- myFICO® Forums

- Types of Credit

- Credit Cards

- Cap One is really starting to irritate me

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Cap One is really starting to irritate me

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One is really starting to irritate me

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One is really starting to irritate me

@Anonymous wrote:Got my QS in January. Got a CLI in March. Been hitting the CLI button several times a month, so I have a pile of denial letters that all read "there has been a recent credit line increase." Yesterday was six months since my March CLI, so I figured this time it would finally happen. Hit it, another denial. This time the letter reads "Your average monthly payment has been too low." Geez. I've been carrying a balance on the card - currently $1018 - since I have 0% APR right now. Been tossing them $100 a month. So, screw it, I just paid off $1000 of that. Left the $18 since it's my only card reporting a balance.

Now let's see what excuse they come up with.

Personal experience here, but any time they've given me a CLI it was a result of paying off my balance. Not carrying one. They'll rotate the excuses as to why they won't grant you one. I was paying $1000/month and they said "average payment too low" so I just paid it totally off and low and behold, just like with my other two Cap One cards, they gave me a $2000 cli. They are strange.![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One is really starting to irritate me

Hit it again yesterday. Still denied with Your average monthly payment has been too low. I wonder if the system hasn't fully digested the $1000 payment.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One is really starting to irritate me

@Anonymous wrote:

@Anonymous wrote:App for the Venture! 15k+ credit line and then you wont have to worry about an increase.

Did you app yet?

Did you app yet?

Did you app yet?

Love your emoji!!! ROFL!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One is really starting to irritate me

@DeeBee78 wrote:

@pizza1 wrote:Sorry Cap

Is this your only CC with them? If not, can you combine them? I use to get all sorts of excuses, all the same one mentioned here already... I use to make multiple monthly payments, then I started letting everything post, and the statement cut on my venture with whatever the amount, and then PIF after sm cuts. So, my last SM had a ball of $1700+, I turned around a few days later and PIF, so they see usage, plus bigger payments.

Also, since i just combined mine, Im good on CL now, LOL..even I wanted to ask, I had to wait 6 months, becasue my combo was considered a CLI..

Did they seriously tell you that your combination was a CLI? I had suspicions that a combination might reset the 6 month CLI cycle! This is exactly why I waited to combine my cards.

It's apart of the information your supposed to read when combining your accounts. The verbiage states that your account may not be eligible for a CLI because of combining the limits.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One is really starting to irritate me

@Anonymous wrote:On a positive note, Clockwork Comenity came through with my monthly Overstock CLI today.

Good one!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: They've always been good to me even when my scores were l...

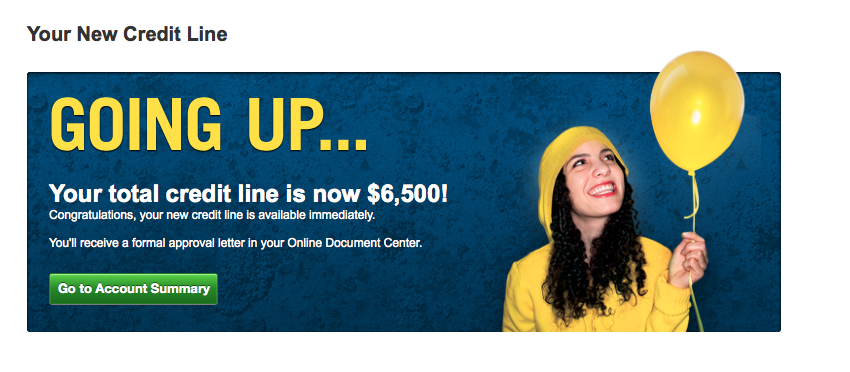

@Anonymous wrote:They've always been good to me even when my scores were low. Ive been with Cap1 for about 1.5 years now and started with a 570~ score? I was initially approved for a QS and Platinum with that score. Last night I logged into hit the Luv button and I went from 3k to 6.5k. I haven't been hitting the Luv button every month though. Maybe 2-3 times since I have had the account. I feel like you get red flagged or something by doing that.

Congrats on your CLI!!! Cap1 has been very good to a lot of people. They have always been generous to my DH. May they continue to show you favor!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One is really starting to irritate me

@pizza1 wrote:

@DeeBee78 wrote:

@pizza1 wrote:Sorry Cap

Is this your only CC with them? If not, can you combine them? I use to get all sorts of excuses, all the same one mentioned here already... I use to make multiple monthly payments, then I started letting everything post, and the statement cut on my venture with whatever the amount, and then PIF after sm cuts. So, my last SM had a ball of $1700+, I turned around a few days later and PIF, so they see usage, plus bigger payments.

Also, since i just combined mine, Im good on CL now, LOL..even I wanted to ask, I had to wait 6 months, becasue my combo was considered a CLI..

Did they seriously tell you that your combination was a CLI? I had suspicions that a combination might reset the 6 month CLI cycle! This is exactly why I waited to combine my cards.

No, they didnt tell me directly. I remember reading on here somewhere though, that after combining the limits, thats considered a "cli" to them. I guess I could try, LOL.. But, honestly, dont need it! It doesnt matter what you did up to the cl combining, its after the combining is my understanding.

Hey pizza! How's it going? It's apart of the information for us to read when we do the combining. You may have read it there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One is really starting to irritate me

@kdm31091 wrote:

Well if one SDs a card, they cant expect much CLI growth. Or if they just use it for a bonus and then barely use it again....not gonna see growth in most cases.

You are right kdm! A card has to offer more than a sign up bonus for me to app for it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One is really starting to irritate me

@beautifulblaquepearl wrote:

@kdm31091 wrote:

Well if oneSDs a card, they cant expect muchCLI growth. Or if they just use it for a bonus and then barely use it again....not gonna see growth in most cases.You are right kdm! A card has to offer more than a sign up bonus for me to app for it.

Blasphemy... A excellent signup bonus is worth a HP/AAoA if it is big enough see Plat 100k MR bonus![]() .. $500+ will typically get a HP out of me without much thought.

.. $500+ will typically get a HP out of me without much thought.