- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- CC account added to EQ

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CC account added to EQ

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CC account added to EQ

Took a 5 point hit for a new bank card account added. SL 1500.00.. How is this possible?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CC account added to EQ

AAoA Hit most likely. You have opened a slew of new accounts recently and they don't come without a cost to your FICO score. Other reasons could be the reason as well, but most likely your AAoA took a ding thus the score reduction. I know sometimes when I hit a certain amount of new accounts my scores drop and then eventually recover if I can stay in a garden for long enough

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CC account added to EQ

New accounts hurt your FICO scores by adding a penalty in the "new accounts" column and by lowering your average age of accounts. Generally speaking, you will always see a minor (or moderate, depending on profile) drop in scores when opening any type of new account, unless it's doing something like lowering your overall and/or individual credit card utilization in a very big way. (Say you had two maxed-out cards with $500 limits and $450 balances, you are using $900 of $1000 in total credit lines, giving you 90% utilization and all of your cards maxed out. You then open a $1500 limit card with 0% balance transfer offer and move all $900 over, now you're using 0% on two cards and 60% on another with no maxed out cards and only 36% utilization - in this case utilization which along with payment history is the biggest factor in a credit score would make huge gains and completely overshadow the hit you'd take from a new account.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CC account added to EQ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CC account added to EQ

Could be AAoA or extended "new account penalty".

If you have an otherwise perfect profile, you lose 5 FICO points if you add a new account. You get those back in 6-7 months. This ignore inquiries and AAoA drop. If you added ANOTHER new account right away, you wouldn't get dinged at all.

If you have a dirty profile, you actually can lose more than 5 FICO points for the new account penalty.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CC account added to EQ

@CreditCuriosity thanks! I've never been accused of writing responses that were too short. LOL

@Anonymous If there were further accounts opened, that could certainly cause a score ding with the reduction in AAoA, but it would depend on the profile. You could also have a very clean and perfect profile and lose a lot more than 5 points for opening a new account. Blanket statements are hard to make in regard to scoring since everyone's profile is different. I can open accounts pretty much with almost total disregard because of the sheer number of aged opened and closed accounts I have to buffer them, but Average Consumer that only has 2-3 credit cards, maybe an auto loan and hasn't applied for credit in a while would take much bigger penalties.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CC account added to EQ

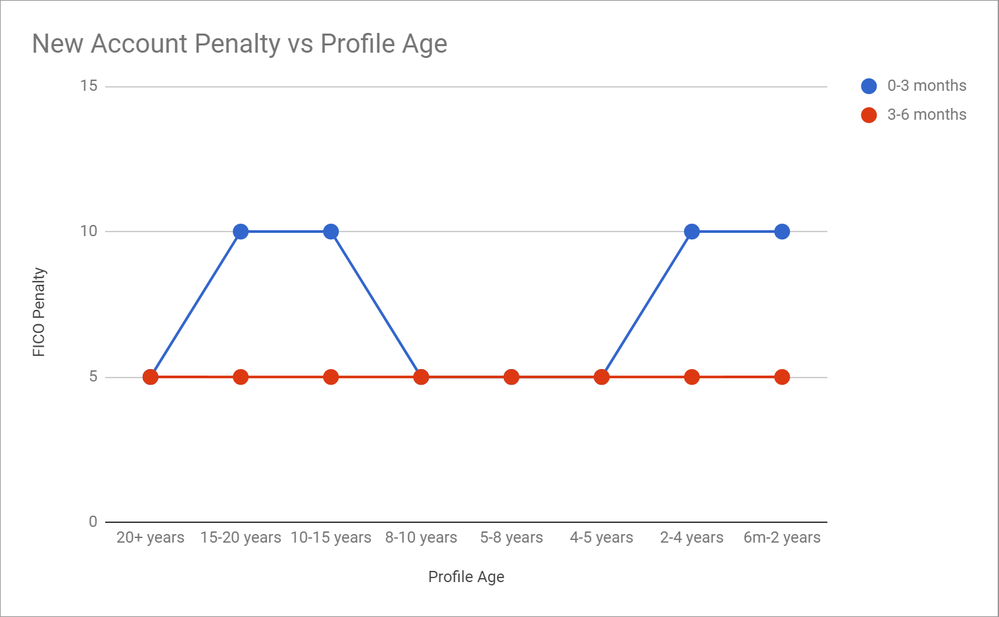

Yep, my 3 outliers in my data are 16 point dings but I threw that data away because their profiles are completely crazy during rebuilding so I assume there's other stuff cluttering it. In reality, my collaborative filter tells me the new account penalty (ignorant of AAoA, inquiries, etc) is 10 points max.

I have 72 individual credit profiles I've entered into my calculator now, over 900 actual 1B reports from those 72. I probably have another 150 1Bs from maybe 30 people to still input but holding off on really complex rebuilders for now.

Here's the "new account penalty" based on strictly responses from my collaborative filter algorithm, but so far it seems pretty consistent that a 0-3 month old newest account will penalize for up to 10 points, and a 3-6 month old newest account will penalize for 5 points. There's a bit of mesh between the two based on the scorecard you're on, though, and finding the scorecards hasn't worked so well for me yet in terms of where the actual data points are!

I have 2 people with 20+ year old mortgages reporting and no new accounts in over a year who are going to test it out this month actually (dad is one of them, lol) to see -- they're both getting new accounts without an inquiry and with AAoA well over 8 years and they won't fall below 8 years from the new account reporting.

My own 1Bs over the past 7 months are too complicated to enter myself, but next year I'll definitely have a 7-8 month period of no new apps so I can test things out considering Amex might do a SP on a new account (Platinum) so I can at least test that out.

My AAoA->FICO estimator will probably need thousands of data points to find any sort of valid data on points lost/gained due to AAoA alone. FICO's "Length of Credit" is 83 points total, 55 of which are purely scorecard based on age of oldest account. That means ~28 points are likely candidates for AAoA, but where the breakpoints are is beyond me!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CC account added to EQ

Thanks everyone.. Most helpful!