- myFICO® Forums

- Types of Credit

- Credit Cards

- Cashback without carrying 20 cards.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Cashback without carrying 20 cards.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cashback without carrying 20 cards.

@Anonymous wrote:For US Bank Cash+, does the bookstore bonus category apply to all Amazon purchases, or just to Kindle ebooks? If it worked like discover or chase freedom, that would be amazing.

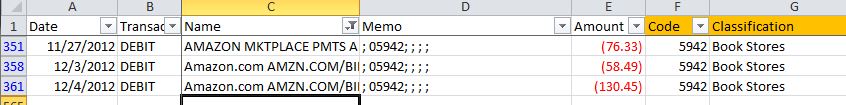

The MCC coding I have from another US Bank CC, from 2012, has Amazon with 5942 which is the Bookstores code, so I think it is all Amazon billings.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cashback without carrying 20 cards.

@redpat wrote:I boycott of anything Walmart, just can't make myself do it, lol.

Even with Amex $25 cashback on membership.

BUY LOCAL!!!!!!.

OP is right about Sam's but I would have to sell my soul......

I agree, Wal-Mart can be dreadful (depending on the location, and the local management especially) but the cash back categories are worth getting a Sam's Club MasterCard even if you never step foot in a Sam's.

I'm making quite a bit off mine, even after you subtract the $45 membership fee! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cashback without carrying 20 cards.

@newhis wrote:

@Anonymous wrote:

@Anonymous wrote:

No, you get a check that can be cashed at customer service.And they let you walk out with the cash? I mean hey if it works it works...I just didn't expect that

From Samsclub website:

...Cash back rewards are forfeited if the Sam’s Club MasterCard account is not in good standing, if the Sam’s Club Membership terminates or lapses, or if the Cash Back earned in a calendar year is less than $5.00...

That is in the 'fine print' but it also states in there that if you get a check and no longer have a membership, you can stop by the front desk and get a "day pass" to cash your check (you're not required to use the cash for a purchase). The website (and even the credit site) actually contridicts itself in several places.

The website also states that Kroger fuel pumps aren't eligible for the 5% cash back, but I did a test run at my local Kroger and I did earn 5% on the purchase. I don't know if it's just my local Kroger or all of them (and perhaps only when swiping at the pump and not with an attendant?), but either way I'm taking advantage of it until they 'fix' it. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cashback without carrying 20 cards.

@UncleB wrote:

@redpat wrote:I boycott of anything Walmart, just can't make myself do it, lol.

Even with Amex $25 cashback on membership.

BUY LOCAL!!!!!!.

OP is right about Sam's but I would have to sell my soul......

I agree, Wal-Mart can be dreadful (depending on the location, and the local management especially) but the cash back categories are worth getting a Sam's Club MasterCard even if you never step foot in a Sam's.

I'm making quite a bit off mine, even after you subtract the $45 membership fee!

I would have to step foot in Sam's to cash the darn check they give you in February. That is the only way to get your cash back from what I understand.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cashback without carrying 20 cards.

It's probably (for most people) not super important to try to cover every single possible category of spend (eg a card just for drugstores, a card just for office supply stores), because again, spreading it among too many cards just dilutes rewards across many programs often with redemption thresholds.

Now, some people need a lot of prescriptions so drugstores become more relevant, so I'm not saying it's 100% of the time, but generally I think trying to "maximize" every single place you might spend money is going to end up just too much spreading with too little gain.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cashback without carrying 20 cards.

@redpat wrote:

@UncleB wrote:

@redpat wrote:I boycott of anything Walmart, just can't make myself do it, lol.

Even with Amex $25 cashback on membership.

BUY LOCAL!!!!!!.

OP is right about Sam's but I would have to sell my soul......

I agree, Wal-Mart can be dreadful (depending on the location, and the local management especially) but the cash back categories are worth getting a Sam's Club MasterCard even if you never step foot in a Sam's.

I'm making quite a bit off mine, even after you subtract the $45 membership fee!

I would have to step foot in Sam's to cash the darn check they give you in February. That is the only way to get your cash back from what I understand.

That is true, you technically have to 'step foot' in a physical club location one time a year to cash the check but you don't have to actually buy anything, if that makes a difference. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cashback without carrying 20 cards.

@kdm31091 wrote:It's probably (for most people) not super important to try to cover every single possible category of spend (eg a card just for drugstores, a card just for office supply stores), because again, spreading it among too many cards just dilutes rewards across many programs often with redemption thresholds.

Now, some people need a lot of prescriptions so drugstores become more relevant, so I'm not saying it's 100% of the time, but generally I think trying to "maximize" every single place you might spend money is going to end up just too much spreading with too little gain.

Agreed on the first point that more and more cash back category cards produce very little marginal return.

Anyone who spends so much on prescriptions that he or she sees value in a "drugstore card" will probably benefit much more from paying lower prescription prices in the first place with a warehouse club membership.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cashback without carrying 20 cards

@kdm31091 wrote:It's probably (for most people) not super important to try to cover every single possible category of spend (eg a card just for drugstores, a card just for office supply stores), because again, spreading it among too many cards just dilutes rewards across many programs often with redemption thresholds.

Now, some people need a lot of prescriptions so drugstores become more relevant, so I'm not saying it's 100% of the time, but generally I think trying to "maximize" every single place you might spend money is going to end up just too much spreading with too little gain.

+1

Since I only go to a free-standing drug store 1-2 times per year (if that often) it wouldn't be worth a dedicated card that gave higher rewards there, but for somebody with significant drug expenses it could make a difference. I see this really as being a good 'also' candidate, as in the AARP is known for 3% back for restaurants, but 'also' gives a bumped-up percent for drugstores, same as the Amazon Visa. You (probably) wouldn't get either of those cards solely for the drug store cash back, but if you've already got either they would be good cards to use.

I also see this similar to having a travel card... for the right person, it's invaluable, but for someone who only leaves their own town once each year it's not necessary, and could even cause you to go 'backwards' rewards-wise (if it has an AF that can't be offset by earning rewards). That's not even taking into account the extra paperwork and time/effort needed for keeping up with an extra account.

(Outlying categories like drugstores, at least for me, are what makes my Quicksilver cards valuable.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cashback without carrying 20 cards.

@Anonymous wrote:

@kdm31091 wrote:It's probably (for most people) not super important to try to cover every single possible category of spend (eg a card just for drugstores, a card just for office supply stores), because again, spreading it among too many cards just dilutes rewards across many programs often with redemption thresholds.

Now, some people need a lot of prescriptions so drugstores become more relevant, so I'm not saying it's 100% of the time, but generally I think trying to "maximize" every single place you might spend money is going to end up just too much spreading with too little gain.

Agreed on the first point that more and more cash back category cards produce very little marginal return.

Anyone who spends so much on prescriptions that he or she sees value in a "drugstore card" will probably benefit much more from paying lower prescription prices in the first place with a warehouse club membership.

That's a great point I wish was mentioned more often around here. Sometimes in the quest for rewards, we forget about pricing things out. For example, if your grocery order would cost you less at walmart but you forego your card's special "grocery" rewards...you should still get them at walmart, not go to the grocery to get the category rewards every time. It's just an example, but it's the same spirit of what you are saying.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cashback without carrying 20 cards.

@kdm31091 wrote:It's probably (for most people) not super important to try to cover every single possible category of spend (eg a card just for drugstores, a card just for office supply stores), because again, spreading it among too many cards just dilutes rewards across many programs often with redemption thresholds.

Now, some people need a lot of prescriptions so drugstores become more relevant, so I'm not saying it's 100% of the time, but generally I think trying to "maximize" every single place you might spend money is going to end up just too much spreading with too little gain.

As usual, you make an excellent point. That's why I'm trying to reduce the number of card while maximizing my reward. Now, I can eliminate chase freedom and it, if I don't spend over $6000 in grocery and gas. That would bring my total down to 5.

On $20,000 spend/year, the difference of 0.5% equals $100.