- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Credit Advice Needed - To Remove as AU

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Advice Needed - To Remove as AU

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit Advice Needed - To Remove as AU

I have been a lurker on the forums for quite somewhile. I recently pulled a free credit score through Credit Karma. My Transunion score came out as 762 and my Equifax came out as 764. I have an Auto Loan, Student Loans, and about $15,000 of personal Credit. On my own personal accounts I've never had a late payment, but I am currently an Authorized User on two accounts that have some issues. I'm trying to weigh the Pro's and Con's of this. The two accounts that have issues (I've posted information below) are also the longest held accounts (opened in 2005). My question is do you think the benefit of having a lengthy account history outweighs the negative of missed/late payments?

I've read that it is pretty easy to be removed as an AU...but if I just ask my parents to remove me as an AU will it come off my Credit Report? Do I even have to contact the reporting agencies if this is something I want to do? If I remove these two account with a history from 2005, my oldest accounts will be from 2009.

Preparing to buy a house in the next 12-24 months so just want to get everything in order. Thanks for your advice.

Baddie #1 - Missed Payments as Recent of March 2015

Account Details

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Advice Needed - To Remove as AU

Welcome to the forums.

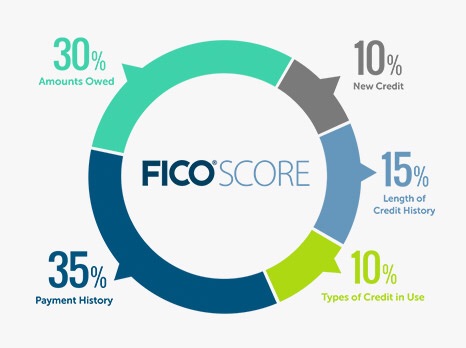

As you can see in this chart, FICO scores are much more affected by late payments then age of accounts (keep in mind those scores you posted from CK are not FICO scores but Vantage Scores). Therefore I would definitely remove myself from those accounts and look into getting your own credit cards.