- myFICO® Forums

- Types of Credit

- Credit Cards

- CapOne rebuilding card question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CapOne rebuilding card question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CapOne rebuilding card question

If someone with a 590-600 score applies for Cap1 plat classic and is denied, will Cap1 counter with secured?? or will the secured card be another trip pull?

Prequal shows secured only.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapOne rebuilding card question

@elim wrote:If someone with a 590-600 score applies for Cap1 plat classic and is denied, will Cap1 counter with secured?? or will the secured card be another trip pull?

Prequal shows secured only.

Another pull -- You might call in and see if they will use that same app/HP's to consider a secured card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapOne rebuilding card question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapOne rebuilding card question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapOne rebuilding card question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapOne rebuilding card question

@Anonymous wrote:

They dont actually care.

Good to know.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapOne rebuilding card question

sorry guys, long day at work.

thanks for all the feedback, i'll look into the student card and have her app for it, if she gets the D then she can try and recon for it or the secured with same pulls, worse case she can have the 6 inq's and handle some of them.

thanks again!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapOne rebuilding card question

Before taking a triple pull for a secured Cap1 card that wont unsecure. I would suggest a SDFCU secured card no HP and reports to the credit bureaus. That doesn't unsecure but in my opinion a much better card.

https://www.sdfcu.org/emv-creditcards

Sam's Mastercard $15k / Walmart Mastercard $10k / Blispay $7.5k PayPal Ex MC $10.8k

CareCredit 5k / Husq $5k / Cap1 QS $4.5k / Barclay Ring $5.35k / Citi DC (WMC) $12k

Gardening Date 7/01/16 / MyFico 08: EQ 801 / TU 777 / EX 771 / 06/08/17

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapOne rebuilding card question

@coldnmn wrote:Before taking a triple pull for a secured Cap1 card that wont unsecure. I would suggest a SDFCU secured card no HP and reports to the credit bureaus. That doesn't unsecure but in my opinion a much better card.

https://www.sdfcu.org/emv-creditcards

so she joins the CU and applies for the CC with no pulls?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapOne rebuilding card question

@Anonymous wrote:

They dont actually care.

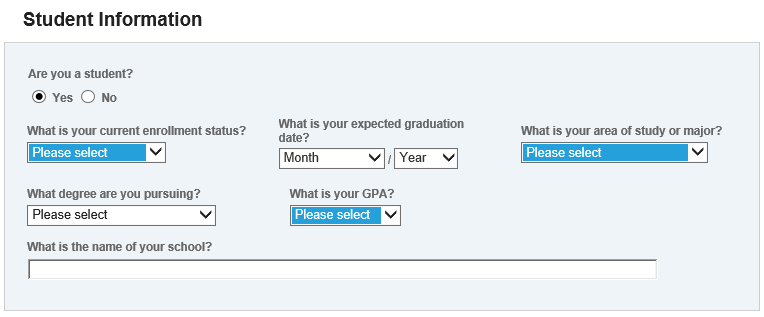

so she can just put her last (short) stint of college classes and they don't check?: