFCU Secured - $4990 / Capital One QuickSiver - $4500 / Ally Master Card - $2800/ Walmart Mastercard - $2250

Andrews FCU SSL $1500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bye, Bye Target card...

Agree. I have a Target Visa from eons ago and have had no issues (knock on wood). Besides, the OP went as far as sharing his experience (including admitting mea culpa) so that others are aware.

An item to keep in mind, aside from Target, there are other lenders who will close accounts if there is a repeated pattern of NSFs and/or non-adherence to the T&C, namely Comenity and Synchrony for instance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bye, Bye Target card...

sorry OP. back when I first got target red card, i set up my bank account info wrong too and had a returned payment. but I also sign into my accounts like 4-5 times a week so I know whats up always lol and I had made the payment 20 days early, so there were no problems. so you really bounced one payment with target and they shut you down? im sorry! and with target there is no one to speak to that has authority to do anything. A 3k limit on that card is good, but oh well you are not missing out on anything spectacular.

I have had this card for almost 3 years and the limit will never move

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bye, Bye Target card...

@ddemari wrote:sorry OP. back when I first got target red card, i set up my bank account info wrong too and had a returned payment. but I also sign into my accounts like 4-5 times a week so I know whats up always lol and I had made the payment 20 days early, so there were no problems. so you really bounced one payment with target and they shut you down? im sorry! and with target there is no one to speak to that has authority to do anything. A 3k limit on that card is good, but oh well you are not missing out on anything spectacular.

I have had this card for almost 3 years and the limit will never move

The OP stated he had 'several' payments returned, not just one. While it is still lousy, at least in this case there's a clear cause/effect for the action that was taken.

Something that's important to remember is that even if a returned payment is well before the due date and a 'successful' payment is completed before the DD, it still counts as a NSF to the lender - even if there's no late fee. While this doesn't impact your credit report, it clearly matters to many lenders.

I allow a few of my creditors to keep my bank info on file for payment purposes, and I guess I'm just paranoid in that I always do a 'copy and paste' from my bank's web site when I enter the account number. A benefit of using your checking account's bill pay service to do an ACH 'push' is that if a payment fails, there's no impact to your history with the lender (assuming you catch it and have it corrected before the due date).

To the OP, thanks for sharing with us. This is a good reminder to us all to take great care when entering account/payment details, and to really keep an 'eye' on things, especially the first time with a new account number.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

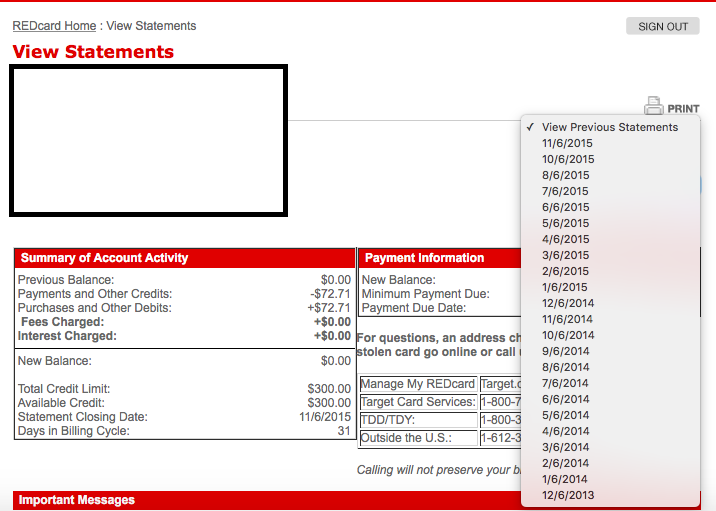

Re: Bye, Bye Target card...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bye, Bye Target card...

I don't blame you. My Target card is sitting at $1,500 credit limit and won't budge. Thinking about getting rid of mine.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bye, Bye Target card...

Were delinquent?

If you were not seriously delinquent they should not have closed your account, that's the only way to bring customers to the store

I am sure they charged you a returned patment fee. I think target just lost a customer. No wonder why they're closing stores left and right.

Sorry. Don't do it again!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content