- myFICO® Forums

- Types of Credit

- Credit Cards

- Credit Union credit cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Union credit cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Union credit cards

texasmommy~ Congrats!! I think it only says under review for a few hours, they work pretty fast. You should be able to go ahead and app online for whatever other products you are interested in. With my CC, they called me a couple hours after applying and said you've been approved.

As far as the 17 pt drop, they will use the score they received from TU at the time of the pull....which depending on where you are getting your scores from, could be higher, lower or the same.

I wonder if they have a referral bonus ![]()

![]() .....for me and score!

.....for me and score!

Gardening until 2019....at least

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Union credit cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Union credit cards

@Anonymous wrote:

I just received an email asking for my most recent utility bill to prove my residency for my savings application. Nothing about the checking application. I'm gonna do that before I leave work and get it done.

That's because the opening of the savings account is the establishment of membership. If the savings account has not been fully opened they won't open the checking account. Please keep us posted on your progress.

Almost forgot. I've been a member of RBFCU since 2012 and after years of banking with Chase I finally moved all of my banking there; they are great.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Union credit cards

@FroggieMom wrote:texasmommy~ Congrats!! I think it only says under review for a few hours, they work pretty fast. You should be able to go ahead and app online for whatever other products you are interested in. With my CC, they called me a couple hours after applying and said you've been approved.

As far as the 17 pt drop, they will use the score they received from TU at the time of the pull....which depending on where you are getting your scores from, could be higher, lower or the same.

I wonder if they have a referral bonus

.....for me and score!

It wont let me apply for anything yet because I'm not officially a member until my application is approved I guess. I sent them what they asked for so now I just wait.....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Union credit cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Union credit cards

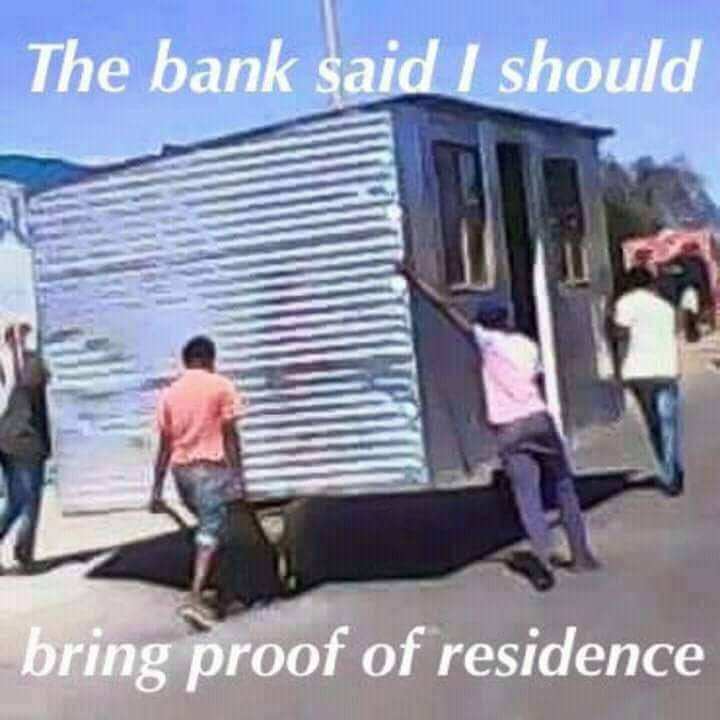

@Anonymous wrote:

@ScoreOrBeScored wrote:

LMAO!!!!

WOOOOW!!!

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Union credit cards

Any news texasmommy??

Gardening until 2019....at least

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Union credit cards

@FroggieMom wrote:Any news texasmommy??

Yep. Denial. I've paid off some cards, gotten credit limit increases and new credit since they pulled my report so I sent them those statements to be reviewed and requested they reconsider. Hopefully I'll get a response tomorrow.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Union credit cards

So they denied you membership as well?? Or just for the credit products?

** I see you mentioned you also opened even more credit since they pulled your report last week. This may have actually hurt you, more than helped you. Trying for too much credit at one time when you still have a "weak" file can signal a red flag to lenders. You may just need to let your accounts you have currently continue to grow for awhile. Come join us in the Garden Club if you decide to wait it out ![]() Everyone in there is friendly, helpful and will keep you on track with you goals!

Everyone in there is friendly, helpful and will keep you on track with you goals!

Gardening until 2019....at least