- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Capital One 0% APR Check

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Capital One 0% APR Check

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One 0% APR Check

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One 0% APR Check

@rlx01 wrote:

@iDShaDoW wrote:

@Anonymous wrote:Yeeeeeeep.

And if you like to keep your accounts i'd suggest paying more than that.

Do you mean if I pay only they minimum Cap1 and the other creditors might slash my credit limits and close my cards on me? I've never really carried a balance at all my entire credit life so not sure how closely they keep an eye on things like what I'm considering.

Figured I'd pay the minimum on the Cap1; put the freed up income towards my student loans, and then plan accordingly so that I can pay the remaining Cap1 balance in full at the 12 month mark.

I'd be skirting the edge with no actual emergency/savings fund while I do this but I can fall back on my family for support worst case scenario. The project I just joined is a 5 year task order so I do have some job security assuming I don't get fired for incompetance - they put me in for a clearance plus I was internal so I'm not sure they'd be all that fast to get rid of me and start looking for another person internal/external and potentially pay to put them in for their clearance.

I'm just rambling now.

I'd take Nixon's doomsdaying with a grain of salt.

Why? CC Companies have been known to AA for such things.

I'd try to get a CLI out of that QS before doing the BT.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One 0% APR Check

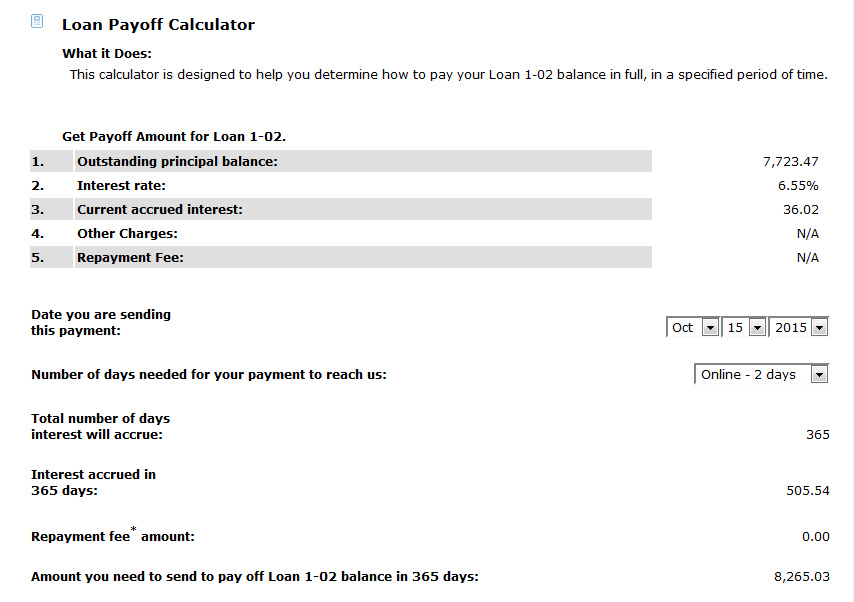

This screen capture is for one of my loans from Sallie Mae's site calculator (I assume it factors in the daily compounding plus capitalized interest since it's not monthly compounding like a credit card balance would be).

I think the missing factor is what the minimum payment would be from Cap1. That way I could aggressively pay down another 6.55% student loan line and effectively reduce the accrued interest on 2 of my higher interest rate loans.

Don't believe I'm eligible for a Cap1 QS CLI for the time being.

Heck, I'm even considering taking a 401k loan (4.25% interest back to myself) to throw at my student loans; probably not the smartest move though - my 401k funds haven't been performing too well anyhow but they may bounce back and I would have effectively cashed out at a loss.

I'm getting off topic now though but I appreciate everyones' input. Gonna mull it over some. Have to wait for one of my new paychecks from my new position to see how much I actually end up with after taxes to calculate with as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One 0% APR Check

My calculation assumed a fixed monthly pay down. If that's the case then the difference is only $47 and not worth taking the FICO hit for.

Depends how you want to play this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One 0% APR Check

@rlx01 wrote:

Your calculation assumes one lump sum payment in a year. In which case the 3% BT fee is 2.25x better.

My calculation assumed a fixed monthly pay down. If that's the case then the difference is only $47 and not worth taking the FICO hit for.

Depends how you want to play this.

$47 buys a lot of ramen noodles.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One 0% APR Check

@coldnmn wrote:Yes there is a minimum payment. After the one year if not paid off any savings will quickly be eaten up by the credit card APR when it goes back to the cards set APR.

Exactly what's said. Minimum. And if you don't pay within 12 months. Just hand over your wallet. As cap one will say. What's in your wallet. Or what's left![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One 0% APR Check

@iDShaDoW wrote:Max out Utilization on this card and potentially reduce my FICO score?

It's not just your score that you need to be concerned about. Utilization matters whether you have an offer or not. Prolonged high utilization can lead to adverse action. You need to manage utilization on the card with the offer. Do not max it out. Definitely do not max it out and then just make minimum payments over a year.

@iDShaDoW wrote:One of the 9 student loan trade lines will be closed out and won't age like the rest lowering my AAoA a bit (or does student loan lines not count towards AAoA?)

Closing accounts does not impact AAoA. However, paying off an installment does have an adverse effect on score.

@lhcole77 wrote:They count towards AAoA. Upside is it will stay on for 10 years after being paid off, with no immediate hit to AAoA. Also having another account report a 0 balance is a plus.

Student loans are not revolving accounts. DTI will improve but paying off a student loan will not help with revolving utilization or number of revolving accounts reporting a balance.

@iDShaDoW wrote:I'm fairly confident in my ability to repay the full amount by the end of the 12 month period too since I'm extremely frugal at this point; and probably will be for quite some time even after the loans are paid off.

You need to be 100% certain. Carefully read the terms. Some offers begin tacking on the back interest if the balance isn't paid in full by the time the offer expires. If you can't pay it off then you're not only not saving any money but you're spending much more in the end.

@iDShaDoW wrote:I've never really carried a balance at all my entire credit life so not sure how closely they keep an eye on things like what I'm considering.

All creditors consider utilization to be a signficiant risk factor. It's why it's the second biggest factor in FICO scoring (Amounts Owed):

http://www.myfico.com/crediteducation/whatsinyourscore.aspx

If you get balance chased or end up with an account closed with a balance your utilization will be in even worse shape and it can be diffiicult to get out of.