- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: CAP ONE raised the AF on the Venture Card

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CAP ONE raised the AF on the Venture Card

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CAP ONE raised the AF on the Venture Card

@Revelate wrote:

@Anonymous wrote:

@Anonymous wrote:Chase's ridiculous 5/24 on CSP is literally putting money into Capital One's pockets -- massive money. Remember that CSP advertises as a 2X card even though it's more than 2X on travel earning->redemption.

So Capital One's Venture is a "2X" card but not equal to Chase's better 2X.

Since people can't get CSP so easily, they just go to Capital One who is happy to give everyone huge SLs.

$95/year is easy money for them. Good on Capital One for profiting from Chase's jealousy.

Right, and why would you pay $95 AF on 2x everything when a card like $0 AF Citi DC exists.

There is no real competition when it come to this card.

You're paying 95 a year for a worthless slab of metal.

Fee for foreign purchases – 3% of the U.S. dollar amount of each purchase.

Because of that on the DC. As others have intimated this is a competitor vs the CSP and similar offerings from Barclays/Amex et al. Citi DC is a different beast for a different type of consumer... for all that we blend it altogether here.

Well, as a later post says, there are alternative cards that have no FTF and give an unrestricted 2% But even if that wasn't the case, this would be a relatively niche use. Compared to using the DC, you would win with the venture only if you spend over $3K on FTF per year ($9,500 compared with the Fidelity Visa with a 1% FTF, and never with the other FTF free cards). But IMO another good comparison is with using the DC (or other 2%) with the free QS for foreign purchases. You get 0.5% less on those but no AF, and you would need to spend $19K on FTF transactions to come out ahead.

So while there are such cases (and probably other cards are better, including the Arrival +, for these), I would bet that most Venture fans on this forum can't really justify it on FTF grounds. Of course, if you can get the AF waived, then it is a different proposition

And IMO it is really not a competitor with the CSP, as it lacks the transfer to partner capability.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CAP ONE raised the AF on the Venture Card

@longtimelurker wrote:

@Revelate wrote:

@Anonymous wrote:

@Anonymous wrote:Chase's ridiculous 5/24 on CSP is literally putting money into Capital One's pockets -- massive money. Remember that CSP advertises as a 2X card even though it's more than 2X on travel earning->redemption.

So Capital One's Venture is a "2X" card but not equal to Chase's better 2X.

Since people can't get CSP so easily, they just go to Capital One who is happy to give everyone huge SLs.

$95/year is easy money for them. Good on Capital One for profiting from Chase's jealousy.

Right, and why would you pay $95 AF on 2x everything when a card like $0 AF Citi DC exists.

There is no real competition when it come to this card.

You're paying 95 a year for a worthless slab of metal.

Fee for foreign purchases – 3% of the U.S. dollar amount of each purchase.

Because of that on the DC. As others have intimated this is a competitor vs the CSP and similar offerings from Barclays/Amex et al. Citi DC is a different beast for a different type of consumer... for all that we blend it altogether here.

Well, as a later post says, there are alternative cards that have no FTF and give an unrestricted 2% But even if that wasn't the case, this would be a relatively niche use. Compared to using the DC, you would win with the venture only if you spend over $3K on FTF per year ($9,500 compared with the Fidelity Visa with a 1% FTF, and never with the other FTF free cards). But IMO another good comparison is with using the DC (or other 2%) with the free QS for foreign purchases. You get 0.5% less on those but no AF, and you would need to spend $19K on FTF transactions to come out ahead.

So while there are such cases (and probably other cards are better, including the Arrival +, for these), I would bet that most Venture fans on this forum can't really justify it on FTF grounds. Of course, if you can get the AF waived, then it is a different proposition

And IMO it is really not a competitor with the CSP, as it lacks the transfer to partner capability.

Why is the average consumer picking up a Venture anyway?

Educated consumer, when someone has to resort to picking 3 CU's (who the overwhelming majority of Americans will never have heard of) and a limited access financial institution regardless of how many people qualify... none of that is as mainstream as Capital One that anyone who's watched an NFL game (among other media they advertised on) in the last decade probably knows.

What's in their wallets? None of those cards, and people don't look even stupid things up on the Internet sometimes.

Good point on the transfer parter bit, that I'll grant a lot more people know about, but hell even on this forum we can't get people do the math on AF's, how many typical consumers out there are going to do the math on Forex fees or will they more likely read the plethora of travel blogs that all state: "Get a card with no forex fee" Enter Cap 1 as the mass market advertised card without it.

We're the outliers here, Cap One is not designing nor marketing this card to us ![]() .

.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CAP ONE raised the AF on the Venture Card

@Anonymous wrote:Right, and why would you pay $95 AF on 2x everything when a card like $0 AF Citi DC exists.

There is no real competition when it come to this card.

You're paying 95 a year for a worthless slab of metal.

Because Citi can be finicky, too. I still don't prequalify for any Citi products, despite being granted 5 figure SL by everybody else in 2017.

Assuming one is educated on their credit and knows what their 2% options are (and let's be honest, the Venture is a 2% cashback card with limited redemption options, not a miles card), they just might not be at the point in their credit lives that they can get a Chase or a Citi, or they don't qualify for a PenFed.

Now, all that being said, $95 is pretty steep for just a cashback card with no other perks. I'm tempted to keep my Venture as long as the AF stays at $49. The only other option is to either roll it into my QS, where the CL becomes high enough to worry about a CLD due to non-use, or PC it to a second QS (because why would I want a VentureOne vs a QS?)

NFCU MR: $25K | Venture: $21K | Amex ED: $18K | NFCU CR: $18K | Amex BCE: $15K | IT #1: $17.5K | PNC Core: $15K | PPMC: $12K | Wells Fargo: $11K | Savor: 12K | Cap1 QS: $8.5K | Barclays Rewards: $7.75K | IT #2: $7.3K | MLife: $9.5K | Sportsman's Guide: $8.7K | PenFed PR: $5.5K | Elan Plat: $2.3K | TRV: $3.6K | BotW: $3K

Current FICO 8 Scores: EQ: 828| TU: 805 | EX: 814

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CAP ONE raised the AF on the Venture Card

@Revelate wrote:Why is the average consumer picking up a Venture anyway?

Educated consumer, when someone has to resort to picking 3 CU's (who the overwhelming majority of Americans will never have heard of) and a limited access financial institution regardless of how many people qualify... none of that is as mainstream as Capital One that anyone who's watched an NFL game (among other media they advertised on) in the last decade probably knows.

What's in their wallets? None of those cards, and people don't look even stupid things up on the Internet sometimes.

Good point on the transfer parter bit, that I'll grant a lot more people know about, but hell even on this forum we can't get people do the math on AF's, how many typical consumers out there are going to do the math on Forex fees or will they more likely read the plethora of travel blogs that all state: "Get a card with no forex fee" Enter Cap 1 as the mass market advertised card without it.

We're the outliers here, Cap One is not designing nor marketing this card to us

.

Sure, but the discussion here is (mainly!) for the people here.... And so I advocate against the Venture in this forum, rather than spending my money on TV ads to convince the public.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CAP ONE raised the AF on the Venture Card

@longtimelurker wrote:Sure, but the discussion here is (mainly!) for the people here.... And so I advocate against the Venture in this forum, rather than spending my money on TV ads to convince the public.

I was thinking of app'ing for a Venture simply for the high SL just to combine it into my QS1 limit. Foolish?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CAP ONE raised the AF on the Venture Card

We’ll see how that goes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CAP ONE raised the AF on the Venture Card

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CAP ONE raised the AF on the Venture Card

"Isn't $95 a lot for a glorifed 2% cashback card?"

I have to disagree...

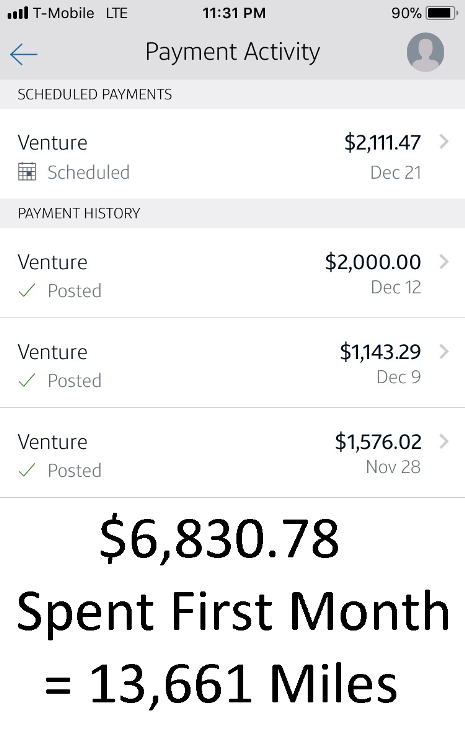

Venture’s AF really isn’t a big deal to me. I’ve earned that and then some in my first month of having this card. I still have 11 months to go yet. If I keep venture as my every day card i will easily earn an international flight ticket with this card every year.

So imo... paying $95 is not a lot to pay, in exchange for a flight ticket that usually costs me between $700-$900.

It always comes down to how a card suits your individual needs. It works great for me ![]()

Sure, there will always be better options out there, and they will come and go. Venture is still a good card though, especially when you use it for what it was intended for (2x Reward Miles).

No foreign transaction fees is a nice perk as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CAP ONE raised the AF on the Venture Card

@Anonymous wrote:"Isn't $95 a lot for a glorifed 2% cashback card?"

I have to disagree...

Venture’s AF really isn’t a big deal to me. I’ve earned that and then some in my first month of having this card. I still have 11 months to go yet. If I keep venture as my every day card i will easily earn an international flight ticket with this card every year.

So imo... paying $95 is not a lot to pay, in exchange for a flight ticket that usually costs me between $700-$900.

It always comes down to how a card suits your individual needs. It works great for me

Sure, there will always be better options out there, and they will come and go. Venture is still a good card though, especially when you use it for what it was intended for (2x Reward Miles).

No foreign transaction fees is a nice perk as well.

Sorry, but this is what makes little sense to many of us! Now the issue is only after the first year, no problem in getting the venture for the first year bonus and the waived AF. But then.

On a free 2% card, you could spend $6,830.78 and get $136.61 back, which you could spend in any way you choose, including towards some airfare. So the same reward as Venture, but with no AF. The only advantage of Venture (again after the first year) over some of the 2% is the no FTF, which for many won't justify the AF either.

It's not "Can this card justify the AF" alone, you need to consider alternatives. As I have given before, I can offer a card that gives 0.1% CASH BACK for a low low low $1 AF. Once you spend $1000, the rest is FREE MONEY!!!!! Is this a good card? Of course not, precisely because you can do much better on rate (e.g. 2%) and a little better on AF (i.e. $0). Same sort of thing with venture.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CAP ONE raised the AF on the Venture Card

@Anonymous wrote:

So imo... paying $95 is not a lot to pay, in exchange for a flight ticket that usually costs me between $700-$900.

What ticket usually costs you $700-$900? Have you looked at airline mile award prices for the route(s) in question?

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select