- myFICO® Forums

- Types of Credit

- Credit Cards

- Combining Limits on Cap1 Cards Question.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Combining Limits on Cap1 Cards Question.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Combining Limits on Cap1 Cards Question.

Not sure how to proceed on this, so thought I'd ask the collective wisdom here.

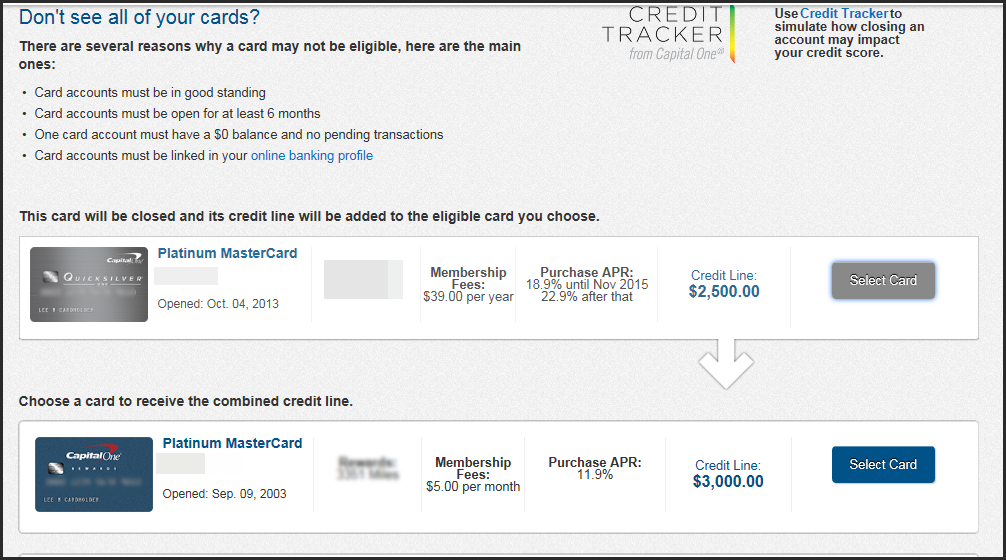

I have two cap1 cards that are available to combine limits, a cap1 Platinum card with a 3K limit and a QS1 card with a 2500 limit.

I was thinking about moving the Platinum card to the QS1 for a new limit od 5.5K, this card has a 19.99%apr. and a 59 af. If I go the other way, QS1 to Platinum will have a 5.5 limit with 11.9% arp and a $5 montlky fee,

I plan on eventually moving these cards to my 20K 11.9% venture IF the card becomes eligible, it isn't showing up as an eligible card now but I have only had it for 4 months.

My goal is to close both of these cards out as they have been SD for a few months.

Best way to proceed? QS1 to Plat or Plat to QS1 or nothing at all?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Combining Limits on Cap1 Cards Question.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Combining Limits on Cap1 Cards Question.

I don't have the answer to your question, but I'm curious. How can you tell if a card is eligible to be combined?

Amazon Store Card - $10,000 | Amex BCE - $2k | Barclaycard Ring - $2.5k | Capital One Platinum - $7,500 | Capital One Venture - $10,000 | Capital One VentureOne - $7500 | Chase Freedom - $3.5k | Citi Diamond Preferred - $1500 | Discover It - $4200 | Ebates Visa - $25,000 | Macy's - $1700 | Lowes - $12,000 | Walmart MasterCard - $15,000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Combining Limits on Cap1 Cards Question.

This is my view, If I close the QS1 with the fee, and then when and if my other cap 1 card becomes elgible I will close the Platinum and move the limit to them.

I think this is the say to go, I rather ahve the low apr, even though I use it very little.

Any other thoughts?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Combining Limits on Cap1 Cards Question.

doc, it is my understanding that you can not combine secured cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Combining Limits on Cap1 Cards Question.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Combining Limits on Cap1 Cards Question.

doc, I believe Cap One will let you have up to 5 cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Combining Limits on Cap1 Cards Question.

My suggestion, the first thing you should do is to call in or chat and ask to have the AF on your QS1 removed. If you have a $20k Venture they will probably be happy do that for you. Then, you could merge your two cards into the QS1 and keep it long term with no AF.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Combining Limits on Cap1 Cards Question.

If you're planning on combining to Venture, I would go with the lowest apr. I just did the same with my two & now have 1 QS. Still need to wait 4 month to combine my Venture's. Go for it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Combining Limits on Cap1 Cards Question.

It depends on what you value you most? The Venture is great but it has a high APR and also comes with an AF. So unless you plan on PC to a VentureOne later then I would transfer all the cards to a QS.

I had a platinum that came from an old orchard account. I have since been able to PC to QS1-AF was waived and recently to a QS- now AF is permentely gone. I plan on combining my venture and venture1 to the QS because it now has an APR 11.99- though I don't carry a balance and PIF before my statement even cuts. It's one of my oldest cards and I just don't want to close it for AAOA purposes... plus I love the Cash back.

If the miles is the more attractive option for you and you can justify the AF once you combine to the Venture, then I would determine when the AF is due on the Plat if it's due after your eligible to combine the venture then go for it because you'll save $20 in monthly fees. If the AF is due sooner then the eligible combination date go for the monthly fee because be $20 in four months and you'll save the $39. Aside from the Fees consider if you carry a balance or not. If I did carry balances regularly on the cards then I would choose the Plat due to the APR since the fees would only equal $60 annually- $1 more then the QS1 with a much higher APR.

Starting Score:Equifax 543

Starting Score:Equifax 543