- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Cards That Do/Do Not Report CL

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Cards That Do/Do Not Report CL

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cards That Do/Do Not Report CL

i just want to get this straight, if i have a BofA world signature card and i have a 20,000 dollar balance on a 25,000 credit limit, because it is a signature card, and it is considered an open account, the balance of 20k is not considered in the utilization calculation?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cards That Do/Do Not Report CL

@oracles wrote:i just want to get this straight, if i have a BofA world signature card and i have a 20,000 dollar balance on a 25,000 credit limit, because it is a signature card, and it is considered an open account, the balance of 20k is not considered in the utilization calculation?

Hard to say for sure.

My BofA MC just converted to World, but as best as I can see, it's being treated the same as any other CC: the CL is reported, and that's what's used for calculating util.

If your CL is reported, that will be used for calculating util. If your highest balance is reported, and not the CL, that will be used for util. If neither is reported, the card will be ignored in calculating util, which can help or hurt, depending on whether you need that card's CL in your total CL.

If your card is using highest balance instead of CL, having a $20K balance report will certainly be painful initially, as it will show you at 100% util, but once it updates again next month, the $20K will be used to calculate future util (instead of the $25K CL.) So unless you let gi-normous balances report, you should wind up in pretty good shape with this scenario, again, once you survive that first month. For util purposes it will be the equivalent of having a card with a $20K CL instead of a $25K CL.

FICO's: EQ 781 - TU 793 - EX 779 (from PSECU) - Done credit hunting; having fun with credit gardening. - EQ 590 on 5/14/2007

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cards That Do/Do Not Report CL

@haulingthescoreup wrote:

@oracles wrote:i just want to get this straight, if i have a BofA world signature card and i have a 20,000 dollar balance on a 25,000 credit limit, because it is a signature card, and it is considered an open account, the balance of 20k is not considered in the utilization calculation?

Hard to say for sure.

Yes.

My BofA MC just converted to World, but as best as I can see, it's being treated the same as any other CC: the CL is reported, and that's what's used for calculating util.

My new Alaska Signature Visa, whose lender is BofA too, doesn't report its credit limit. Its account type is revolving, and its type of loan is flexible spending credit card. What's the loan type of your World card? I guess the card agreements of the two cards resemble each other.

If your CL is reported, that will be used for calculating util. If your highest balance is reported, and not the CL, that will be used for util. If neither is reported, the card will be ignored in calculating util, which can help or hurt, depending on whether you need that card's CL in your total CL.

If the high balance is reported, but not the credit limit, I gather it's used for util if the account type is revolving; if the account type is open, my experience from an older Signature Visa card is that the reported high balance is not used for util.

DW has a Citi AAdvantage MC card, whose account type is revolving and whose loan type is credit card, and neither the credit limit nor the high balance is reported. I see that your closed Citi Sears Citi MC card mentioned elsewhere reported a credit limit. Maybe it would behoove her to call Citi and ask why hers isn't, or at least the high balance.

If your card is using highest balance instead of CL, having a $20K balance report will certainly be painful initially, as it will show you at 100% util, but once it updates again next month, the $20K will be used to calculate future util (instead of the $25K CL.) So unless you let gi-normous balances report, you should wind up in pretty good shape with this scenario, again, once you survive that first month. For util purposes it will be the equivalent of having a card with a $20K CL instead of a $25K CL.

I plan on doing just that soon with my new Signature Visa card. It's a pity though that it's necessary to play games like that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cards That Do/Do Not Report CL

@oracles wrote:i just want to get this straight, if i have a BofA world signature card and i have a 20,000 dollar balance on a 25,000 credit limit, because it is a signature card, and it is considered an open account, the balance of 20k is not considered in the utilization calculation?

I have begun to think that it's a case of misguided logic (by the CRAs or the CCCs) to believe the open-ended nature of a no preset spending limit translates into an account type of open. In myFICO score reports' definition of account types is stated, "Open (or charge): an account that must be paid in full every period (usually monthly)." The card agreement of a Signature bank credit card doesn't say so in my experience (although it does for what's charged beyond the credit access line).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cards That Do/Do Not Report CL

It's a new critter in the world of credit, and so I'd say that there isn't a logical data field in the reports to describe it. So sometimes it shows as open, others as revolving, and so on.

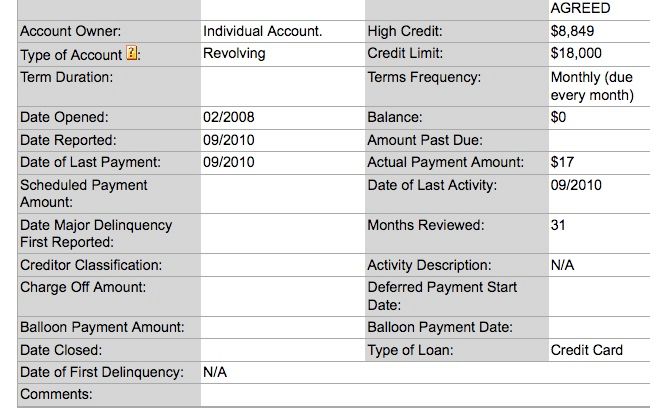

Here's how mine is showing on EQ, so far:

It's the same way that its predecessor reported, revolving + credit card.

FICO's: EQ 781 - TU 793 - EX 779 (from PSECU) - Done credit hunting; having fun with credit gardening. - EQ 590 on 5/14/2007