- myFICO® Forums

- Types of Credit

- Credit Cards

- Chase Marriott 120,000 Point Offer

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase Marriott 120,000 Point Offer

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Chase Marriott 120,000 Point Offer

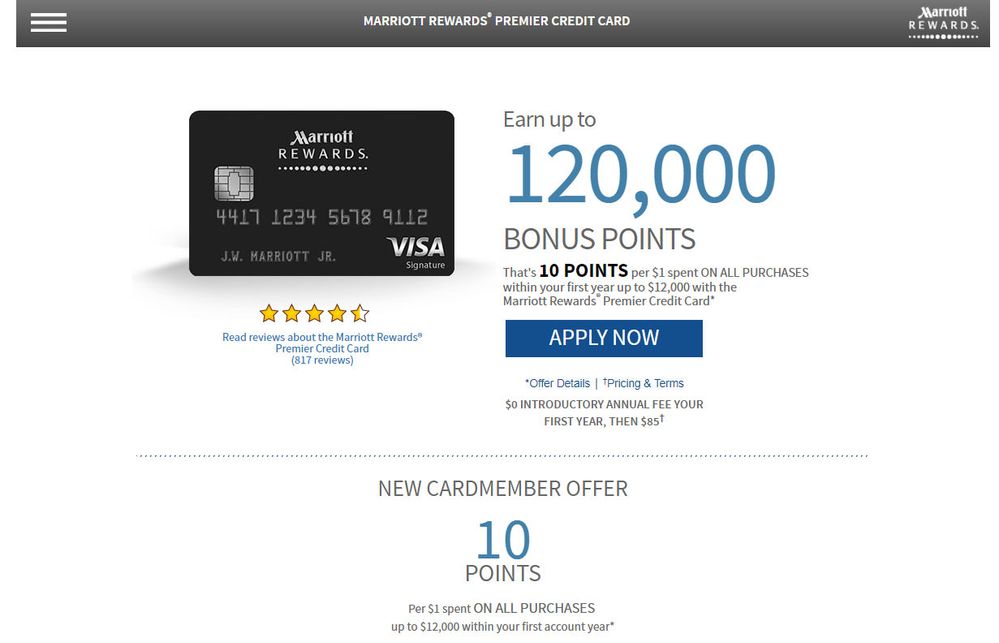

So, I got this offer in my inbox a few minutes ago. Why oh why does it have to be under 5/24, Chase? I'll take 120k for up to $12k spending over 80k or 100k for $x,000 spending any day! Reading through the fine print, I did notice an interesting little addition to the bottom of the terms:

Chase cardmembers who currently have or have had a Chase credit card in any Rewards Program associated with this offer, may not be eligible for a second Chase credit card in the same Rewards Program. Chase cardmembers currently receiving promotional pricing, or Chase cardmembers with a history of only using their current or prior Chase card for promotional pricing offers, are not eligible for a second Chase credit card with promotional pricing.

I'm so tempted to try anyway, but I know if I did that it would just be an absolutely wasted HP or two. Sigh.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Marriott 120,000 Point Offer

Sorry, I feel you pain. I expect to be under Chase 5/24 in about a year. Most of my inquiries and new cards are going to come off.

All the junk cards are not worth the inquiries or the new card space. The application spree really hurts something like this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Marriott 120,000 Point Offer

Oh yeah, forgot to highlight that this offer also waives the $85 annual fee for the first year, which the public 80k and 100k offers don't. Because of the bar of spending needed to obtain this bonus, it really should be exempt from 5/24. Typically (I know there would be some exceptions), churners and bonus chasers aren't going to commit to $12,000 in spending.

I am 5/24 until April 2019 (got my NFCU Flagship Rewards and PenFed Power Cash Rewards 7 months ago), when I will be 3/24. By then, I'm sure the Marriott landscape will have changed greatly. Hopefully I'll instead be enjoying a nice bonus on an ultra-premium $450 AF Amex Marriott card by then.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Marriott 120,000 Point Offer

It is still not clear as to the Marriott + SPG for next year. I still plan to get another personal SPG open late this year or early next year. The super premium card space gets crowded too. Can't have them all.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Marriott 120,000 Point Offer

NFCU Flagship Rewards and PenFed Power Cash Rewards

I do not really know those cards well. I only pick up a couple of $500 bonus cards each year. Still light with Citi, Barclay, Capital One and US Bank.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Marriott 120,000 Point Offer

Chase's analysts who came up with 5/24 specifically should win a Nobel prize for psychological science or something. They really nailed the numbers perfectly in terms of boosting Chase's products "premierness" and hurting the competition with reducing the number of accounts out there.

This is glorious warfare in the financial market.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Marriott 120,000 Point Offer

Well, I see the need for Chase to limit the # of premium cards or the cards with good bonus. But what is the need to block people from having Amazon credit card?? It has low bonus ($50?) and average rewards. Anyone with decent credit should be allowed to get one, even with $1,000 credit limit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Marriott 120,000 Point Offer

@K-in-Boston wrote:

So, I got this offer in my inbox a few minutes ago. Why oh why does it have to be under 5/24, Chase? I'll take 120k for up to $12k spending over 80k or 100k for $x,000 spending any day! Reading through the fine print, I did notice an interesting little addition to the bottom of the terms:

Chase cardmembers who currently have or have had a Chase credit card in any Rewards Program associated with this offer, may not be eligible for a second Chase credit card in the same Rewards Program. Chase cardmembers currently receiving promotional pricing, or Chase cardmembers with a history of only using their current or prior Chase card for promotional pricing offers, are not eligible for a second Chase credit card with promotional pricing.

I'm so tempted to try anyway, but I know if I did that it would just be an absolutely wasted HP or two. Sigh.

Eh, I don't think this is as good as it looks.

If you stay at Marriotts with any frequency (5 nights per month or more), using this card only for Marriotts for the first year at $1,000/month (very doable), you'll walk away with 240k points (120k + 120k) before any MegaBonus/Elite bonuses. With the base offer of 80k for $3000 spend, this same pattern would result in 260k points (80k + 120k + 60k). It gets even less appealing if you stay less or spend less at Marriotts. Taking the baseline 80k point sign-up for $3000 spend, if you get that card and only use it for $3000 at Marriott properties, you'll get at least 125k points (80k + 30k + 15k) before any MegaBonus/Elite bonus points, and still have $9,000 you can use toward miles or something else.

The only use case where I see this being good is for the person who wants Marriott points but rarely spends/stays at Marriott. If this person is looking for a way to accumulate points, this would certainly do it, though after the promotion it will get difficult to generate points at any rate without at least some spend with Marriott.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Marriott 120,000 Point Offer

@iced wrote:Eh, I don't think this is as good as it looks.

If you stay at Marriotts with any frequency (5 nights per month or more), using this card only for Marriotts for the first year at $1,000/month (very doable), you'll walk away with 240k points (120k + 120k) before any MegaBonus/Elite bonuses. With the base offer of 80k for $3000 spend, this same pattern would result in 260k points (80k + 120k + 60k). It gets even less appealing if you stay less or spend less at Marriotts. Taking the baseline 80k point sign-up for $3000 spend, if you get that card and only use it for $3000 at Marriott properties, you'll get at least 125k points (80k + 30k + 15k) before any MegaBonus/Elite bonus points, and still have $9,000 you can use toward miles or something else.

The only use case where I see this being good is for the person who wants Marriott points but rarely spends/stays at Marriott. If this person is looking for a way to accumulate points, this would certainly do it, though after the promotion it will get difficult to generate points at any rate without at least some spend with Marriott.

One of the other major differences here from the regular signup bonuses is that this offer is 10 points per dollar spent on the first $12,000 of spend. Not an additional 10 points, so your "not as good as it looks" point is well taken and for some people it may not be as good as a standard offer. Also, the fine print for that "Earn up to 120,000 bonus points" is actually misleading since you're not going to get that many bonus points. (There's also a rare targeted 150,000 point offer for $30,000 that is the same as this but 5 points per dollar for the first $30,000 in spend.) From the fine print:

The 10 points will appear on your statement as follows: 5 points plus an additional 5 points on qualifying purchases made at participating Marriott®, The Ritz-Carlton®, and SPG® locations; 2 points plus an additional 8 points on each $1 spent in the following categories: restaurants; airline tickets purchased directly from the airline; and car rental agencies; and 1 point plus an additional 9 points for each $1 spent on all other purchases. After that you’ll earn [insert standard reward structure for this card]...

If I were able to get this offer, it would be great for me because the only spend I would be putting on it would have been 1x spend. I do have spend that is non-category with cases where I cannot use my preferred payment method (Amex SPG). So 80k standard offer + 12k (at 1x, and inflating the annual spend to make the spending even between offers) would be a fantastic 92,000 points but this way I'd be getting 120,000 that normally would have been on something like CSP for only 12,000 Marriott points.

If you stay at Marriotts with any frequency (5 nights per month or more), using this card only for Marriotts for the first year at $1,000/month (very doable), you'll walk away with 240k points (120k + 120k) before any MegaBonus/Elite bonuses. It would actually only be the 120k. With the base offer of 80k for $3000 spend, this same pattern would result in 260k points (80k + 120k + 60k). It's been a long day, so maybe I missed something but you lost me here. Wouldn't it be 80k signup bonus and then with $12k of Marriott spend be 60k points, for a total of 140k points? It gets even less appealing if you stay less or spend less at Marriotts. For my spend, that would be 80k bonus plus 12k in 1x spend. I'm the first to say that under normal circumstances, a Marriott card is a horrible way to earn Marriott points, even if it's all spent at Marriott - SPG is so much better! LOL Taking the baseline 80k point sign-up for $3000 spend, if you get that card and only use it for $3000 at Marriott properties, you'll get at least 125k points (80k + 30k + 15k) I'm lost again; 80k bonus + 15k (5 points x 3k) is 95k - where's the 30k from? before any MegaBonus/Elite bonus points, and still have $9,000 you can use toward miles or something else. With my spend, I'd certainly only put Marriott charges on SPG for the higher earning wherever possible so I would barely eek out any points.

Just want to say that I see where you were going with that (even if I am confused by the actual totals) and I'm not debating your point. My actual spend at Marriott is minimal. I think I'll hit 17 nights this year and that'll likely continue 15-20 or so annually since I don't really travel for business purposes - almost exclusively leisure. For me, using SPG (3x points for everything but Marriott/SPG which is 6x) for everything but flights (Amex Platinum, 5x), non-Marriott hotels (Amex Platinum via Amex Travel, 5x), Freedom categories (5x), or places where I can't use Amex (Freedom or CSP at 1x) is the best way to earn Marriott points, but I would certainbly be willing to switch up my 1x non-Amex spend for an extra 108k points!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Marriott 120,000 Point Offer

@K-in-Boston wrote:

Just want to say that I see where you were going with that (even if I am confused by the actual totals) and I'm not debating your point. My actual spend at Marriott is minimal. I think I'll hit 17 nights this year and that'll likely continue 15-20 or so annually since I don't really travel for business purposes - almost exclusively leisure. For me, using SPG (3x points for everything but Marriott/SPG which is 6x) for everything but flights (Amex Platinum, 5x), non-Marriott hotels (Amex Platinum via Amex Travel, 5x), Freedom categories (5x), or places where I can't use Amex (Freedom or CSP at 1x) is the best way to earn Marriott points, but I would certainbly be willing to switch up my 1x non-Amex spend for an extra 108k points!

Not to change the subject here, but just something I noticed: according to your signature, why do you use the Freedom/CSP at 1x when you can use the FU at 1.5x? Sure the 0.5 is minimal, but I'll argue it's something.