- myFICO® Forums

- Types of Credit

- Credit Cards

- Credit Card Reporting Question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Card Reporting Question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Reporting Question

@morgacj2004 wrote:I would contact EO and argue the point. I could understand if this happened a few years ago when things were really tight but in todays climate? Really. BofA needs a wake up call. Thats not how you treat customers.

It is highly doubtful the OP could seek much relief from the EO. She's welcome to try but it's fairly rare that BOA would budge - depends on the circumstances. If they've had the OP on their radar for sometime, then it was just a matter of time before AA manifested as it did - and I'm sure this caught the OP by surprise. Also, while an economic meltdown ensued several years ago, lenders have adjusted their risk models and AA doesn't sleep at the wheel anymore. Today's climate is irrelevant to AA.

I mean, is it not a fact the OP has been agressively seeking new credit? (regardless of FICO scores - this wasn't about one or two inquiries or one new added account). BOA just felt they were not willing to take on the risk. Just like consumers can end relationships, so can banks. It is what it is.

And, given what the OP shared, wouldn't the same consitent approach apply as you posted on another thread? This is not an attack on the OP or to minimize the BOA closure but rather illustrate the point that AA doesn't spare anyone.

@morgacj2004 wrote:I think the term I was looking for is OVER EXPOSURE!! LOL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Reporting Question

The comment I made regarding over exposure is in regards to an individual who has 96 accounts!!! The OP in this thread is not even close to that threshold. His utilization, scores are very good. I really dont think it is fair to comprare the two individuals in question. Different circumstances result in different opinions. And after all it is only my opinion and should not be treated as fact.

AX Hilton Aspire 20k, AX Bonvoy Brilliant 15k, AX BCP 2k, AX Blue Bus Cash 15k, AX Delta Air Platinum 49k, (AU) AX Delta Gold 15k, AX Amazon Prime Bus 25k, BC Uber 29k, AKUSA FCU -10k , CITI AAdvantage Exec World Elite MC 16.5k, Discover (2) 16k, Kohls-4k, VS Comenity $3k, BofA AK Air Siggy 9.8k, WF Propel AX 5k, JCP $10k PFCU Plat Rewards Siggy 39.5k, PFCU Power Cash Rewards AX 10.5k, NFCU Flagship 50k, CLOC 15k, CITI Costco 9.5k, GAP VISA Synchrony $9k,Target MC 9k, Ulta MC Comenity 9k, Pay Pal 1k, CO Venture One 23k, US Bank Radisson Rewards Signature 10k, US Bank Fred Meyers World MC, 11k, US Bank Plat VISA 15.7k, VS Comenity 2k, 240k total available credit. Utiliz-2%, Current FICO EQ-724, EX 763,TU 802 ,Chapt 7 BK D/C 11-2012. Starting scores 520-550

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Reporting Question

I guess once you reach a certain number of cards / tradelines and everything is running smooth u get distracted from the underlying issues of risk.

My original post was not intended to be a soob story, im not ignorant when it comes to having information available to me such as google lol and knowing a lil bit about the credit game.

I am more so concerned how this is going to report on my CR's and pray to god it doesnt create a trickle effect.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Reporting Question

Do you even use all those cards? I mean, they are way too many ![]() Just curious.

Just curious.

Also, dont take it personal and this is not intended to you at all...but it seems to me that people these days are in a race to see who can get the best cards, the most cards, the most approvals or the most CLs in their cards etc...I have just a few and i dont use them all. I only got them to repair my credit after BK in 2010 and even before then, i only had about 6 cards that i actually use.

Anyways, we all have our reasons and im sure you have yours. Did you call BOA yet? are you going to? Best of luck if you do, sincerely.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Reporting Question

I use at least 50 percent of my cards monthly, another 25 percent at least once every 2 months and I have a few cards that I have balance transfers on which I don't use.

All of my cards report a statement every month and get used at least once a month if not more, except some store cards that I use every 2 months or so. I keep activity on all my cards pretty recent.

I also don't let most of them report a balance and pay in full be the statement cuts. I did contact bank of america in regards to my questions and supposedly will a call back this afternoon.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Reporting Question

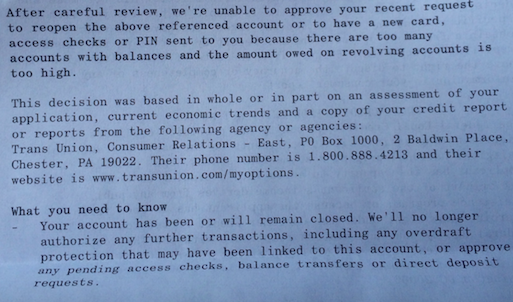

Received my letter from bank of america today. Im slowly letting it go though.

I was a little teed off so i wrote some just unhappy customer posts on twitter, facebook and consumers affairs

I do have balances on card, low utilization across the board due to high limits and what not. I mean i understand boa is mad that i have balances on cards, but im aggressively paying them off. I might email this lady back and just say I have these balances but I have a 3 month plan where I will have these cards paid off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Reporting Question

@ddemari wrote:Received my letter from bank of america today. Im slowly letting it go though.

I was a little teed off so i wrote some just unhappy customer posts on twitter, facebook and consumers affairs

I do have balances on card, low utilization across the board due to high limits and what not. I mean i understand boa is mad that i have balances on cards, but im aggressively paying them off. I might email this lady back and just say I have these balances but I have a 3 month plan where I will have these cards paid off.

Ok, so there are several CCs that are not in your signature from all your recent approvals. On a percentage basis (not utilization), how many CCs are actually carrying balances? So, for example, if you have 30 CCs, are you carrying balance on 15-20 of them? Also, what is the highest balance being carried and on which card and CL? It appears they have noticed a peculiar trend with increasing debt and the high number of recent accounts popping left and right on your CRs.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Reporting Question

You are right FinStar. I have not wanted to admit to myself that their decision is not unwarranted. I have gotten into a cycle of naivety thinking just because my credit score is good, I can open whatever cards i want and have several large balances reporting.

I did a look at my Equifax report and I have 32 TL’s.

And, I am reporting a balance on way too many cards, some higher balances than I wanted to admit. I used to be really good at paying my card off, letting the statement cut with a zero balance but then it became to much work to do that on several cards every month. So I have just been paying the balance before the bill is due in full and then will continue to use that card but times that by several cards.

I have lots of inquiries, lots of new unnecessary cards, lots. But I am not in financial problems of any kind. Other than paying off some large balance transfers with large monthly payments.

I have opened an excessive amount of cards; have added debt and boa probably was heightened to it by a balance transfer that I had never done with them before.

I can sit here and be mad at myself. I have known opening all these cards was not going to look good. But if they all shut me down, then I guess I will be back to square one and just pay my cards off. I’m never late, no lates reported and Ill continue that behavior on an arsenal of closed cards. That’s the worst that can happen I’m thinking but I know what I got to do now, I just needed to really admit it to myself. And, I have had a great relationship with boa, so this AA really has made me take the whole thing by heart and change my behavior moving forward.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Reporting Question

@ddemari wrote:You are right FinStar. I have not wanted to admit to myself that their decision is not unwarranted. I have gotten into a cycle of naivety thinking just because my credit score is good, I can open whatever cards i want and have several large balances reporting.

I did a look at my Equifax report and I have 32 TL’s.

And, I am reporting a balance on way too many cards, some higher balances than I wanted to admit. I used to be really good at paying my card off, letting the statement cut with a zero balance but then it became to much work to do that on several cards every month. So I have just been paying the balance before the bill is due in full and then will continue to use that card but times that by several cards.

I have lots of inquiries, lots of new unnecessary cards, lots. But I am not in financial problems of any kind. Other than paying off some large balance transfers with large monthly payments.

I have opened an excessive amount of cards; have added debt and boa probably was heightened to it by a balance transfer that I had never done with them before.

I can sit here and be mad at myself. I have known opening all these cards was not going to look good. But if they all shut me down, then I guess I will be back to square one and just pay my cards off. I’m never late, no lates reported and Ill continue that behavior on an arsenal of closed cards. That’s the worst that can happen I’m thinking but I know what I got to do now, I just needed to really admit it to myself. And, I have had a great relationship with boa, so this AA really has made me take the whole thing by heart and change my behavior moving forward.

Well, all is not lost ddemari. Yes, it is unfortunate that they closed the BOA card and I understand being upset about it. However, once the smoke clears the air and you get things normalized, give it some time to reconsider if you want to have another account with them. Btw, I'm not judging you in any way. I was trying to get a perspective on where things stood on your end on what prompted the closure since I was looking at it from both angles because at some point, when we trip and fall, we need to get up again. You'll get through this! ![]()

You have an excellent collection of cards and your accomplishments in getting them is commendable - just gotta apply the brakes a bit and slow down. Once your profile is like an aircraft carrier, then you can take some hits without affecting you much, but it takes time though. I think you have a decent plan laid out and just focus on paying those balances down (primarily the BOA card) so that your FICOs can cushion some of the fall with the closure.

So, just leave the BOA situation in the rear view mirror as a lesson learned and move forward. Yet, I seriously doubt anyone else would take any AA on you though. I wish you the best in getting all this sorted out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content