- myFICO® Forums

- Types of Credit

- Credit Cards

- Chase - Nervous about AA / account closure and que...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase - Nervous about AA / account closure and question about total CL exposure for AUs

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase - Nervous about AA / account closure and question about total CL exposure for AUs

12 CC's, Auto loan, LOC totalling 135k in 1 year and Chase is still keeping me as a customer (so far). My exposure is quite less with Chase at 11k so that is certainly a difference. I PIF and report less than $100 a month on 1 card. I run 2k - 3k a month thru Chase Cards. My scores are low at 680 - 710. I have an open FED Tax Lien. My income is Poor (42k). My AU's credit sucks (2 AU's, both on 2 Chase cards with low/mid 600 scores). weeeeeeeeeeee

Some of what i have read here... closures when rewards are racked up questionably or, a business account is involved with personal account... and a few having mega exposure, medium UTIL and many new accounts when they got nuked by Chase.

I'm betting yours will be A-OK.

good luck

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase - Nervous about AA / account closure and question about total CL exposure for AUs

I was always afraid Chase could AA me but I'm very grateful they haven't and hope to keep it that way. I got every card I need from them and have no intentions of getting more. AA isn't necessarily just a Chase thing at all. Citi and Amex can do it too and have before.

Current FICOS: Mid 640s-50s on all reports, Ch 7 BK D/C Aug 2019

Starting scores: EX - 534, EQ - 574, TU - 516 | Total TLs: $91k approx | Total Utilization: 17%, getting this back down

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase - Nervous about AA / account closure and question about total CL exposure for AUs

@syeb wrote:I have read enough posts here about Chase and other CC companies' virtually random AA whether with CLD or account closure to be nervous.

After not having any rewards cards, or even using credit cards much over the past 6 years, and closing out (6 months ahead of schedule) a DMP that was started in the depths of the financial crisis, My wife and I both went on an app spree for rewards cards in preparation for some heavy vacation and other travel this summer and fall.

The background:

In total, my DW opened 11 new accounts totaling $65k in credit lines and one Amex PRG charge. No denials so inquiries equal approvals and the inqs were mostly TU with a few EX and EQ. And of course CapOne all three CRAs.

FICO scores are EQ: 733, TU: 740, and EX: 714. Prior to the app spree they were in the 740 - 750 range so reasonable movement.

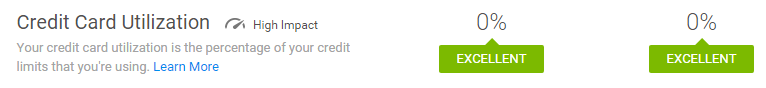

Util is between 10-15%.

AAOA is 3.5 years

Total Chase exposure is four cards totalling $32k

CSP $10k CL, $800 balance will be paid this week

BA $10k, $0 balance

Marriott $6k, $1,500 balance will be paid this week

United $6K, Approved today when I saw the 50k miles offer

So question #1: Do I need to worry about account closures considering 11 new accounts is pretty significant? Consider that they did approve the United card today so perhaps I am being unnecessarily nervous. And the Chase exposure is not that terrible.

Question #2: a more general question - does Chase or other lenders count the CL for an account for which one is an AU in calculating total exposure to that lender?

Thanks!

As one poster said, pay your bills and on time. Keep utilization down and you'll be fine. I've opened up 30+ cards amassing over 300k since my Chase approval and no AA (as I'm knocking on wood) on my sole Chase account. Granted, they won't extend anymore credit to me because I have too much available credit. Even if they did give me some AA, their $10,000 wont hurt me at all.

___________ 12Njoy

FICO - EX 810; EQ 797; TU 804 I'm climbing back to 800+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase - Nervous about AA / account closure and question about total CL exposure for AUs

@chalupaman wrote:I was always afraid Chase could AA me but I'm very grateful they haven't and hope to keep it that way. I got every card I need from them and have no intentions of getting more. AA isn't necessarily just a Chase thing at all. Citi and Amex can do it too and have before.

Popa which cards do you have now with Chase?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase - Nervous about AA / account closure and question about total CL exposure for AUs

@joedtx wrote:

@chalupaman wrote:I was always afraid Chase could AA me but I'm very grateful they haven't and hope to keep it that way. I got every card I need from them and have no intentions of getting more. AA isn't necessarily just a Chase thing at all. Citi and Amex can do it too and have before.

Popa which cards do you have now with Chase?

CSP, Chase AARP, and Freedom. I did more downsizing with them recently

Current FICOS: Mid 640s-50s on all reports, Ch 7 BK D/C Aug 2019

Starting scores: EX - 534, EQ - 574, TU - 516 | Total TLs: $91k approx | Total Utilization: 17%, getting this back down

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase - Nervous about AA / account closure and question about total CL exposure for AUs

@chalupaman wrote:

@joedtx wrote:

@chalupaman wrote:I was always afraid Chase could AA me but I'm very grateful they haven't and hope to keep it that way. I got every card I need from them and have no intentions of getting more. AA isn't necessarily just a Chase thing at all. Citi and Amex can do it too and have before.

Popa which cards do you have now with Chase?

CSP, Chase AARP, and Freedom. I did more downsizing with them recently

Trimming off the fat....eh? A leaner meaner Popa for the Summer ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase - Nervous about AA / account closure and question about total CL exposure for AUs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase - Nervous about AA / account closure and question about total CL exposure for AUs

If they approved you today, I wouldn't give it a second thought. You're good! I think if you did something crazy like max one out, they might get nervous. Congrats on all the approvals! ![]() I did 10 in 1 month and never thought about it. Been 6 months now & I'm glad I did.

I did 10 in 1 month and never thought about it. Been 6 months now & I'm glad I did.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase - Nervous about AA / account closure and question about total CL exposure for AUs

A bit late to worry about now IMO. This should be considered before a massive spree ![]() For now you can only do as suggested and keep your balance low.

For now you can only do as suggested and keep your balance low.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content