- myFICO® Forums

- Types of Credit

- Credit Cards

- Citi LOVE !!!! 0% APR and 10K Bonus Miles

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Citi LOVE !!!! 0% APR and 10K Bonus Miles

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Citi LOVE !!!! 0% APR and 10K Bonus Miles

Citi is playing with my mind. I can't seem to figure them out.

1. Citi AAdvantage Platinum Select World Elite opened 4/2016.

2. Denied EVERY app since then. Just gave up.

3. I thought I'd try my luck on another Citi AAdvantage Platinum World Elite with the recent 50K bonus miles with no wording on the 24 month rule. APPROVED.

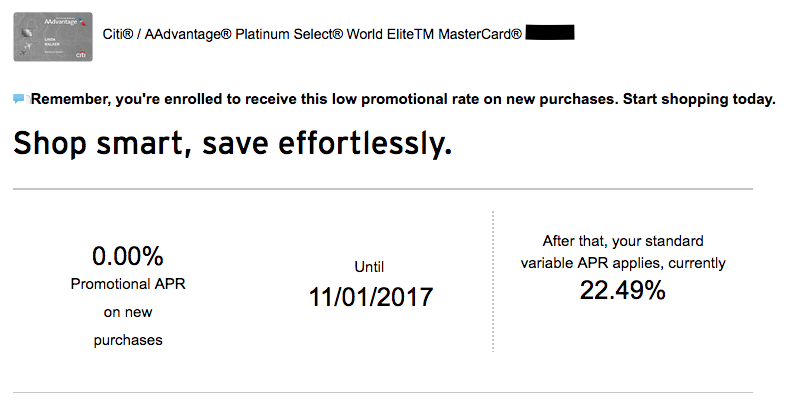

4. I was bored and browsed around Citi website. Hidden in the bottom corner is a small box with APR Bonus offer. No email or anything. They're givng me 0% APR for 10 months !!! WHAT??? I was speechless. 22% APR after that. I don't carry balances anyway but this can come handy.

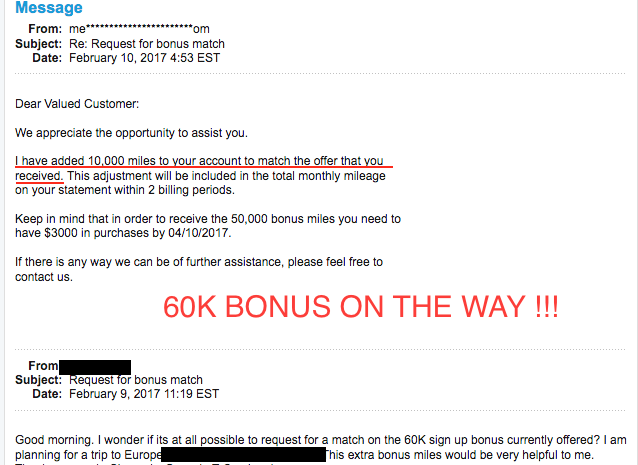

5. Then I read on one of the travel blogs a new 60K bonus they're offering for the AAdvantage card. It said send them a message and ask. I did. They're giving me 10K even if I don't meet the spend requirement for the 50K.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi LOVE !!!! 0% APR and 10K Bonus Miles

I am about to apply myself. Who do I email? Or what travel blog gave you this info? I've been googling and can't find this offer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi LOVE !!!! 0% APR and 10K Bonus Miles

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi LOVE !!!! 0% APR and 10K Bonus Miles

That's awesome!!! Congrats!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi LOVE !!!! 0% APR and 10K Bonus Miles

That is great!! Congrats! Time to play the lotto...lol...![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi LOVE !!!! 0% APR and 10K Bonus Miles

So I just applied. Was approved for $5500. Their email says I can't log on until I receive the card and have the number in hand. How did you communicate with Citi if you don't me asking? And you said in a small box it offered 0% for ten months. On what page did it say that if you don't mind me asking? I want to follow your success plan to a tee if possible. Great job by the way!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi LOVE !!!! 0% APR and 10K Bonus Miles

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi LOVE !!!! 0% APR and 10K Bonus Miles

Great stuff! Thanks again! First Citi card!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi LOVE !!!! 0% APR and 10K Bonus Miles

What you describe is basically how Citi bonus matches go..you technically didn't get the "bonus" matched; you got automatic "courtesy" points that are posted immediately without minimum spend.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content