- myFICO® Forums

- Types of Credit

- Credit Cards

- Credit Utilization - Please Help!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Utilization - Please Help!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit Utilization - Please Help!

I have been trying to search around to see in regard to utilization to make sure my credit profile is as solid as possible before applying for some new credit lines especially larger ones. I know the three credit bureas usually recommend a 30% overall utilization. During my research, I found some other information stating that ideally each existing individual credit line should be below 50% of it's limit and there is no beneift in terms in the eyes of the credit card companies to pay the cards below this number. I can see how the individual utilization would make more sense as a lender doesn't want to see anyone maxed out on a certain card, but then again I also can see the argument for overall utilization being more important as some cards make more sense to use than others.

Does anyone have any insight on this? I am helping guide a couple friends with the information I have learned here and I'm sure they can get their existing balances under 50% utilization on each line, but I don't want them to pay the lines down unnecesarilly.

Any information would be GREATLY appreciated! This form has been awesome - I managed to sign up my family for Navy FCU and get some decent approvals after doing loads of reading here.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Utilization - Please Help!

@Anonymous wrote:I have been trying to search around to see in regard to utilization to make sure my credit profile is as solid as possible before applying for some new credit lines especially larger ones. I know the three credit bureas usually recommend a 30% overall utilization. During my research, I found some other information stating that ideally each existing individual credit line should be below 50% of it's limit and there is no beneift in terms in the eyes of the credit card companies to pay the cards below this number. I can see how the individual utilization would make more sense as a lender doesn't want to see anyone maxed out on a certain card, but then again I also can see the argument for overall utilization being more important as some cards make more sense to use than others.

Does anyone have any insight on this? I am helping guide a couple friends with the information I have learned here and I'm sure they can get their existing balances under 50% utilization on each line, but I don't want them to pay the lines down unnecesarilly.

Any information would be GREATLY appreciated! This form has been awesome - I managed to sign up my family for Navy FCU and get some decent approvals after doing loads of reading here.

Thank you!

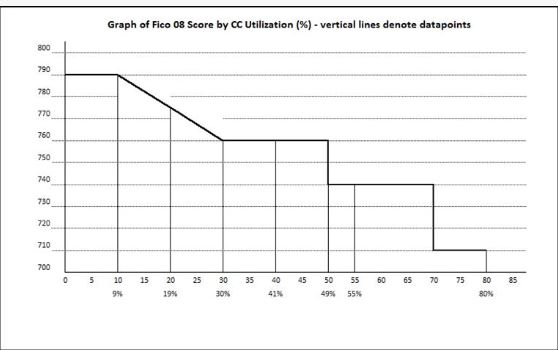

Oh how wrong the info you have recieved is. First of all, utilization is a point in time metric...it only maters what it shows on the report when pulled. The amount of utilization points you recieve is as best we can tell for overall utilization graded in 4 tiers. Lower utilization better, but need 1 account reporting balance. The tiers are 9%, 30%, 50%, and 80%. So ideally, you want a very low utilization to report on 1 card, with all others reporting 0 balance at the time of the pull for credit. What the utilization is in previous months does not matter at all, as utilization has no history. Most of the people who maintain a consistently high credit scores, which is not neccessary I might add, keep their utilization under 5%. Utilization can be considered the credit scoring metric with high impact but no memory. In fact only payment history is more significant in impact. Most creditors, and the fico score, would consider even near 50% utilization too high. Overall utilization is the most important, but even individual card utilization has an impact.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Utilization - Please Help!

@Anonymous wrote:I have been trying to search around to see in regard to utilization to make sure my credit profile is as solid as possible before applying for some new credit lines especially larger ones. I know the three credit bureas usually recommend a 30% overall utilization. During my research, I found some other information stating that ideally each existing individual credit line should be below 50% of it's limit and there is no beneift in terms in the eyes of the credit card companies to pay the cards below this number. I can see how the individual utilization would make more sense as a lender doesn't want to see anyone maxed out on a certain card, but then again I also can see the argument for overall utilization being more important as some cards make more sense to use than others.

Does anyone have any insight on this? I am helping guide a couple friends with the information I have learned here and I'm sure they can get their existing balances under 50% utilization on each line, but I don't want them to pay the lines down unnecesarilly.

Any information would be GREATLY appreciated! This form has been awesome - I managed to sign up my family for Navy FCU and get some decent approvals after doing loads of reading here.

Thank you!

Someone came up with this chart to help...copied from a previous post

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Utilization - Please Help!

Link to the the best thread on utilization I can remember...pay attention to Thomas_Thumb's post

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Utilization - Please Help!

@Sarge is correct

Whoever gave the OP that advice was.... well let's assume just confused or mistaken.

1) One thing bother me about the OPs post that I'll address right away, to get it off my chest.

This talk of NOT having folks PAY DOWN their revolving debt 'unnessarily' is a very concerning POV...IMO the pay down of debt, especially debt that is revolving monthly on a CC should be a more of a priority in a financially healthy household...not treated like an unpleasant chore, if we treat buying more than we can afford with the same disdain as many treat the repayment of such, we'd be better off, in the first place.

Ok now, that's done

2) Let's also clear up this notion about 'the banks or CCC's ' desires when it comes to the SCORING of our credit.....they don't score ANYTHING!

The industry and hype allow the wrong words to bleed together for what purpose I'm not sure...but when trying to manipulate the scoring model we need to focus on what the model wants to see,what the program has been written to see, calculate and reward, period.

And has @Sarge said optimal is one account with 1-9% reporting and the rest at 0% is ideal.

Never would 50% be ideal... remember the scoring model is a RISK model....the entire point of the score is to judge the RISK of default under current at that moment conditions.

What are the chances if I lend NEXT is really the proposition being asked and of course all things equal is YOU are about to be next in line to lend... you'd prefer or at least feel LESS risky if the one owed LESS $$$ out not more, right?

No matter how well the borrower has paid I'm the past, how many girlfriends the player has now, there is always a RISK that the Next one is when the music stops

So as mentioned earlier under ANY circumstance LESS debt will be more favorable than MORE.

The reason the model wants to see 'some'usage on at least one card is to show the file is ALIVE and not totally dormant, otherwise all zeros would be the ideal.

Lastly, a lot of ppl hear that one wrong as well...when we say 1-9% reported balance it just means so something shows up for reporting it does NOT mean one has to carry a balance past a due date and incur a NICKEL of %.... many ppl incorrectly confuse allowing a small balance to REPORT with carrying a balance, so the CCC will be pleased and it's gibberish.

You are perfectly fine paying Day 1 after the balance reports...

Best of Luck

Have your pals pay those balances down, so they don't waste their family's future on silly cc debt😉

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Utilization - Please Help!

@Anonymous wrote:

+1

@Anonymous is correct

Whoever gave the OP that advice was.... well let's assume just confused or mistaken.

1) One thing bother me about the OPs post that I'll address right away, to get it off my chest.

This talk of NOT having folks PAY DOWN their revolving debt 'unnessarily' is a very concerning POV...IMO the pay down of debt, especially debt that is revolving monthly on a CC should be a more of a priority in a financially healthy household...not treated like an unpleasant chore, if we treat buying more than we can afford with the same disdain as many treat the repayment of such, we'd be better off, in the first place.

Ok now, that's done

2) Let's also clear up this notion about 'the banks or CCC's ' desires when it comes to the SCORING of our credit.....they don't score ANYTHING!

The industry and hype allow the wrong words to bleed together for what purpose I'm not sure...but when trying to manipulate the scoring model we need to focus on what the model wants to see,what the program has been written to see, calculate and reward, period.

@Anonymous has @Anonymous said optimal is one account with 1-9% reporting and the rest at 0% is ideal.

Never would 50% be ideal... remember the scoring model is a RISK model....the entire point of the score is to judge the RISK of default under current at that moment conditions.

What are the chances if I lend NEXT is really the proposition being asked and of course all things equal is YOU are about to be next in line to lend... you'd prefer or at least feel LESS risky if the one owed LESS $$$ out not more, right?

No matter how well the borrower has paid I'm the past, how many girlfriends the player has now, there is always a RISK that the Next one is when the music stops

So as mentioned earlier under ANY circumstance LESS debt will be more favorable than MORE.

The reason the model wants to see 'some'usage on at least one card is to show the file is ALIVE and not totally dormant, otherwise all zeros would be the ideal.

Lastly, a lot of ppl hear that one wrong as well...when we say 1-9% reported balance it just means so something shows up for reporting it does NOT mean one has to carry a balance past a due date and incur a NICKEL of %.... many ppl incorrectly confuse allowing a small balance to REPORT with carrying a balance, so the CCC will be pleased and it's gibberish.

You are perfectly fine paying Day 1 after the balance reports...

Best of Luck

Have your pals pay those balances down, so they don't waste their family's future on silly cc debt😉

I will also state that the only wise way to use a credit card is to PIF every single month...and make it a habit to do so. Too many people are a slave to the credit card issuers. If the credit card issuer decides to change terms, interest rate, rewards, or request a copy of your tax return...can you close the card without it causing you problems? If you can not, then you need to make it your goal to be able to. It should never be a great concern, if a credit card issuer was to close your account, it wont be if you PIF, and you'll get rewards, extend warranties, purchase protection, and never pay a cent in interest. The ones who use cards to spend more than they make are on a slippery slope to financial problems. Be a transactor, not a revolver.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Utilization - Please Help!

I will also state that the only wise way to use a credit card is to PIF every single month...and make it a habit to do so. Too many people are a slave to the credit card issuers. If the credit card issuer decides to change terms, interest rate, rewards, or request a copy of your tax return...can you close the card without it causing you problems? If you can not, then you need to make it your goal to be able to. It should never be a great concern, if a credit card issuer was to close your account, it wont be if you PIF, and you'll get rewards, extend warranties, purchase protection, and never pay a cent in interest. The ones who use cards to spend more than they make are on a slippery slope to financial problems. Be a transactor, not a revolver.

I will slightly disagree with just that part...otherwise, it appears we're of the same mindset.

However, I think a CC can be used WISELY to make short term low to no % purchase....as long as the user has a responsible BDP (buy down plan).

Unlike the Dave Ramseys of the world I believe grown men and women can

have a drink w/o becoming alcoholic

visit Vegas, play a few games w/o need for gamers anonymous meetings

visit the donut shop and not become a diabetic or weigh 400lbs (this one is stuff though ![]() )

)

and yes a CC holder can use credit w/o losing themselves in debt ...needing to be TOLD they can't handle their own affairs.

Ex: If a family wants to purchase a washer/dryer and gave use of it NOW vs saving up to PIF in 3 months

I can still see a WISE way to do so

Say the statement cuts on the 10th due the following month on the 5th

Person gets paid the 1st and 15th.....and they PLAN their purchase

Hold $ on the 1st of March

buy via CC on the 11th ($1000)

make a $300 payment on the 15th

(from the $150 from the 1st and 15tn paycheck)

make another $150 payment from the 1st paycheck

Now the Apr statement balance on the 10th is $550

(with a 25 day grace period) Due May 5th

$150 payment from Apr 15 check

$150 payment from May 1st check

on the May 10 statement % would have only been charged on the $250 balance (at `1%)

May 15 $150 payment

June 1st PIF

Subject % paid from 1.5% cash back

= Wise use of CC financing for low to zero cost still picking up all the goodies you mentioned

+ usage of said washer/dryer set starting in Marcah vs waiting to June

(including the money saved from driving to the laundrymat and quarters in the machine and the multi-tasking available by being home vs not)

My only point is ...with transaction timing and a clear pay back plan CCs can be great short term finance products, even if a few bucks in % bleeds out,

especially considering taking delivery of an item 30-55 earlier may add enough value that $20 in % may be a bargain.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Utilization - Please Help!

@Anonymous wrote:I will also state that the only wise way to use a credit card is to PIF every single month...and make it a habit to do so. Too many people are a slave to the credit card issuers. If the credit card issuer decides to change terms, interest rate, rewards, or request a copy of your tax return...can you close the card without it causing you problems? If you can not, then you need to make it your goal to be able to. It should never be a great concern, if a credit card issuer was to close your account, it wont be if you PIF, and you'll get rewards, extend warranties, purchase protection, and never pay a cent in interest. The ones who use cards to spend more than they make are on a slippery slope to financial problems. Be a transactor, not a revolver.

I will slightly disagree with just that part...otherwise, it appears we're of the same mindset.

However, I think a CC can be used WISELY to make short term low to no % purchase....as long as the user has a responsible BDP (buy down plan).

Unlike the Dave Ramseys of the world I believe grown men and women can

have a drink w/o becoming alcoholic

visit Vegas, play a few games w/o need for gamers anonymous meetings

visit the donut shop and not become a diabetic or weigh 400lbs (this one is stuff though

)

and yes a CC holder can use credit w/o losing themselves in debt ...needing to be TOLD they can't handle their own affairs.

Ex: If a family wants to purchase a washer/dryer and gave use of it NOW vs saving up to PIF in 3 months

I can still see a WISE way to do so

Say the statement cuts on the 10th due the following month on the 5th

Person gets paid the 1st and 15th.....and they PLAN their purchase

Hold $ on the 1st of March

buy via CC on the 11th ($1000)

make a $300 payment on the 15th

(from the $150 from the 1st and 15tn paycheck)

make another $150 payment from the 1st paycheck

Now the Apr statement balance on the 10th is $550

(with a 25 day grace period) Due May 5th

$150 payment from Apr 15 check

$150 payment from May 1st check

on the May 10 statement % would have only been charged on the $250 balance (at `1%)

May 15 $150 payment

June 1st PIF

Subject % paid from 1.5% cash back

= Wise use of CC financing for low to zero cost still picking up all the goodies you mentioned

+ usage of said washer/dryer set starting in Marcah vs waiting to June

(including the money saved from driving to the laundrymat and quarters in the machine and the multi-tasking available by being home vs not)

My only point is ...with transaction timing and a clear pay back plan CCs can be great short term finance products, even if a few bucks in % bleeds out,

especially considering taking delivery of an item 30-55 earlier may add enough value that $20 in % may be a bargain.

I do not necessarily mean that you could not strategically carry a balance in some circumstances, but it is wise to be in the habit of paying in full. I have a huge sum of retirement savings that is tax deffered. I am disabled 58yo, and I can withdraw any amount I wish during the year, but if I draw too much out it can put me not only in a higher income tax bracket, but can make up to 85% of my SSDI payments taxable. So especially if I have drawn out a bit more than I originally planned, and if I have a 0% introductory rate, it could certainly make sense to carry a balance until I could withdraw the money to pay it in the next tax year. That is an example of why I might choose to carry a balance, but it would only be because it was fiscally advantageous. I still have the readily available means to pay it now...if I choose to. It is the establishment of a PIF habit that is important, but even with good habits, there can be exceptions! I do keep a very low interest card that I could use if it was something important enough to me to choose to carry a balance. That being said...in 10 years how much credit card interest have I actually paid? Not one penny. How many times have I found it necessary to carry a balance? None yet, but the preceding circumstances could happen to make it advantageous to do so, and I would then do so. I will never allow myself to be at the mercy of a credit card issuer though. Life is too short for that.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Utilization - Please Help!

When I first started researching credit utilization, I found this article on CK, which I love. Moderator, please remove if I'm not allowed to post this link.

https://www.creditkarma.com/article/CreditCardUtilizationAndScore

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Utilization - Please Help!

OK, I want to add this about establishing a habit of PIF. I was for about 40 years, a two pack a day smoker. A one week hospital stay finally broke me of that habit. Now during the 40 years I smoked, there were times I had to go 6-8 hours without a cigarette, but the craving was always there and growing with each passing hour. Human beings are naturally creatures of habit. If you PIF, and pay bills even early for long enough, it can and will become a habit. That does not mean that at some point circumstances might not lead to you having to carry a balance. But if you have successfully made it a habit to pay early, like a smoker with a habit, you will be craving to remove that balance. You can make a habit of anything, smoking, gambling, drinking etc. You can actually make a good habit also, and once you do, good financial choices will be easier, because it will be a habit.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20