- myFICO® Forums

- Types of Credit

- Credit Cards

- Comenity No Fee BT Offer at 0%

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Comenity No Fee BT Offer at 0%

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Comenity No Fee BT Offer at 0%

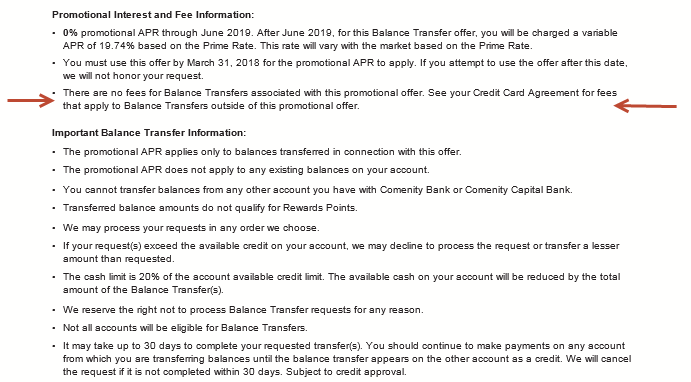

I just got an email from Comenity for a No Fee, 0% Balance Transfer offer today. This appears to be the same No Fee, 0%, BT offer they did about 6 or 7 months ago.

- 0 % APR though June 2019

- Must use offer by March 31, 2018 (for no fees)

This is a good one guys! Nearly 18 months for no fee, 0 % APR!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity No Fee BT Offer at 0%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity No Fee BT Offer at 0%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity No Fee BT Offer at 0%

This email came on a Lexus Visa. But last time Irish80 saw it first on his Sportsman Guide Visa. Then others also reported the offer on Total Rewards Visa. There could be others too.

Comenity cuts physical checks for the transfer. It takes about a week to show up in your transactions and probably a few more days to clear on the receipient side. To be safe, I would plan for two weeks for the whole process to complete.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity No Fee BT Offer at 0%

This is a great deal. Keep in mind, they will send you an email asking you to respond to a survey with questions like "will you continue to make purchases on the card during your 0% BT offer?".

I had two promos on my Blispay that were coming to an end, one close to $1,000. I also wanted this 55" curved 4K tv I found a great deal on. So I bought the tv on my Blispay and transferred the entire balance over to my Sportsmans Guide Visa. I have until September 2018 to get it all paid off without finance charges. My balance is down to $1,200 now so I feel really good about things.

My experience with a Comenity BT has been exceptional. The first and only one I have ever done.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity No Fee BT Offer at 0%

I just got this one on my Ulta MasterCard too ![]() Sometimes Comenity pulls one out of left field and makes me rethink my dislike of them!

Sometimes Comenity pulls one out of left field and makes me rethink my dislike of them!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity No Fee BT Offer at 0%

That's terrific!!

I got the same offer a few months back on my BJ's Perks Elite Card.

Comenity has done nothing but treat me like a king!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity No Fee BT Offer at 0%

I have the offer on both my BJs and Loft cards - my only two Comenity cards. I got it on both cards when they offered it a few months ago also. Nice deal. I haven't taken them up on it yet. I never seem to need a balance transfer when the offer rolls around.

NFCU Flagship $32K | NFCU Cashrewards $42K | Discover IT $39K | SECU Visa $20K | Chase SW $24k | CSR $15K | Chase Bonvoy $11.5K | Chase Freedom $11.5K | Chase Amazon Visa 8.5K | AMEX Bonvoy $18.1K | AMEX Hilton Surpass $15K | AMEX Hilton Aspire $24.4K | AMEX Gold | Aviator Red $16K | Uber Visa 10k | Citi TY Premier $24.6K | BoA Premium Rewards 35k | BoA Cash Rewards Visa $31.5k | BoA Cash Rewards MC $23k | US Bank Cash+ $10k | USAA AMEX $6K | Cap1QS $11K | BJs MC $27.6K | Walmart MC $5.1K | Loft MC $25,000 | Macy’s Store/Amex $20K/$1K | BR Visa $10K | JCP $1K | VS $3.2K | Home Depot $5K | Lowes $8.5K | Target $14.5k

NFCU Flagship $32K | NFCU Cashrewards $42K | Discover IT $39K | SECU Visa $20K | Chase SW $24k | CSR $15K | Chase Bonvoy $11.5K | Chase Freedom $11.5K | Chase Amazon Visa 8.5K | AMEX Bonvoy $18.1K | AMEX Hilton Surpass $15K | AMEX Hilton Aspire $24.4K | AMEX Gold | Aviator Red $16K | Uber Visa 10k | Citi TY Premier $24.6K | BoA Premium Rewards 35k | BoA Cash Rewards Visa $31.5k | BoA Cash Rewards MC $23k | US Bank Cash+ $10k | USAA AMEX $6K | Cap1QS $11K | BJs MC $27.6K | Walmart MC $5.1K | Loft MC $25,000 | Macy’s Store/Amex $20K/$1K | BR Visa $10K | JCP $1K | VS $3.2K | Home Depot $5K | Lowes $8.5K | Target $14.5k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity No Fee BT Offer at 0%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity No Fee BT Offer at 0%

@Anonymous wrote:

How is Comenity with credit limits? Are they generous?

I think Comenity gives decent limits.

I got my Loft card in 2013 – originally a store card with a $750 limit. It was upgraded to a Mastercard 2 months later. I have received several CLIs – all SP – over the years. Current CL is $11,250. More than enough considering I only use this card at Loft and Ann Taylor.

I’ve had my BJs Mastercard since 2014. I started with a $9,000 limit. I’ve had a couple of increases so the current limit is $13,000. Again, I only use this card at BJs so the limit is more than enough. I haven’t asked for an increase in over 2 years.

NFCU Flagship $32K | NFCU Cashrewards $42K | Discover IT $39K | SECU Visa $20K | Chase SW $24k | CSR $15K | Chase Bonvoy $11.5K | Chase Freedom $11.5K | Chase Amazon Visa 8.5K | AMEX Bonvoy $18.1K | AMEX Hilton Surpass $15K | AMEX Hilton Aspire $24.4K | AMEX Gold | Aviator Red $16K | Uber Visa 10k | Citi TY Premier $24.6K | BoA Premium Rewards 35k | BoA Cash Rewards Visa $31.5k | BoA Cash Rewards MC $23k | US Bank Cash+ $10k | USAA AMEX $6K | Cap1QS $11K | BJs MC $27.6K | Walmart MC $5.1K | Loft MC $25,000 | Macy’s Store/Amex $20K/$1K | BR Visa $10K | JCP $1K | VS $3.2K | Home Depot $5K | Lowes $8.5K | Target $14.5k

NFCU Flagship $32K | NFCU Cashrewards $42K | Discover IT $39K | SECU Visa $20K | Chase SW $24k | CSR $15K | Chase Bonvoy $11.5K | Chase Freedom $11.5K | Chase Amazon Visa 8.5K | AMEX Bonvoy $18.1K | AMEX Hilton Surpass $15K | AMEX Hilton Aspire $24.4K | AMEX Gold | Aviator Red $16K | Uber Visa 10k | Citi TY Premier $24.6K | BoA Premium Rewards 35k | BoA Cash Rewards Visa $31.5k | BoA Cash Rewards MC $23k | US Bank Cash+ $10k | USAA AMEX $6K | Cap1QS $11K | BJs MC $27.6K | Walmart MC $5.1K | Loft MC $25,000 | Macy’s Store/Amex $20K/$1K | BR Visa $10K | JCP $1K | VS $3.2K | Home Depot $5K | Lowes $8.5K | Target $14.5k