- myFICO® Forums

- Types of Credit

- Credit Cards

- CapitalOne CLI question, help me choose!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CapitalOne CLI question, help me choose!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CapitalOne CLI question, help me choose!

Hi All!!

So a brief history on my cards...I currenyl have 3x capital one cards, they are as follows:

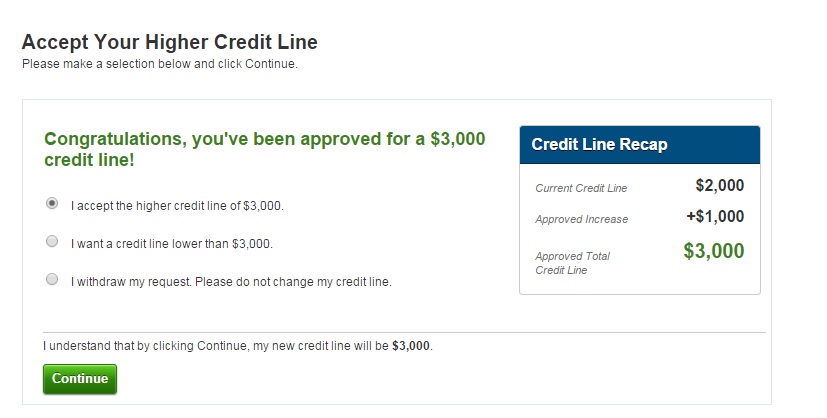

Capital One Platinum (opened: 9/14) started $500 -> $1500 -> $2000 ($1300 balance)

Capital One QS1 (opened: 11/14) started $500 -> $1500 -> $2000 ($1300 balance)

Capital One QS1 (opened: 1/15) started $500 -> $1500 -> $2000 ($1000 balance)

My oldest card just hit the 1 year mark. I was just offered a +$1000 CLI on my oldest card sitting on a $1300 balance. Now my question is, based on your experiences, should I deny the CLI they are offering me of ($1000)? Do I wait til closer to the end of the year when I pay off my balances, then attempt a CLI?

Would waiting for a CLI yield a better result if my accounts have a much lower balance? I know it's free money on the table and before I wouldn't even question accepting it, but I'm trying to get the most bang for the buck here that I can. All my cards started as credit steps cards and have all matured. From the time I was originally approved for these cards, my scores have gone up 50-60 points since. Still have 3 baddies on reports, set to fall off 2/2016.

So my other question is, do I wait til I have a 95% clean TU report (with EE) and then try??? I'm sure once those CO fall off I should see a decent score bump. No new INQ on any of my reports in the last 6 months. Your insight would be greatly appreciated myFico fam!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne CLI question, help me choose!

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne CLI question, help me choose!

I'd take the increase. End of the year is 4 months away, and in 6 months you will be eligible for another SP CLI anyway. So you can take the increase now, and get another one on March 1, which if it is indeed affected by balances, should be a bigger increase then.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne CLI question, help me choose!

@yfan wrote:I'd take the increase. End of the year is 4 months away, and in 6 months you will be eligible for another SP CLI anyway. So you can take the increase now, and get another one on March 1, which if it is indeed affected by balances, should be a bigger increase then.

Hmm, never thought about it that way. That doesn't sound like a bad idea..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne CLI question, help me choose!

@yfan wrote:I'd take the increase. End of the year is 4 months away, and in 6 months you will be eligible for another SP CLI anyway. So you can take the increase now, and get another one on March 1, which if it is indeed affected by balances, should be a bigger increase then.

My thinking exactly

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne CLI question, help me choose!

Anyone else?

Anything would be appreciated ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne CLI question, help me choose!

@yfan wrote:I'd take the increase. End of the year is 4 months away, and in 6 months you will be eligible for another SP CLI anyway. So you can take the increase now, and get another one on March 1, which if it is indeed affected by balances, should be a bigger increase then.

I agree. Take the money and run.

Start: 619 (TU08, 9/2013) | Current: 809 (TU08, 3/05/24)

BofA CCR WMC $75000 | AMEX Cash Magnet $64000 | Discover IT $46000 | Disney Premier VS $43600 | Venmo VS $30000 | NFCU More Rewards AMEX $25000 | Macy's AMEX $25000 Store $25000 | Cash+ VS $25000 | Altitude Go VS $25000 | Synchrony Premier $24,200 | Sony Card VS $23750 | GS Apple Card WEMC $22000 | WF Active Cash VS $18,000 | Jared Gold Card $16000 | FNBO Evergreen VS $15000 | Citi Custom Cash MC $14600 | Target MC $14500 | BMO Harris Cash Back MC $14000 | Amazon VS $12000 | Freedom Flex WEMC $10000 | Belk MC $10000 | Wayfair MC $4500 ~~

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne CLI question, help me choose!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne CLI question, help me choose!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne CLI question, help me choose!

Take it without any doubt. The util also wud get better with the extra 1k for the coming months. What happens in the future, vl think of it later.

In a committed relationship with Chase from 12/2012.

Age: 26, Income: $59,240/-, Current score: TU from CK: 750/A (12/24/14), TU Vantage score from CK: 775/C (12/24/14), Experian from Creditsesame: 717, Equifax from myfico: 724, Overall Util: 1% (12/24/14), Total credit limits: $62,150, In the garden from 12/19/2014, AAoA : 7 months, Oldest account: 8 months, Newest account: 1 week, HP: 18.