- myFICO® Forums

- Types of Credit

- Credit Cards

- Citi Double Cash Question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Citi Double Cash Question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Double Cash Question

@Open123 wrote:From a rewards perspective, QS is a better optioin only with low spending making the $25 min redemption impractical. In all other scenarios, the DC is better rewards wise. As Lurker observed, 33% is a huge difference. Sure, it's inconsequential nominally when one is spending $50 per month, but this comes out to $333 for one who spends $10,000. However, I do agree for non-bonus spending of small amounts, say $25-$50 per month, the QS is a better option.

I don't see how "paying" the bill to receive a reward is an extra step, since we all have to pay our bills eventually. When I look at rewards benefits, I don't consider the underwriting, cs, or anything else with the card--just the rewards valuation.

And that's your prerogative. I disagree. I care about CS and underwriting just as much as reward valuation. I'm not blindly going in for the top reward if Citi is going to "reward" me with $1k at 22.99%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Double Cash Question

@kdm31091 wrote:Cash+'s remaining 5% categories are mostly pretty specific e.g. furniture and department stores, both of which are relatively niche. Most people are not running out and buying new furniture every month. If you spend at dept stores that can be useful, but it depends.

The card is less useful than it used to be for sure.

Right, and now with the $25 bonus on $100 redemption gone, it's only use are for marginal and niche categories, especially since retaurants no longer earn 5%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Double Cash Question

@kdm31091 wrote:Cash+'s remaining 5% categories are mostly pretty specific e.g. furniture and department stores, both of which are relatively niche. Most people are not running out and buying new furniture every month. If you spend at dept stores that can be useful, but it depends.

The card is less useful than it used to be for sure.

But for example cell phones probably is used every month. And things like electronics if you know that next quarter you plan to buy computer stuff.

It is MUCH less useful than it was in the distant pass (uncapped, bill pay/airfare/home improvements, unlimited $25 bonus) and for those wanting to use it for restaurants, the recent change was bad, but still far from useless. Most other cards don't have 5% restaurants either!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Double Cash Question

Perhaps we were just spoiled with 5% back in restaurants.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Double Cash Question

@longtimelurker wrote:But for example cell phones probably is used every month. And things like electronics if you know that next quarter you plan to buy computer stuff.

It is MUCH less useful than it was in the distant pass (uncapped, bill pay/airfare/home improvements, unlimited $25 bonus) and for those wanting to use it for restaurants, the recent change was bad, but still far from useless. Most other cards don't have 5% restaurants either!

To this day, not app'ing for this card from the beginning because it lacked an upfront bonus was one of my biggest mistakes. For the time they left this uncapped (still can't believe they offered this program without considering the potential abuse), I likely missed out on $10,000 in cashback.

The 5% and $25 restaurant category removed has diminised the value considerably for me. Basically, not it's just 5% on Best Buy and 5% on Opera/Symphony tickets when I buy them. That's it for this card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Double Cash Question

I understand about best buy and whatnot but I think the remaining categories are very niche and related more to things occasionally purchased, like computers or furniture, vs more frequently useful categories.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Double Cash Question

@kdm31091 wrote:

Cell phones are okay as a category but its also capped based on the amount of your bill. As such, may not add up to much.

I understand about best buy and whatnot but I think the remaining categories are very niche and related more to things occasionally purchased, like computers or furniture, vs more frequently useful categories.

Right, like everything it depends on your spending. If your cell phone bill isn't large it won't be that important, in the same way that a small grocery and gas bill makes BCE/BCP/ED/EDP less attractive. Until they increased my discount last month, my cell phone bill was larger than my restaurant spend

And, as someone working in big telecomm, if your cell phone bill is small, please go out and get several extra lines, just in case!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Double Cash Question

I was so this close [ ] so apping last night since my pre qual gave me a 12.9 rate.

that would be my lowest rate ever ! but ill rather have higher limits in the cards i have!

and my gut is telling me im probably getting 3k limit.

so i dodnt apply.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Double Cash Question

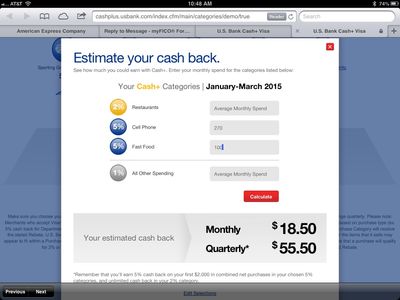

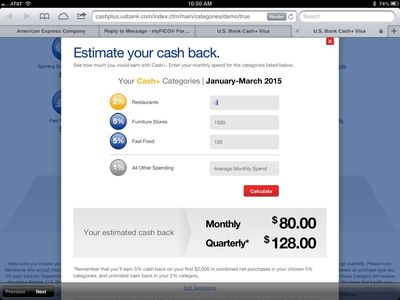

For the record, U.S. Bank Cash+ is still an excellent card for many.

For my spending, for instance, it would be netting me $18.50 in cash back per month, just for $370 ($270 in cell phone, $100 in fast food) in monthly spending. You would have to spend over $1200 on Quicksilver alone to net that much cash back.

And then I thought about it even more. You can pick your categories EVERY quarter. What if you were going to be moving into a new house/apartment? Furniture might be a very useful category then. A new $1500 furniture set would net you $75 back just by itself. Then pick something different next quarter, like electronic stores if you're going to be buying a new TV. It seems like as long as you consider your 5% options carefully, there's still a lot of money to be made with the Cash+.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Double Cash Question

@Anonymous wrote:For the record, U.S. Bank Cash+ is still an excellent card for many.

For my spending, for instance, it would be netting me $18.50 in cash back per month, just for $370 ($270 in cell phone, $100 in fast food) in monthly spending. You would have to spend over $1200 on Quicksilver alone to net that much cash back.

And then I thought about it even more. You can pick your categories EVERY quarter. What if you were going to be moving into a new house/apartment? Furniture might be a very useful category then. A new $1500 furniture set would net you $75 back just by itself. It seems like as long as you consider your 5% options carefully, there's still a lot of money to be made with the Cash+.

I'm not necessarily saying the furniture category or electronic stores or whatever are totally useless. They have value if you are making a large electronic purchase like a computer, or you are moving into a new house, like you pointed out. In those situations yes it of course beats a Quicksilver.

My point is that typically, these are not things you will be often spending a lot of money on, so the categories as a whole are not as "useful" simply because they do not relate much to everyday spending. They are more occasional spend type of categories. Which is fine -- again, depends how many cards you want to carry and all that debate, but for me, I'm not gonna open a new account for something I very occasionally purchase. If you are fine having extra cards for occasional use categories, it can be valuable.

They have a few more broadly useful categories -- cell phone, department store, maybe a couple I'm forgetting -- but something like restaurants is something many people would spend on often. To me, that is more "useful" than something like Best Buy. It depends on your spend, of course. The root of my argument that the card is significantly less useful now is that the categories are not really "everyday spend" categories anymore for many people (insert objection that one shops at Best Buy everyday because they are a tech nerd), and the remaining useful categories like cell phone are fairly limited in what they can provide for you.

I'm not saying it's a bad card, but the fact that you do not see a thread with people rushing to apply for it now that it's readily available should speak volumes. It seems to be well past its prime. I certainly will not waste a HP/AAOA ding on it, but if you have some large furniture or electronic purchases coming up it could make sense. Yes, you can change them every quarter, but the question is to what? Outside of furniture and electronics, the remaining 5% categories are:

"Select" clothing stores, Gyms, Sporting Good Stores, Bookstores, Dept Stores, Fast Food, Car Rental, Charity, Movie Theaters

Almost all of those are things that either a) you may not typically spend a lot of money on repeatedly (sporting goods, books), b) are not really "everyday spend" type of things for many people (car rental, charity), or c) are limited in what they provide because the expense is fairly fixed (i.e. gym membership)

Also, don't forget the 5% is capped. You can only buy so much furniture for $2,000; same with computers/electronics. So the usefulness is limited inheritenly there.

It depends on your goals/wants/needs. If you want to apply for it and the current categories suit your spend, then go for it. I just do not find it particularly exciting at this point.