- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Credit Gardening Plan (starting with a CR of 0...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Gardening Plan (starting with a CR of 002)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit Gardening Plan (starting with a CR of 002)

After not using credit cards for the past 10 years, I decided to get back into the game. I had no baddies - just a foolish lack of trust in credit. Here is my initial journey:

(2/15) My initial pull of one of my free yearly reports was a 002 on Transunion. No data...

Decided to get a secured card with no hard pull in order to establish myself. Picked up an Opensky secured CC with a $300 limit ($29 yf) and used that for 1 month.

(3/15) Applied for an Amazon card online and was denied (was purchasing a $1000 HDTV so I thought I'd try). Used that denial to pull my TU report again and saw that I was up to a 439

Applied for a Capital One secured card (no yearly fee, $49 for a $200 initial CL) in order to get multiple credit lines going. The free credit tracker showed I was up to a 661 on TU.

(4/15) Applied for a Discover IT after running the prequalify web link. Approved for $1000 CL.

Logged on to creditkarma and creditsesame and saw that my score was now a 661 - 669 - 662 across the three rating agencies.

This took three months...

In each case I've made sure my statements show 10% or less utilization. But due to the small amount of balance I tend to run through $100 - $500 utilization on each card per month making multiple immediate payments. When the Discover CLI increases that will be my wallet carry card and I'll probably just use the Cap One and Opensky cards for Netflix, HBO Now in order to show some activity.

-------------------------------------------

My questions:

1. Is it a good idea to add one more bank card and apply for Macys/Amazon (again) in order to have 4 bank cards and 2 store cards and just garden those for the next few years? My thinking is to just get it over with and have multiple credit lines aging together....

2. Is it possible to get a score of over 700 in a year with low utilization (and low CL) on these cards? (If ther is a "credit wall" I'd like to know what it is)

3. I've joined a credit union and plan to replace the Opensky card when its yearly fee is about to kick in with a credit union card that can grow with me. Does this sound ok?

My goal:

1. purchase a starter home in 3 years. my income is currently $50k, but will be about $65k in about 3 years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Gardening Plan (starting with a CR of 002)

An installment loan would help, but buying a car or taking student loans just for credit isn't a great plan. See if any CUs or banks near you offer Credit Builder installment loans, which are like secured cards but paid off over a fixed term.

Otherwise you need CLIs, new cards with higher limits, and more history, and those all will come with time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Gardening Plan (starting with a CR of 002)

@MarkEPoo,

Welcome to MYFICO...

To answer your questions...

1. Is it a good idea to add one more bank card and apply for Macys/Amazon (again) in order to have 4 bank cards and 2 store cards and just garden those for the next few years? My thinking is to just get it over with and have multiple credit lines aging together.... -Yes, it is a good idea.

2. Is it possible to get a score of over 700 in a year with low utilization (and low CL) on these cards? (If ther is a "credit wall" I'd like to know what it is)- Getting a 700 score is dependant on other factors in your credit file such as AAoA, payment history etc... So it will be a hard call as it varies from individual to individual...

3. I've joined a credit union and plan to replace the Opensky card when its yearly fee is about to kick in with a credit union card that can grow with me. Does this sound ok? - Yes..

My goal:

1. purchase a starter home in 3 years. my income is currently $50k, but will be about $65k in about 3 years. - Great goal to have.

Also, If I were you I'd stay away from Chase for now as they like to see history and also the Venture with such a young credit history. Foound out what your real FICOs are as that is what most lenders use instead of going of Credit Karma.

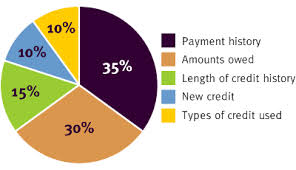

Lastly, use this model as a guide to what makes up what score...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Gardening Plan (starting with a CR of 002)

I think it is possible to get to 700 fairly quickly... Some advice...

- can you get a car loan? Many credit unions will let you put a loan on your current paid for car if it isn't too old for a used car loan. Car loans boost FICO scores.

- you are in a rare, rare place having such a new profile. In my opinion, you should load up on any tradeline you can in the mext month or two. Any card you can, store cards whatever. Go to your credit union and ask if they report secured loans to the credit bureaus (not all do). FInd one that does if they don't! Ask what the smallest secured loan you can get is. Get 2 or 3 of them, do it a week apart if you feel funny about doing them all at once.

- Don't miss a single payment.

In 6 months you'll have a very nice profile, probably 700 or so. When you're ready for that house, you'll have a very strong profile. Getting a bunch of tradelines is counter-intuitive, because usually being patient is a virtue with your scores, but you are in a special situation. You'll never be in this place with a new profile again.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Gardening Plan (starting with a CR of 002)

I've joined Municipal Credit Union in NYC and they have savings secured loans. A small personal loan is my plan for months 18 - 30. Never thought of taking out two $500 secured loans.

I need to ask them if I can start a secured credit line "with no hard pull" - and:

(a) if it reports to all 3 agencies

(b) if it reports as secured or unsecured

(c) if it graduates to an unsecured card (or if they add unsecured CLIs)

And yeah, I probably should ask them if the savings secured loans report as "secured" as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Gardening Plan (starting with a CR of 002)

@Anonymous wrote:I've joined Municipal Credit Union in NYC and they have savings secured loans. A small personal loan is my plan for months 18 - 30. Never thought of taking out two $500 secured loans.

I need to ask them if I can start a secured credit line "with no hard pull" - and:

(a) if it reports to all 3 agencies

(b) if it reports as secured or unsecured

(c) if it graduates to an unsecured card (or if they add unsecured CLIs)

And yeah, I probably should ask them if the savings secured loans report as "secured" as well.

Chances are, you will get a hard pull, (just for membership alone sometimes) and if it is reported, it will be reported as secure. But yeah be sure to ask, reporting secured loans is by no means universal. Not unusual either, but close enough to 50/50 that you should verify for sure.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Gardening Plan (starting with a CR of 002)

Discover, Capital One and Opensky Cards now reporting. Utilization at 5% on Discover card, 0% on other cards. 2 payments on Opensky. 1 payment on Discover and Capital One.

695 Transunion, 701 Equifax, 678 Experian

However these are Fakos from Credit Karma, Credit Sesame, Credit.com and Capital One credit Tracker (lowest scores used).

Will report back at 90 days all accounts and 6 mos.