- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Club Carlson Credit Card

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Club Carlson Credit Card

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Club Carlson Credit Card

Hello all,

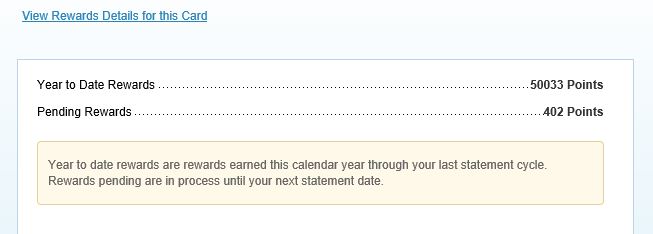

I was recently approved for the Club Carlson credit card after 3 recon call, got the platinum one even though applied for the Premier Rewards VS. Anyway, still not bad. Made the first purchase, first statement cut and it now shows the 50k points in my us bank online account.

With other's experiences here, after how much time were you able to see your points post to your Club Carlson account ?

In a committed relationship with Chase from 12/2012.

Age: 26, Income: $59,240/-, Current score: TU from CK: 750/A (12/24/14), TU Vantage score from CK: 775/C (12/24/14), Experian from Creditsesame: 717, Equifax from myfico: 724, Overall Util: 1% (12/24/14), Total credit limits: $62,150, In the garden from 12/19/2014, AAoA : 7 months, Oldest account: 8 months, Newest account: 1 week, HP: 18.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Club Carlson Credit Card

Mine post to my Club Carlson account after one billing cycle. So I made the bonus on one account in January, statement closed 2/1/15 but won't post until 3/1/15. I don't know what takes it so long, but I have both Business and Personal and it's like that on both accounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Club Carlson Credit Card

@Chaselover wrote:Hello all,

I was recently approved for the Club Carlson credit card after 3 recon call, got the platinum one even though applied for the Premier Rewards VS. Anyway, still not bad. Made the first purchase, first statement cut and it now shows the 50k points in my us bank online account.

With other's experiences here, after how much time were you able to see your points post to your Club Carlson account ?

Shame they made you settle for the gag prize platinum....Probably so they didn't have to cover that larger bonus. US Bank is known for that crap.

Good going on the pts though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Club Carlson Credit Card

Congratulations!

OP what bureau did they pull?

This is the next card on my list, because I have nearly 50,000 points already, and no way to feed more points to keep them alive until I can use them. The annual points are not to be ignored.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Club Carlson Credit Card

@Chaselover wrote:Hello all,

I was recently approved for the Club Carlson credit card after 3 recon call, got the platinum one even though applied for the Premier Rewards VS. Anyway, still not bad. Made the first purchase, first statement cut and it now shows the 50k points in my us bank online account.

With other's experiences here, after how much time were you able to see your points post to your Club Carlson account ?

Nice.

This and Venture I'm probably gonna try again in March or April. Too many inquiries was the reason they cited for me on Club Carlson.

Current FICOS: Mid 640s-50s on all reports, Ch 7 BK D/C Aug 2019

Starting scores: EX - 534, EQ - 574, TU - 516 | Total TLs: $91k approx | Total Utilization: 17%, getting this back down

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Club Carlson Credit Card

@NRB525 wrote:Congratulations!

OP what bureau did they pull?

This is the next card on my list, because I have nearly 50,000 points already, and no way to feed more points to keep them alive until I can use them. The annual points are not to be ignored.

Thank you so much, Sorry for the late reply. They pulled TU for me, I am in Michigan//

In a committed relationship with Chase from 12/2012.

Age: 26, Income: $59,240/-, Current score: TU from CK: 750/A (12/24/14), TU Vantage score from CK: 775/C (12/24/14), Experian from Creditsesame: 717, Equifax from myfico: 724, Overall Util: 1% (12/24/14), Total credit limits: $62,150, In the garden from 12/19/2014, AAoA : 7 months, Oldest account: 8 months, Newest account: 1 week, HP: 18.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Club Carlson Credit Card

@chalupaman wrote:

@Chaselover wrote:Hello all,

I was recently approved for the Club Carlson credit card after 3 recon call, got the platinum one even though applied for the Premier Rewards VS. Anyway, still not bad. Made the first purchase, first statement cut and it now shows the 50k points in my us bank online account.

With other's experiences here, after how much time were you able to see your points post to your Club Carlson account ?

Nice.

This and Venture I'm probably gonna try again in March or April. Too many inquiries was the reason they cited for me on Club Carlson.

I got the same reason for denial, which is true for me (I have about 16) but still its all about getting the right person on the recon call.

In a committed relationship with Chase from 12/2012.

Age: 26, Income: $59,240/-, Current score: TU from CK: 750/A (12/24/14), TU Vantage score from CK: 775/C (12/24/14), Experian from Creditsesame: 717, Equifax from myfico: 724, Overall Util: 1% (12/24/14), Total credit limits: $62,150, In the garden from 12/19/2014, AAoA : 7 months, Oldest account: 8 months, Newest account: 1 week, HP: 18.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Club Carlson Credit Card

Sorry you got the infamous 'bait and switch' US bank is known for doing this. Who knows why or what causes these app downgrades... I have heard that over time people have gotten 'upgraded' to higher levels of the card so call them in 3-6 months and inquire about it if you cannot make them move you now. It may not work, but still, 50k points is very usable.

AU- United+ Visa 33k, *97. GM MasterCard 15k, *95.

Individual- PenFed Plat Rew 7k, *08. Amex Blue 6.7k, *12. Hilton Amex 5.5k, *12. Chase Sapphire 15k, *12. U.S. Bank Cash+ 12.3k, *12. Barclays Priceline.com Rewards Visa 11k, *13. Citi DoubleCash (PC'd in *14) 7k, *13. Club Carlson Premier 9k, *13.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content