- myFICO® Forums

- Types of Credit

- Credit Cards

- Close Slate?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Close Slate?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Close Slate?

@Anonymous wrote:

@Anonymous wrote:@Anonymous,

Thanks for the clarification.. I don't have the Slate and was inquiring if it will be a perk of other cards. I guess he doesn't know what he is talking about with the FICOs then. It just makes you wonder eh?...

Makes me wonder how no one ever seems to know anything at any of these companies but I've learned to accept it. I wasn't going to apply until I confirmed what type of FICO was attached to this card.

Thats smart on your part really.. Can you Imagine though? That wil lbe false advertising..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Close Slate?

@skimmie48 wrote:

@Anonymous wrote:

@Anonymous wrote:

@skimmie48 wrote:I was recently approved for the CSP. I have had Freedom and Slate for about 14 months and really don't use the Slate at all. Used it a couple of times, once for a major purchase. It's been PIF since Dec. The CL is 3,200. I don't need the card or the CL. Just close outright or let it sit awhile? Without the Slate I will still have over 20K in CL with Chase.

I'd move the CL to a card and close it. The FICO score Chase is providing is between 350 - 900 I am told by a banker. So I doubt if it is a real FICO store. If you need the free FICO, I'd wait to see if it a really FICO. If not I'd close it.

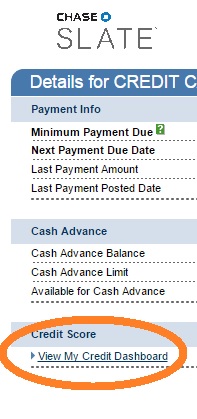

I believe you were given incorrect information. This is the Slate EX dashboard, not my score but someone else from this site attached it in a different thread. 300-850

I have no dashboard.

Neither do I at the moment ![]() If you had the card before Chase started offering the free FICO I believe you have to call them or send a secure message and ask for the newer version that includes the FICO.

If you had the card before Chase started offering the free FICO I believe you have to call them or send a secure message and ask for the newer version that includes the FICO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Close Slate?

@Anonymous wrote:

@skimmie48 wrote:

@Anonymous wrote:

@Anonymous wrote:

@skimmie48 wrote:

I'd move the CL to a card and close it. The FICO score Chase is providing is between 350 - 900 I am told by a banker. So I doubt if it is a real FICO store. If you need the free FICO, I'd wait to see if it a really FICO. If not I'd close it.

I believe you were given incorrect information. This is the Slate EX dashboard, not my score but someone else from this site attached it in a different thread. 300-850

I have no dashboard.

Neither do I at the moment

If you had the card before Chase started offering the free FICO I believe you have to call them or send a secure message and ask for the newer version that includes the FICO.

That is correct. If you want the Free FICO with Slate, you have to call or secure message to get it Product Changed. It's actually a different product than the OG slate.

I confirmed that you don't lose your account history with the PC to "Chase Slate with FICO".

Secure Message was easy for me. They replied back within a day and asked me to confirm the PC and I said yes. 2 days later I got the credit dashboard link

And if you're really observervant, you'll notice the Slate Logo also looks different with the product change

I like the new EX FICO score because it actually gives you details on your score...unlike most of the other "Free" scores that only give you the score and very little detail about your credit report.

I have a feeling it's a FICO '04 or possible '08 but really no way to confirm it... it is 22 points lower than my TU '08 from last month but that could be discrepancies between TU/EX and new accounts I opened.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Close Slate?

@Anonymous wrote:

@Anonymous wrote:

@skimmie48 wrote:

@Anonymous wrote:

@Anonymous wrote:

@skimmie48 wrote:

I'd move the CL to a card and close it. The FICO score Chase is providing is between 350 - 900 I am told by a banker. So I doubt if it is a real FICO store. If you need the free FICO, I'd wait to see if it a really FICO. If not I'd close it.

I believe you were given incorrect information. This is the Slate EX dashboard, not my score but someone else from this site attached it in a different thread. 300-850

I have no dashboard.

Neither do I at the moment

If you had the card before Chase started offering the free FICO I believe you have to call them or send a secure message and ask for the newer version that includes the FICO.

That is correct. If you want the Free FICO with Slate, you have to call or secure message to get it Product Changed. It's actually a different product than the OG slate.

I confirmed that you don't lose your account history with the PC to "Chase Slate with FICO".

Secure Message was easy for me. They replied back within a day and asked me to confirm the PC and I said yes. 2 days later I got the credit dashboard link

And if you're really observervant, you'll notice the Slate Logo also looks different with the product change

I like the new EX FICO score because it actually gives you details on your score...unlike most of the other "Free" scores that only give you the score and very little detail about your credit report.

I have a feeling it's a FICO '04 or possible '08 but really no way to confirm it... it is 22 points lower than my TU '08 from last month but that could be discrepancies between TU/EX and new accounts I opened.

Only way I could see to confirm it would be to pull your FICO 08 EX score from this site if you feel like paying $15.95 for it. I'm hoping that it shows itself within the next couple weeks before I cancel this 3B monitoring so I can compare. TU is always my highest score and consistently at least 15-20 points higher than the others. Why I have no idea. All three bureaus have the exact same information reporting. Thats FICO scoring for you ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Close Slate?

@skimmie48 wrote:I think I'm just worried about my exposure with Chase. I know a lot of people have more, but the CSP is my highest card and I love my Freedom and after reading about all of the CLD and closure people have experienced I don't want that to happen.

You can't just read other posts and assume that the same will happen to you. It's important to understand why someone experiences AA if you're trying to assess whether or not it will happen to you and that can be difficult with many of the "I have been AA'd by X" threads. Chase isn't going to just AA for hitting your internal limit. Plenty of us have bumped into our internal limits and have been able to open new cards by reallocating. Those getting AA are seeing it for more than simply limits.

I'd also suggest transferring the credit over to another Chase card that is of use to you. Don't look at limits as how much you intend to spend. Keep in mind how revolving utilization is considered as a scoring and risk factor.

@Anonymous wrote:The FICO score Chase is providing is between 350 - 900 I am told by a banker. So I doubt if it is a real FICO store.

There is not just one FICO model and they do not all use the 300 to 850 range. See also the Understanding FICO Scoring subforum and its stickies.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Close Slate?

@takeshi74 wrote:

@Anonymous wrote:The FICO score Chase is providing is between 350 - 900 I am told by a banker. So I doubt if it is a real FICO store.

There is not just one FICO model and they do not all use the 300 to 850 range. See also the Understanding FICO Scoring subforum and its stickies.

I understand that as not all of them are reliable. For example, the FICO score Penfed provides me isn't used anywhere else hence not reliable and not worth it for me. But it is nice to see.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Close Slate?

If you understand that then you shouldn't be relying on the scoring range to determine if a score is a FICO or not. The bankcard enhanced scores which are used by a number of creditors are not on the same scale as the standard FICO 8 models either.

Reliability isn't what really matters. One needs to consider the scoring model used by a given creditor (i.e. relevance).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Close Slate?

@takeshi74 wrote:Reliability isn't what really matters. One needs to consider the scoring model used by a given creditor.

If you understand that then you shouldn't be relying on the scoring range to determine if a score is a FICO or not. The bankcard enhanced scores which are used by a number of creditors are not on the same scale as the standard FICO 8 models either.

I am not going to go back and forth with you. But I am looking at it from a point of getting the FICO for free verses paying for it. Not going into the jibberish world of FICO scores used by particular companies and models. But as always, your response is welcome.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Close Slate?

Thanks for the screenshot Credit Flunky. Confirms I don't have the right Slate. SM hasn't been helpful getting the right one...yet.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Close Slate?

OP... I strongly support Nixon's advice and would move CL over to a Chase card that you use and let the Slate sit around with 500$ just to use the free EX Fico score. Since exposure is the same for Chase by moving CL around I would not worry about any AA as long as you do not go wild with your cards or apps and do nothing against their terms.