- myFICO® Forums

- Types of Credit

- Credit Cards

- Capital One - Automatic CLI Review Frequency

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Capital One - Automatic CLI Review Frequency

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital One - Automatic CLI Review Frequency

I have only one card with Capital One and that is the Secured card. Recently, the policies for this card changed (no more adding deposit for higher CL) and one of the things stated in the letter was that this card, like the other cards, will now be reviewed periodically and if the person meets their internal criteria for a CLI, they will get one.

Can anyone tell me how often C1 gives automatic CLI's? Or, if you have the Secured card and have received an increase, can you tell me how long ago that was?

I'm very curious. Most people ditch the card but I am weird and don't want to close my oldest account but have a CL of $550 just makes me sad when I'm capped on my Amex (BCE).

When speaking with the chat rep he verified and said that my account was eligibile for an increase when it gets reviewed as it does periodically. He didn't actually give me an increase or imply that I would get one if I tried online. (I havn't clicked the LUV button because I already tried that a few times and just get the denial letters)

Thanks for your help!

Active Cards: Chevron Texaco, Amex BCE, Barclays Ring, Chase Freedom, Chase Freedom Unlimited, Best Buy Visa, Marvel MC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One - Automatic CLI Review Frequency

@SecretAzure wrote:I have only one card with Capital One and that is the Secured card. Recently, the policies for this card changed (no more adding deposit for higher CL) and one of the things stated in the letter was that this card, like the other cards, will now be reviewed periodically and if the person meets their internal criteria for a CLI, they will get one.

Can anyone tell me how often C1 gives automatic CLI's? Or, if you have the Secured card and have received an increase, can you tell me how long ago that was?

I'm very curious. Most people ditch the card but I am weird and don't want to close my oldest account but have a CL of $550 just makes me sad when I'm capped on my Amex (BCE).

When speaking with the chat rep he verified and said that my account was eligibile for an increase when it gets reviewed as it does periodically. He didn't actually give me an increase or imply that I would get one if I tried online. (I havn't clicked the LUV button because I already tried that a few times and just get the denial letters)

Thanks for your help!

Unfortunately this is a new policy for their secured cards so I don't think there has been enough time for anyone to know. My guess would be 6 months since that is the time frame needed between CLI on their non secure cards. But it is only a guess.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One - Automatic CLI Review Frequency

@dragontears wrote:

@SecretAzure wrote:I have only one card with Capital One and that is the Secured card. Recently, the policies for this card changed (no more adding deposit for higher CL) and one of the things stated in the letter was that this card, like the other cards, will now be reviewed periodically and if the person meets their internal criteria for a CLI, they will get one.

Can anyone tell me how often C1 gives automatic CLI's? Or, if you have the Secured card and have received an increase, can you tell me how long ago that was?

I'm very curious. Most people ditch the card but I am weird and don't want to close my oldest account but have a CL of $550 just makes me sad when I'm capped on my Amex (BCE).

When speaking with the chat rep he verified and said that my account was eligibile for an increase when it gets reviewed as it does periodically. He didn't actually give me an increase or imply that I would get one if I tried online. (I havn't clicked the LUV button because I already tried that a few times and just get the denial letters)

Thanks for your help!

Unfortunately this is a new policy for their secured cards so I don't think there has been enough time for anyone to know. My guess would be 6 months since that is the time frame needed between CLI on their non secure cards. But it is only a guess.

I appreciate your response. Your guess makes sense. I had no idea how long these things normally take for non-secure cards so we'll just go with that. ![]()

Active Cards: Chevron Texaco, Amex BCE, Barclays Ring, Chase Freedom, Chase Freedom Unlimited, Best Buy Visa, Marvel MC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One - Automatic CLI Review Frequency

I opened a cap 1 secured card on october 2014 and I got an auto cli on may 2015,but no more auto cli

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One - Automatic CLI Review Frequency

In most cases, Cap One is known to give auto CLIs to those enrolled in Credit Steps.

For other Cap One customers, it needs them to push the CLI button online (or over phone) no less than 6 months after the last CLI.

OP, since they told you that you will be given CLIs based on reviews, you can go check on your online profile now if there is a CLI button. Cap One CLIs are soft pull (for regular cardholders), so some of us keep hitting it till a CLI is given.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One - Automatic CLI Review Frequency

@Ghoshida wrote:In most cases, Cap One is known to give auto CLIs to those enrolled in Credit Steps.

For other Cap One customers, it needs them to push the CLI button online (or over phone) no less than 6 months after the last CLI.

OP, since they told you that you will be given CLIs based on reviews, you can go check on your online profile now if there is a CLI button. Cap One CLIs are soft pull (for regular cardholders), so some of us keep hitting it till a CLI is given.

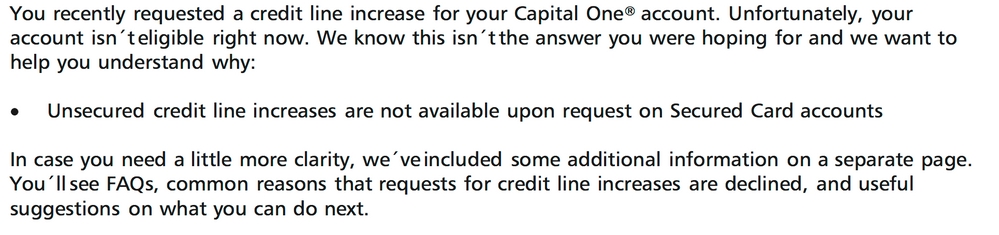

There is a CLI button but here's what happens if you hit it on a secured card after the 2-3 day message.

There's a possibility for an unsecured CLI somewhere around the 5-7 month mark with Credit Steps, but I have no idea if they'll give more increases after that. I don't think anyone knows yet.