- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Chase Freedom lists 5% cash back categories fo...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase Freedom lists 5% cash back categories for 2011

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

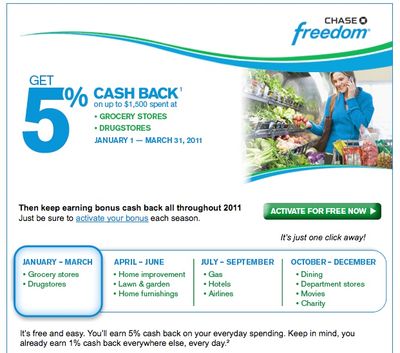

Chase Freedom lists 5% cash back categories for 2011

FYI, for those considering applying. If you choose points instead of cash back, it's 5 points, if I read the fine print correctly:

It's a little unsettling, because the categories for where the card was used that show on the Chase monthly statement don't match these categories, and the cash back doesn't appear until a month or so into the next quarter, so you just have to keep hoping that everything is being credited correctly. The Chase CSR I spoke to a couple of months ago said that they were getting a lot of requests for the ability to track the awards, and they're "considering it."

FICO's: EQ 781 - TU 793 - EX 779 (from PSECU) - Done credit hunting; having fun with credit gardening. - EQ 590 on 5/14/2007

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom lists 5% cash back categories for 2011

Precisely why I stopped using my Chase Freedom, even with these "awesome" 5% categories. You can't track anything, so how would you know if you are actually getting your 5%? The whole thing is slightly shady to me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom lists 5% cash back categories for 2011

I had a freedom card briefly, it was my highest CL too. I kept a low balance untl I started putting books on there and racked up a bill. I was making minimum payments and then through a small mistake (I was paying online and must have entered the checking account number wrong) I got hit with some fees. Fair enough, made a payment to correct it but didn't factor in the fees, so they kep accessing finance charges. I finally had canceled my account when they took all my points.

I WOULD never apply for another chase freedom card. Not worth it to me.

In the Garden Club since: 07/05/2017

6/9/2008-TransUnion-703

6/9/2008-Equifax-712

6/9/2008 Experian-635

2/16/2011 Transunion - 675

3/11/2011 Equifax - 688

5/13/2011 Equifax - 704

5/28/2011 Equifax - 704

5/28/2011 Transunion - 724

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom lists 5% cash back categories for 2011

A month into the next quarter? That is shady to me. Even though Discover's caps are much lower, I like how the cashback appears on your monthly statements and is then immediately credited after the statement's been released. Also, I see the merchant category right away online after it shows up on my tab.

Has anyone ever experienced a substantial non-crediting of well-deserved cashback due to the vendor not being properly categorized?

I think especially gas stations and grocery stores should be easy for Chase to rezognize, though.

Provided, everything works fine with Chase and provided you really spend in the given categories, the cashback is still awesome. One of these days, I'll re-apply for the Freedom.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom lists 5% cash back categories for 2011

lol, I hear all of you. And I had to fuss at them for almost a year after they switched my original Borders Visa to Chase Freedom before they'd give me the 5%.

It's still not my go-to card, except in the 5% categories. ![]()

FICO's: EQ 781 - TU 793 - EX 779 (from PSECU) - Done credit hunting; having fun with credit gardening. - EQ 590 on 5/14/2007

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom lists 5% cash back categories for 2011

@kc12286 wrote:I had a freedom card briefly, it was my highest CL too. I kept a low balance untl I started putting books on there and racked up a bill. I was making minimum payments and then through a small mistake (I was paying online and must have entered the checking account number wrong) I got hit with some fees. Fair enough, made a payment to correct it but didn't factor in the fees, so they kep accessing finance charges. I finally had canceled my account when they took all my points.

I WOULD never apply for another chase freedom card. Not worth it to me.

Umm not to sound antagonistic, but why? you admit yourself you made the errors, and not just one but several that compounded. You sound like you are blaming Chase.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom lists 5% cash back categories for 2011

I made one error, which was when I was paying online. My balance before that, had not been very high. So in effect, my balance shot up after I made the payment to correct my error. I tried to pay it down, but NONE of the subsequent payments made seemed to make a difference, thus I closed it. The finance charges got so high that at one point Chase wanted more than 1k in order for my account to be considered current. When I closed the card I hadn't used it in six months, so what was appearing on the statements were finance charges and I'm guessing the intial fee(s) from the checking error.

Maybe my intial post didn't make sense, sorry about that.

Edit: I just looked at my account, as it was a Chase card and I can see what I spent while the account was open. Prior to my mistake with the checking account, my balance had been current and I had no late fees or past dues. Once I made the error, they assessed a late fee, past due, return check fee, etc. They took some of those fees off and I did make a payment above the minimum, but that payment must not have factored in the fees, as it was sent out the next day as soon as the error was noticed. So Chase considered those fees past due balances and even though I made payments every month after that, not of those payments went towards those past due fees, so the past due balance continued to increase and did the minimum payment that I owed. I finally had no choice but to close the account. I was working a mimimum wage job and despite my best efforts could not get a second job. It was the right decision for me. And looking at the account now, the rewards were not worth what I went through. It was nice card and might be useful others, but it wasn't the right card for me. I started out using it for gas, as it offered 5 points on every $1 spent at a gas station, grocery station etc. But like someone else said, those points didn't show up right away like they do with some other cards. So by the time I closed my account, I only had a little over 1k in points.

If it works for you great, but I wouldn't get another freedom card from chase.

In the Garden Club since: 07/05/2017

6/9/2008-TransUnion-703

6/9/2008-Equifax-712

6/9/2008 Experian-635

2/16/2011 Transunion - 675

3/11/2011 Equifax - 688

5/13/2011 Equifax - 704

5/28/2011 Equifax - 704

5/28/2011 Transunion - 724

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom lists 5% cash back categories for 2011

@haulingthescoreup wrote:

FYI, for those considering applying. If you choose points instead of cash back, it's 5 points, if I read the fine print correctly:

It's a little unsettling, because the categories for where the card was used that show on the Chase monthly statement don't match these categories, and the cash back doesn't appear until a month or so into the next quarter, so you just have to keep hoping that everything is being credited correctly. The Chase CSR I spoke to a couple of months ago said that they were getting a lot of requests for the ability to track the awards, and they're "considering it."

For the past 2 Freedom quarterly promotions, I've been receiving some of my rewards before the promotional period ends. On my December Chase statement, I received bonus points for purchases made from October-November:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom lists 5% cash back categories for 2011

I just recently got the card last November and my new points were updated within the month. I do wish that we didn't need to call or sign up online every quarter for the promotions though. But I think discover and citi have people do the same thing.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom lists 5% cash back categories for 2011

I went back through some statements, and duh me, they've been crediting the points all along. ![]() I should know better than to listen to a CSR...

I should know better than to listen to a CSR...

Nevertheless, there still isn't a breakdown of which charges resulted in the points, and the category names in the "Activity" section don't match the 5% categories.

I do know that I've collected a ton of points since I was able to start using the 5% categories, so I figure I'm OK, but still!

FICO's: EQ 781 - TU 793 - EX 779 (from PSECU) - Done credit hunting; having fun with credit gardening. - EQ 590 on 5/14/2007