- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Card Cancelations

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Card Cancelations

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Card Cancelations

Cards in Sig. Should I cancel barclay rewards, chase freedom, capital one and BOA? I really only plan on using arrival plus, CSP and the amex.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Card Cancelations

@Anonymous wrote:Cards in Sig. Should I cancel barclay rewards, chase freedom, capital one and BOA? I really only plan on using arrival plus, CSP and the amex.

How old are they?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Card Cancelations

if you do decide to close it, move barclay rewards credit limit to arrival plus before closing

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Card Cancelations

@Anonymous wrote:if you do decide to close it, move barclay rewards credit limit to arrival plus before closing

Do the same with the Freedom.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Card Cancelations

@Anonymous wrote:

@Anonymous wrote:Cards in Sig. Should I cancel barclay rewards, chase freedom, capital one and BOA? I really only plan on using arrival plus, CSP and the amex.

How old are they?

And are there any AF's?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Card Cancelations

Keep the Freedom active. You can use it instead of CSP for 5% category purchases and transfer to CSP. I want to get the Freedom to do this. Freedom with CSP = easier to optimize points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Card Cancelations

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Card Cancelations

The other thing I do is on each card in the SD, I put an auto charge on each. Gym membership, Netflix, Sirius XM, etc...then set the account up for auto full payment a few days before the due date. Easy breezy.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Card Cancelations

Long term, I don't think closing accounts you don't use makes any practical difference. You only need a few credit cards to maximize your scores. I know the conventional wisdom on many sites is to keep all AF-free accounts open, even if there's virtually no chance that you'll ever use the card again, but I'm starting to close my accounts that fall under this category. It's unnecessary overhead for me to try to keep track of them and check up on them every month to make sure I still have a $0 balance (ie, no fraud, no clerical issues, etc)... Yes, I may take hits in the short term, but they're only temporary. Only time I wouldn't close such accounts is if doing so inflates your UTIL so badly that you fall out of the "optimal zone" and/or opens you up to potential AA from your other lenders.

Just my opinion though. I don't work anywhere in the financial sector. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Card Cancelations

@Anonymous wrote:Cards in Sig. Should I cancel barclay rewards, chase freedom, capital one and BOA? I really only plan on using arrival plus, CSP and the amex.

Hey Man2.

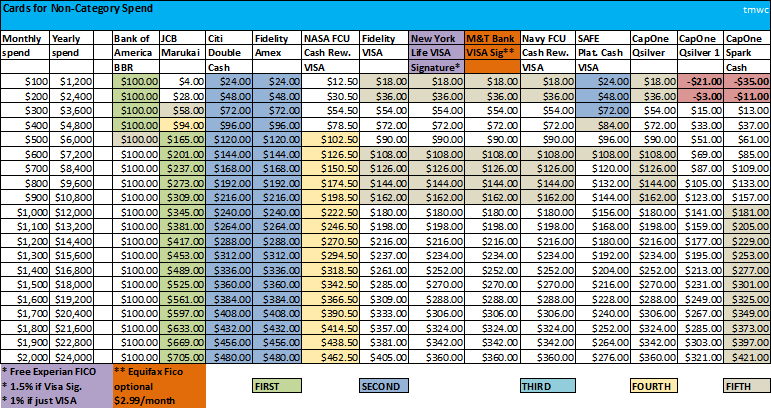

Product change the BOA card into a BOA Better Balance Rewards, then put your smallest monthly bill on that card (greater than $25) and set it to pay in full. That should get you at least $100 cash back per year, $120 if you bank with BOA. Someone here has 4 BBR cards, so it doesn't hurt to start collecting them ![]()

Keep the Freedom. Life is like a box of chocolates, you never know when you'll need a Freedom quarterly category.

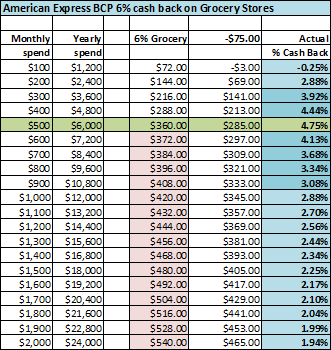

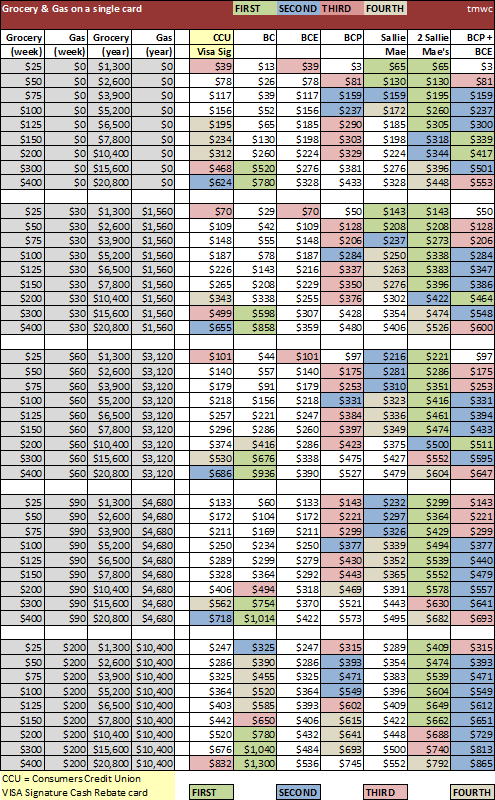

Try to transfer the limit from the Barclay Rewards before closing. I'm not a big fan of the Amex BCP, the spending cap and large annual fee really reduces the cash back potential. I prefer 1 or 2 Barclays Sallie Mae Mastercards, as 5% cash back with no annual fee will often beat a BCP.

https://www.salliemae.com/credit-cards/sallie-mae-card/

I don't see a need for the QuickSilver One. Citi Double Cash can handle it, along with as many BOA Better Balance Rewards cards as you can get...

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800