- myFICO® Forums

- Types of Credit

- Credit Cards

- CSR to 50k sign-up 1/12/17

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CSR to 50k sign-up 1/12/17

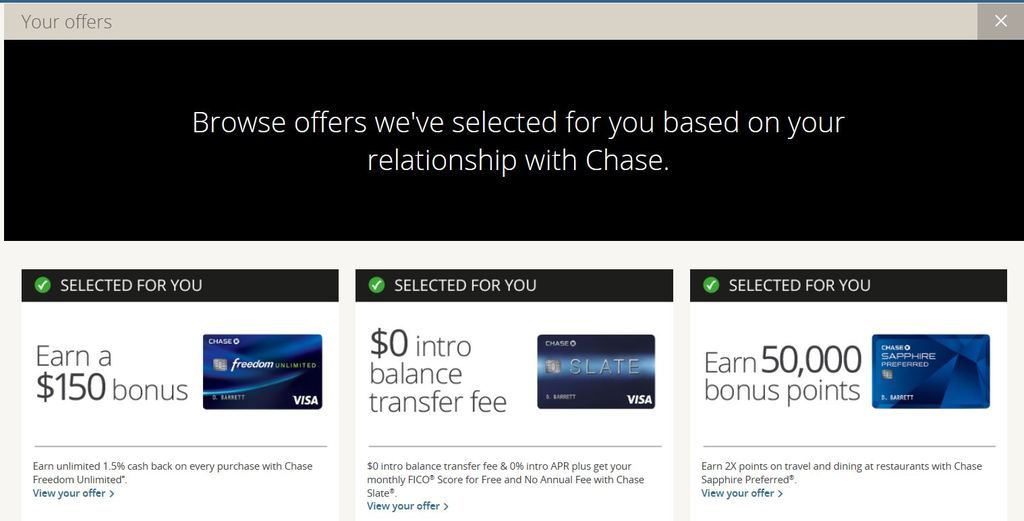

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSR to 50k sign-up 1/12/17

When is the AF charged?

Last INQ: 3/26/21

AAoA: 4y 7m

Lowest limit: Chase Freedom Visa - $13,000

Highest limit: Discover It - $56,500

Available credit: $200,600 (8 cards)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSR to 50k sign-up 1/12/17

@heyitsyeh wrote:When is the AF charged?

On the first statement.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSR to 50k sign-up 1/12/17

@heyitsyeh wrote:When is the AF charged?

too soon lol. mine happened right after the first cut - I branch apped 11/8 - yeah I know - and the cut was 12/2 and it happend the day after. you get credit for flipping parking meters, the $ 300 is on auto pilot imo and the remaining 150 get knocked down to 50 with global entry. great card, really and it fits your scores. bet you are one of the ones that get $30K++

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSR to 50k sign-up 1/12/17

@bourgogne wrote:

@Anonymous wrote:bourgogne, I've been in the branch to check several times with no luck (no prequals at all).

The interesting part is that I am showing prequals online (no CSR).

well now that is odd. how many cuts on your chase card? have you tried multiple branches?

EDIT: what is your average score and what is your high cl card and how long has you had it?

Not sure what cut means? I've been using the same banker but I could try another branch too.

TCL over 100K. Oldest card 10 years, average age just over 2 years.

| Fico | ||

| Transunion | Experian | Equifax |

| 805 | 778 | 798 |

Edit: util under 1%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSR to 50k sign-up 1/12/17

@Anonymous wrote:

@bourgogne wrote:

@Anonymous wrote:bourgogne, I've been in the branch to check several times with no luck (no prequals at all).

The interesting part is that I am showing prequals online (no CSR).

well now that is odd. how many cuts on your chase card? have you tried multiple branches?

EDIT: what is your average score and what is your high cl card and how long has you had it?

Not sure what cut means? I've been using the same banker but I could try another branch too.

TCL over 100K. Oldest card 10 years, average age just over 2 years.

Fico Transunion Experian Equifax 805 778 798

how many statements on your freedom? I had to try 3 branches, somehow it might be keyed into zip code. the branch I finally got the pre-app in was the closest to my billing address. not a data point as I also passed my 6th cut when I tried the new branch. I have heard that you have to have 6 cuts to get a branch approval to show. again this is internetforklore. I find it odd that nothing showed at the 2 BH branches and when I tried the one close to my house everything all of a sudden appeared. just got your pm, you are post 1 year with chase. I would try the branch that is close to the billing address for starters. I know, all this sound lame

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSR to 50k sign-up 1/12/17

@myjourney wrote:

@CreditCuriousity wrote:This really sucks.. Chase continues to make life rough for alot of people.. People hoping to be under 5x24 to get the 100k UR's.. It is still a good card for many and still considering to PC my CSP to the CSR and just ignore the bonus and earn UR's at a higher rate which makes it a 150 AF card after travel expenses. Probably will PC it in a few months.

Feel bad for those that were trying to get under 5x24.. Kinda like Chase is pushing away customers as alot will say screw it and start to apply for other cards such as Merrill with $500 cash or $1000 airfare credit and other cards that have decent sign-up bonuses with NO annual fees.

If you have a decent amount of spend eating out and traveling then this card certainly is still a good card, just losing out on $500...

I fall into this group.

I'll be 4/24 in Feb ...yep that's right weels to go

So now my only option is to hope I can get an early exclusion via EX

We know the odds of that ...But I'll try

I dont think Ill ever fall into this group, lol! ![]()

I might be 25/24 by then....![]() haha

haha

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSR to 50k sign-up 1/12/17

@pizza1 wrote:

@myjourney wrote:

@CreditCuriousity wrote:This really sucks.. Chase continues to make life rough for alot of people.. People hoping to be under 5x24 to get the 100k UR's.. It is still a good card for many and still considering to PC my CSP to the CSR and just ignore the bonus and earn UR's at a higher rate which makes it a 150 AF card after travel expenses. Probably will PC it in a few months.

Feel bad for those that were trying to get under 5x24.. Kinda like Chase is pushing away customers as alot will say screw it and start to apply for other cards such as Merrill with $500 cash or $1000 airfare credit and other cards that have decent sign-up bonuses with NO annual fees.

If you have a decent amount of spend eating out and traveling then this card certainly is still a good card, just losing out on $500...

I fall into this group.

I'll be 4/24 in Feb ...yep that's right weels to go

So now my only option is to hope I can get an early exclusion via EX

We know the odds of that ...But I'll try

I dont think Ill ever fall into this group, lol!

I might be 25/24 by then....

haha

You'll make it factoring in your recent HP's by 2023

Providing you don't app anything this year ....hmmm wonder what are the chances of that are ![]()

![]()

Have you done your research of the CC?

Does it fit your spending?

Do you have a plan for the bonus w/o going into debt?

Can you afford the AF?

Do you know the cards benefits? Is it worth the HP?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSR to 50k sign-up 1/12/17

@myjourney wrote:

@pizza1 wrote:

@myjourney wrote:

@CreditCuriousity wrote:This really sucks.. Chase continues to make life rough for alot of people.. People hoping to be under 5x24 to get the 100k UR's.. It is still a good card for many and still considering to PC my CSP to the CSR and just ignore the bonus and earn UR's at a higher rate which makes it a 150 AF card after travel expenses. Probably will PC it in a few months.

Feel bad for those that were trying to get under 5x24.. Kinda like Chase is pushing away customers as alot will say screw it and start to apply for other cards such as Merrill with $500 cash or $1000 airfare credit and other cards that have decent sign-up bonuses with NO annual fees.

If you have a decent amount of spend eating out and traveling then this card certainly is still a good card, just losing out on $500...

I fall into this group.

I'll be 4/24 in Feb ...yep that's right weels to go

So now my only option is to hope I can get an early exclusion via EX

We know the odds of that ...But I'll try

I dont think Ill ever fall into this group, lol!

I might be 25/24 by then....

haha

You'll make it factoring in your recent HP's by 2023

Providing you don't app anything this year ....hmmm wonder what are the chances of that are

LMAO!! hahahah....

Id say my chances are actually pretty good. oh wait, I meant by 2023 my chances will be good, ![]() hehehehe

hehehehe

idk....I still like like to throw out a Chase app every now and then, you know, to warm them up to my credit report, so its not such a shock when I go to recon, LOL..they been "conditioned", ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSR to 50k sign-up 1/12/17

@pizza1 wrote:

@myjourney wrote:

@pizza1 wrote:

@myjourney wrote:

@CreditCuriousity wrote:This really sucks.. Chase continues to make life rough for alot of people.. People hoping to be under 5x24 to get the 100k UR's.. It is still a good card for many and still considering to PC my CSP to the CSR and just ignore the bonus and earn UR's at a higher rate which makes it a 150 AF card after travel expenses. Probably will PC it in a few months.

Feel bad for those that were trying to get under 5x24.. Kinda like Chase is pushing away customers as alot will say screw it and start to apply for other cards such as Merrill with $500 cash or $1000 airfare credit and other cards that have decent sign-up bonuses with NO annual fees.

If you have a decent amount of spend eating out and traveling then this card certainly is still a good card, just losing out on $500...

I fall into this group.

I'll be 4/24 in Feb ...yep that's right weels to go

So now my only option is to hope I can get an early exclusion via EX

We know the odds of that ...But I'll try

I dont think Ill ever fall into this group, lol!

I might be 25/24 by then....

haha

You'll make it factoring in your recent HP's by 2023

Providing you don't app anything this year ....hmmm wonder what are the chances of that are

LMAO!! hahahah....

Id say my chances are actually pretty good. oh wait, I meant by 2023 my chances will be good,

hehehehe

idk....I still like like to throw out a Chase app every now and then, you know, to warm them up to my credit report, so its not such a shock when I go to recon, LOL..they been "conditioned",

Yeah conditioned to transition from oh no to Hell to the naw Lol

![]()

![]()

Have you done your research of the CC?

Does it fit your spending?

Do you have a plan for the bonus w/o going into debt?

Can you afford the AF?

Do you know the cards benefits? Is it worth the HP?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSR to 50k sign-up 1/12/17

@myjourney wrote:

@pizza1 wrote:

@myjourney wrote:

@pizza1 wrote:

@myjourney wrote:

@CreditCuriousity wrote:This really sucks.. Chase continues to make life rough for alot of people.. People hoping to be under 5x24 to get the 100k UR's.. It is still a good card for many and still considering to PC my CSP to the CSR and just ignore the bonus and earn UR's at a higher rate which makes it a 150 AF card after travel expenses. Probably will PC it in a few months.

Feel bad for those that were trying to get under 5x24.. Kinda like Chase is pushing away customers as alot will say screw it and start to apply for other cards such as Merrill with $500 cash or $1000 airfare credit and other cards that have decent sign-up bonuses with NO annual fees.

If you have a decent amount of spend eating out and traveling then this card certainly is still a good card, just losing out on $500...

I fall into this group.

I'll be 4/24 in Feb ...yep that's right weels to go

So now my only option is to hope I can get an early exclusion via EX

We know the odds of that ...But I'll try

I dont think Ill ever fall into this group, lol!

I might be 25/24 by then....

haha

You'll make it factoring in your recent HP's by 2023

Providing you don't app anything this year ....hmmm wonder what are the chances of that are

LMAO!! hahahah....

Id say my chances are actually pretty good. oh wait, I meant by 2023 my chances will be good,

hehehehe

idk....I still like like to throw out a Chase app every now and then, you know, to warm them up to my credit report, so its not such a shock when I go to recon, LOL..they been "conditioned",

Yeah conditioned to transition from oh no to Hell to the naw Lol

Stop it!! Im dying over here, LOLOL!!

The day I get any card from Chase, you know that hell has frozen over, or I did one hell of a recon, (which Ive been known to do)...LOL. ![]()