- myFICO® Forums

- Types of Credit

- Credit Cards

- Cap One Quicksilver?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Cap One Quicksilver?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One Quicksilver?

@linux007969 wrote:I called for the heck of it and asked if my account could be converted to the quick silver just for giggles.....lol..... and they said that there are no offers on my account and the nice indian rep asked me how i heared about the card? and I said I saw it on the Capital One website and she said i could apply for it if i wanted to and i said no thanks, and She was like "you already have a rewards card" and I was like "well i saw on tv at one time you had a card that offers a 50% bonus and my card has 25% bonus and is there any kind of offers for that card?" she said no. I did ask her about lowering my APR and she said that she "would have to transfer me to an account specialist but their office is currently closed and asked me to call back when it was most convienent for me to have them review my account"

She did say something usuful that i want to share but maybe take it with a grain of salt please.... she said that "if you have any HSBC products they will be automatically converted to Quicksilver cards to earn 1.5% cash back"

I truely wasn't expecting anything out of a regular CSR as i called the number on the back of my card..... I was just seeing if a phone rep sees something different on their end compaired to a chat rep.... and well i was board i guess....lol.

Grain of salt indeed...

Starting Score: 515

Starting Score: 515Current Score: EQ08 711 EX08 731 TU08 735

Goal Score: 740+

Amex BCP $25k | Discover IT $15.7k | Cap 1 QS $10k | PSECU $10k | Citi DC $9300 | Citi DP $6800 | Barclay Ring $6500 | PayPal Extras MC $5045 | DCU $5000 | Chase Slate $5000 | Barclays AA $4100 | Chase Freedom $4000 | Union Plus $1000 | Target $500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One Quicksilver?

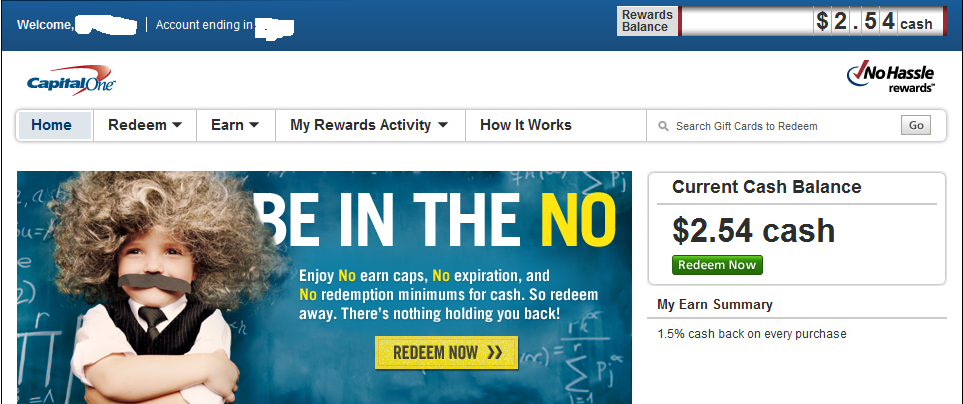

So I also got the 'No Hassles' Cash Rewards card just a short time ago and I saw this thread so I thought that I would discuess the card with them, you know just for giggles.

The first person I spoke to said there were no offers. Then the next person I spoke to gave me conflicting information. I asked if I my Cash Rewards was a Signature card and was told that it was a Platinum. Then I asked if the Quicksilver was the replacement card and was told yes. So then I asked if it is the replacement why isn't the Cash Rewards card a Signature card. OK to make a long story short, I mean a long long story, I got it converted to a Quicksilver Card.

So what about the Household conversion. Since I have the no fee card, does that mean it will be converted to a Quicksilver Signature Card? I would find that funny since it has a $500 limit. A $500 Visa Signature card. (I doubt that will happen since it is a MasterCard, which means it will probably convert to the $39 version. Which also means that I will probably have to contact the EO about it and get it waived. I can't wait for the upcoming fun! Yee Haw.)

I think with a little effort anyone who wants it can get the card converted.

Always follow these rules: Only take a HP for a new account. Always use the best rewards card for that reward category. Don't close a card unless you know you really should. Never use more than 35% of a credit limit. Recon as much and as best you can. Use the introductory period to the best advantage. Get the signup bonus. Whenever possible PIF or balance transfer so you pay less in interest. Never give an excellent rating when it is actually the norm. Always look for a discount as more is always better.

Always accept candy from strangers because they have the best candy or from people you know have good candy.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One Quicksilver?

I'll just have to wait until next May! Who knows, there might even be another new card by then. I already have too much cash back to forfeit it. Maybe someone will find out if EO is willing to let us keep the cashback we're expecting at card anniversary ![]() and will give us a greenlight to PC

and will give us a greenlight to PC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One Quicksilver?

@Simply827 wrote:

@linux007969 wrote:She did say something usuful that i want to share but maybe take it with a grain of salt please.... she said that "if you have any HSBC products they will be automatically converted to Quicksilver cards to earn 1.5% cash back"

Grain of salt indeed...

hmm, interesting, when we say HSBC product we probably aren't referring to the BB Reward Zone are we?

JP

TU:552 | EQ:561 | EX:567 | Starting Score [LP from 08]

TU:552 | EQ:561 | EX:567 | Starting Score [LP from 08]TU:693 | EQ:682 | EX:700 | Current Score [11.21.13]

[720 Overall] Goal Score - The grass is greener in the garden! (Amex made me fall out... since 12.13)

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One Quicksilver?

quite interested in this card. Though it's only 0.5% more cash back than common cards.

Cards in my wallet: AMEX BCE ($8000) // CITI AA VISA SIG ($5000) // CHASE FREEDOM ($3500) // DISCOVER IT ($1000) // CAP ONE NC ($1000) // WALMART DISCOVER ($1600)

Credit Scores: FICO TU08 (10/13): 739 // Credit Karma (10/13): 677??!! // Credit Sesame (10/13): 730

Next Goal: CSP (after mortgage probably...)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One Quicksilver?

@SpeeDj wrote:

@Simply827 wrote:

@linux007969 wrote:She did say something usuful that i want to share but maybe take it with a grain of salt please.... she said that "if you have any HSBC products they will be automatically converted to Quicksilver cards to earn 1.5% cash back"

Grain of salt indeed...

hmm, interesting, when we say HSBC product we probably aren't referring to the BB Reward Zone are we?

JP

Nope, those are going to Citi later this year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One Quicksilver?

So I called again to check again about lowering my APR and the indian rep said that she "would have to transfer me to an account specialist" like she did last night and i was actually transfered to a Senior Account Manager Supervisor in the USA, who was very nice and asked me how i was doing and if i had any plans for the weekend, and if there is anything exciting to do in my town and things like that..... It's it good that they are actually care about their customers by being nice......LOL.... any way once my account came up on her screen, as i've heard before "there are no offers" and I asked again about the Quicksilver card and she checked again and there were "no upgrade offers, but you are more than welcome to go on our website for more information about the card" and i asked her "How does that work, do the upgrade offers just appear after a certain amount of time?" she was like "Well you have the No Hassle Cash Rewards Card, and there would be an upgrade option on my screen next to it." I said to her "I wish you guys had more power to help us out" she said "ya if i could offer you a lower apr and quicksilver upgrade i would"

I said "thanks for trying" and we nicely ended the call.

It was nice that I was transfered all the way up to a Senior Account Manager Supervisor without having to ask, so I think Capital One is trying to make things better in terms of customer service at least or maybe too its the fact that they might see notes on my account from the Executive Office.... LOL.

I really don't want to apply for any more credit cards i would just rather upgrade and continue to build good credit history.

I'm guessing that before the credit crash in 2008, capital one was more flexable when it came to credit limit increases, lowering apr, and upgrading accounts?

I hope someday they change things back, cuz I want an upgrade. I read in another thread that it's rumored that once you have a limit of $3K or more the system produces an upgrade offer? If that is true i am gonna keep working the the executive office to get increases..... LOL.

Sorry if i'm a lil off topic, please forgive me.

Rebuilding Credit since 2016

Debt: Almost $80,000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One Quicksilver?

I just called them to see if there is any upgrade for me. There is none for me. They told me it is basically the same as Cap1 Cash Rewards. It has different name and a new good looking card. I think it has the same terms as the old Cash Rewards card.

Ron.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One Quicksilver?

@zyzzus wrote:

@WallyxD wrote:

Enharu, I think so. I haven't seen ONE post on here where CapOne has only pulled from one bureau. But I'd also like to know if anyone's applied for it. I'm on the fence.If I had a need for another card to catch my spending in a non 5% category this would be high on my list. The only other card that offers a similar (same I suppose before $15000 net spend) is the Fidelity Visa Signature. 1.5% back on everything is great.

I contacted customer service via chat twice and the phone once. No success. I have been receiving direct mail as well as email communication on changing my rewards so I gave a shout out to the Executive office to see if they would be able to faciliate a change.

Oddly the representative that answered said she would forward my request to the last persons that 'assisted' me. Earliest I'd hear back is Friday if not Monday.

Request was honored today.

I am not sure why capital one gets such a bad wrap. They have been great to me for the two small reequests I have made. I now have a Mastercard with no annual fee that does not have a foreign transaction charge and gets 1.5% cashback on every purchase. That is a primie card in my opinion.

Capital One Quicksilver- $5,400 | Chase Freedom - $8,000 | Chase Freedom Unlimited- $13,000 | Chase Amazon -$5,000 | Priceline Visa -$10,000 | US Bank Cash+ - $18,200 | Fidelity Visa -$10,000 | Sallie Mae- $10,000 | DCU Platinum $12,000 | Discover IT - $10,000 | Amex EveryDay - $25,000 | Amex BlueCash Everyday- $9,800 | Citi DoubleCash - $18,000 | Sapphire Preferred- $13,000 | Freedom Unlimited- $7,000 | Blispay- $12,000 | Chase Sapphire Reserve- $18,000 | Consumers Credit Union Visa Sig Cash Rebate- $25,000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One Quicksilver?

Is the card metal?

It is called Quicksilver, and non embossed from the picture. So it looks like a candidate for a metal card. I know it says you can change the image, but they may just send you a normal card then.