- myFICO® Forums

- Types of Credit

- Credit Cards

- Chase Freedom and Bonus Estimate

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase Freedom and Bonus Estimate

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Chase Freedom and Bonus Estimate

Hello all. i have asimple question about chase after reading about the account closings and all. and knowing they are super sensitive.

I had been trying to get in with chase for about 6 months. as i applied last year in september and was turned down. forgot reason. something like no experience with high limits.

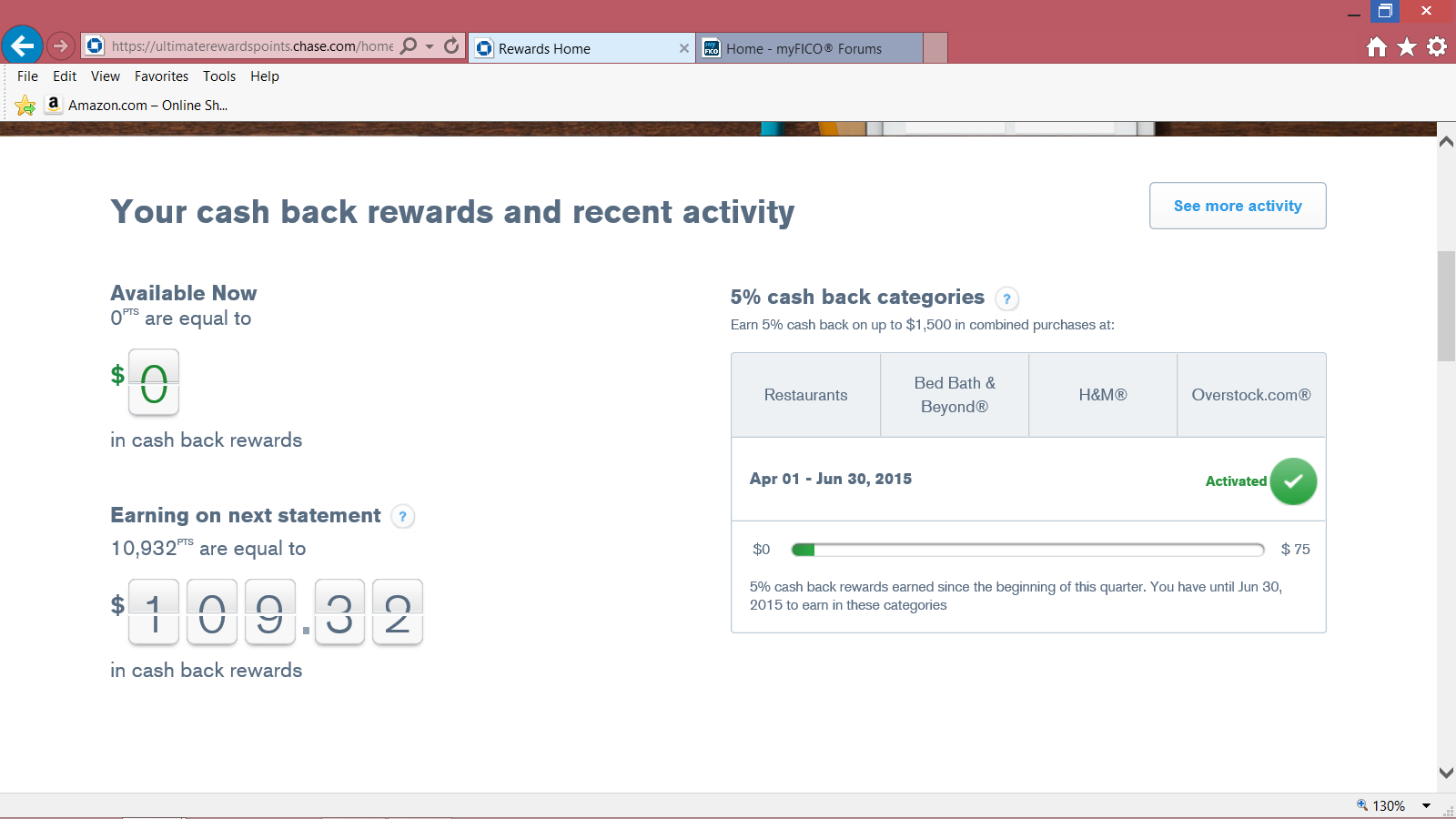

Anyway. i told myself i would not apply for a chase card until i got pre approval. which i did last month.. I went thru all the drama of their verification and got my card finally. so. Their 500 spend in first 3 months. i prioritized it and am done. i don't need restaurants as Discover is showing love and i will show love back by using their card. i will use The freedom in november when my 18 months of 0 percent Discover Runs out. Which will get me about 8 extra months of 0 percent on the freedom. Main question. will they shut me down. as i will just ask for statement credit with the bonus then SD the card. at least until november. Snap shot of my bonus below. I do appreciate the free money however. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom and Bonus Estimate

@taxi818 wrote:Hello all. i have asimple question about chase after reading about the account closings and all. and knowing they are super sensitive.

I had been trying to get in with chase for about 6 months. as i applied last year in september and was turned down. forgot reason. something like no experience with high limits.

Anyway. i told myself i would not apply for a chase card until i got pre approval. which i did last month.. I went thru all the drama of their verification and got my card finally. so. Their 500 spend in first 3 months. i prioritized it and am done. i don't need restaurants as Discover is showing love and i will show love back by using their card. i will use The freedom in november when my 18 months of 0 percent Discover Runs out. Which will get me about 8 extra months of 0 percent on the freedom. Main question. will they shut me down. as i will just ask for statement credit with the bonus then SD the card. at least until november. Snap shot of my bonus below. I do appreciate the free money however.

Why would they shut you down?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom and Bonus Estimate

As it will be 6 months before i use the card again after i cash out the bonus?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom and Bonus Estimate

@taxi818 wrote:As it will be 6 months before i use the card again after i cash out the bonus?

Just put a random charge on it every so often.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom and Bonus Estimate

Yep. will do. i just was in shock reading all the recent shutdowns. or AA from chase. I know we never hear entire story. but since i have no experience with them. was just wondering. Honestly. i just wanted the realtionship for future considerations. like when that only collection drop off in a year or so and my scores are hovering 760 plus. then i will go for the good chase cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom and Bonus Estimate

@Anonymous wrote:

@taxi818 wrote:As it will be 6 months before i use the card again after i cash out the bonus?

Just put a random charge on it every so often.

I agree. Just use it for something like every couple months to keep it active. An item to keep in mind, you also want to build an internal score with them since they are algorithm-based (among other factors and criteria). If you stop using your account for a prolonged period, then there will be no incentive for auto-CLI (let alone a CLI) and other products (if you're remotely interested - like CSP) which would be dependent on the history of your first card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom and Bonus Estimate

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom and Bonus Estimate

@FinStar wrote:

@Anonymous wrote:

@taxi818 wrote:As it will be 6 months before i use the card again after i cash out the bonus?

Just put a random charge on it every so often.

I agree. Just use it for something like every couple months to keep it active. An item to keep in mind, you also want to build an internal score with them since they are algorithm-based (among other factors and criteria). If you stop using your account for a prolonged period, then there will be no incentive for auto-CLI (let alone a CLI) and other products (if you're remotely interested - like CSP) which would be dependent on the history of your first card.

Hmm. Yes. thats the reason. to get the csp in a year or so. in that case. I could make exception and just use Chase. especially since Gas is coming up and i spend about 1k per month. i was gonna try and make the Venture spend. but I could mothball it for chase. and put the Venture away and lose that bonus. As the long term relationship is worth much more than a bonus to me. Thanks Fin. Did not think of that aspect.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom and Bonus Estimate

@taxi818 wrote:

@FinStar wrote:

@Anonymous wrote:

@taxi818 wrote:As it will be 6 months before i use the card again after i cash out the bonus?

Just put a random charge on it every so often.

I agree. Just use it for something like every couple months to keep it active. An item to keep in mind, you also want to build an internal score with them since they are algorithm-based (among other factors and criteria). If you stop using your account for a prolonged period, then there will be no incentive for auto-CLI (let alone a CLI) and other products (if you're remotely interested - like CSP) which would be dependent on the history of your first card.

Hmm. Yes. thats the reason. to get the csp in a year or so. in that case. I could make exception and just use Chase. especially since Gas is coming up and i spend about 1k per month. i was gonna try and make the Venture spend. but I could mothball it for chase. and put the Venture away and lose that bonus. As the long term relationship is worth much more than a bonus to me. Thanks Fin. Did not think of that aspect.

How much do you still have left on your Venture spend for the sign up bonus? Yeah, I wouldn't fret too much with Chase as far as AA. Just don't go hog wild with opening too many accounts for the next 6 months or so and keep utilization in check. Other than that, just throw them a bone here and there to maintain some usage. You decide what works best ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom and Bonus Estimate

Chase is a keeper and I agree most of the the time for AA is w/chase is more than you hear.. Either high Utilization on their card or other creditors cards or MS or churning or along those lines... You Freedom will be just fine... Sure they aren't happy how many cards I have opened since them, but they will live with it.. They at least get 1k charges a month between the CSP/Freedom..