- myFICO® Forums

- Types of Credit

- Credit Cards

- DCU - Pre-approved?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

DCU - Pre-approved?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DCU - Pre-approved?

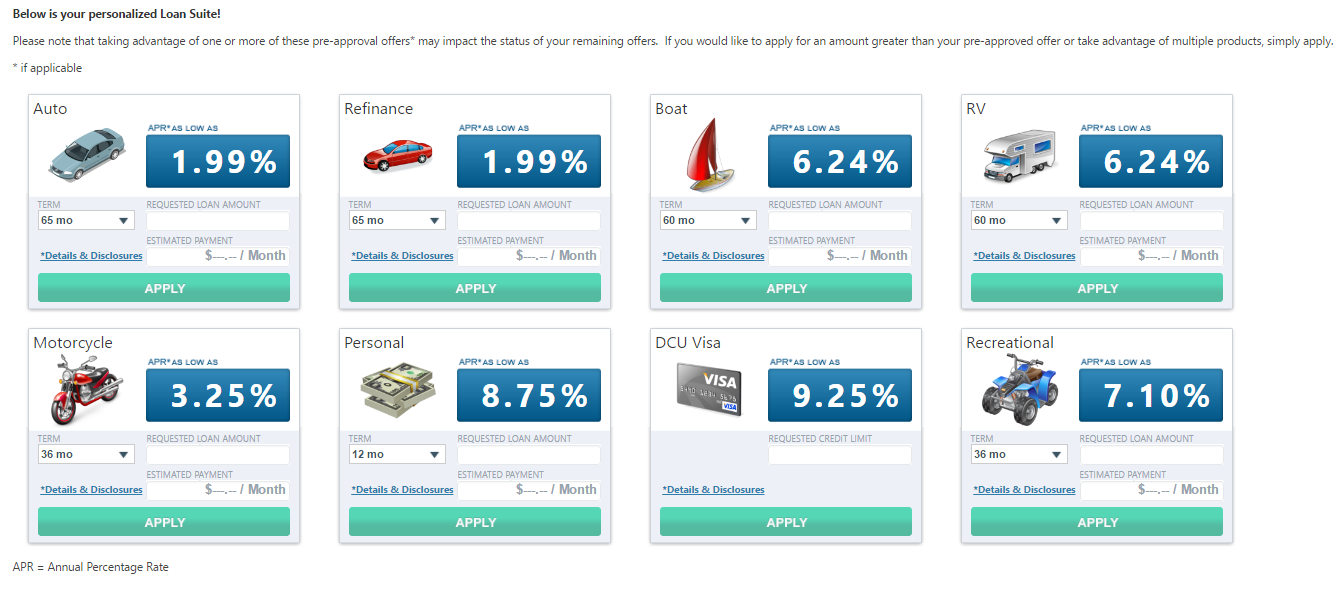

When I first joined DCU they showed my score as they calculate it as 610. I apped their Visa back then and got denied. That was back in April 2016. My FICO 8 for EQF is 680 now. On a hunch I logged in and went to their loan application page and they list all sorts of loans. See below. This is the first time I have seen this. I have been in the garden since August and as of 5-1-2016 I only have 1 inquiry between all 3 CRA less than 12 months old. My question is, do these look like guarantees? Like pre-approved? If so, I won't lie, I need this badly right now. I can refi my truck and get a better rate and maybe get a BT card for some of my debt. The rates are static but if I change the loan repayment duration (months to pay back) the rates change.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU - Pre-approved?

Disregard. I clicked on one of the Details & Disclosures and it shows a rate spread based on credit worthiness and not a static rate. I will let my score come up a bit more before I get into anything like this.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU - Pre-approved?

@MyLoFICO wrote:When I first joined DCU they showed my score as they calculate it as 610. I apped their Visa back then and got denied. That was back in April 2016. My FICO 8 for EQF is 680 now. On a hunch I logged in and went to their loan application page and they list all sorts of loans. See below. This is the first time I have seen this. I have been in the garden since August and as of 5-1-2016 I only have 1 inquiry between all 3 CRA less than 12 months old. My question is, do these look like guarantees? Like pre-approved? If so, I won't lie, I need this badly right now. I can refi my truck and get a better rate and maybe get a BT card for some of my debt. The rates are static but if I change the loan repayment duration (months to pay back) the rates change.

Yes disregard is right! If you ever become pre-approved the green box where it says apply will say preapproved.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU - Pre-approved?

@Anonymous wrote:

@MyLoFICO wrote:When I first joined DCU they showed my score as they calculate it as 610. I apped their Visa back then and got denied. That was back in April 2016. My FICO 8 for EQF is 680 now. On a hunch I logged in and went to their loan application page and they list all sorts of loans. See below. This is the first time I have seen this. I have been in the garden since August and as of 5-1-2016 I only have 1 inquiry between all 3 CRA less than 12 months old. My question is, do these look like guarantees? Like pre-approved? If so, I won't lie, I need this badly right now. I can refi my truck and get a better rate and maybe get a BT card for some of my debt. The rates are static but if I change the loan repayment duration (months to pay back) the rates change.

Yes disregard is right! If you ever become pre-approved the green box where it says apply will say preapproved.

That is good to know. I think I will end up at PenFed to be honest but these caught me off guard so I thought I would ask.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU - Pre-approved?

@MyLoFICO wrote:

@Anonymous wrote:

@MyLoFICO wrote:When I first joined DCU they showed my score as they calculate it as 610. I apped their Visa back then and got denied. That was back in April 2016. My FICO 8 for EQF is 680 now. On a hunch I logged in and went to their loan application page and they list all sorts of loans. See below. This is the first time I have seen this. I have been in the garden since August and as of 5-1-2016 I only have 1 inquiry between all 3 CRA less than 12 months old. My question is, do these look like guarantees? Like pre-approved? If so, I won't lie, I need this badly right now. I can refi my truck and get a better rate and maybe get a BT card for some of my debt. The rates are static but if I change the loan repayment duration (months to pay back) the rates change.

Yes disregard is right! If you ever become pre-approved the green box where it says apply will say preapproved.

That is good to know. I think I will end up at PenFed to be honest but these caught me off guard so I thought I would ask.

Well I know this for a fact because I applied for a CLI on my DCU visa 8 months ago thinking i was preapproved and got declined. I was pissed that I had a HP thinking I was preapproved and even more pissed I was declined.

But it was my fault, I should have called and asked. During my mini battle with them over it they actually took the time and emailed me a demo picture showing me what a preapproved offer looked like. They also recoded the HP to a soft pull because they believed me when I raised a small argument that they needed to be more specific.

I like DCU, I have my payroll direct deposited there, I got their lowest auto refinance rate of 1.74% 9 months ago. Plus I was instantly approved for the Platinum with a 10k credit line at their lowest which was 8.75%, but since has gone to 9%. Can complain, really.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU - Pre-approved?

@Anonymous wrote:

@MyLoFICO wrote:

@Anonymous wrote:

@MyLoFICO wrote:When I first joined DCU they showed my score as they calculate it as 610. I apped their Visa back then and got denied. That was back in April 2016. My FICO 8 for EQF is 680 now. On a hunch I logged in and went to their loan application page and they list all sorts of loans. See below. This is the first time I have seen this. I have been in the garden since August and as of 5-1-2016 I only have 1 inquiry between all 3 CRA less than 12 months old. My question is, do these look like guarantees? Like pre-approved? If so, I won't lie, I need this badly right now. I can refi my truck and get a better rate and maybe get a BT card for some of my debt. The rates are static but if I change the loan repayment duration (months to pay back) the rates change.

Yes disregard is right! If you ever become pre-approved the green box where it says apply will say preapproved.

That is good to know. I think I will end up at PenFed to be honest but these caught me off guard so I thought I would ask.

Well I know this for a fact because I applied for a CLI on my DCU visa 8 months ago thinking i was preapproved and got declined. I was pissed that I had a HP thinking I was preapproved and even more pissed I was declined.

But it was my fault, I should have called and asked. During my mini battle with them over it they actually took the time and emailed me a demo picture showing me what a preapproved offer looked like. They also recoded the HP to a soft pull because they believed me when I raised a small argument that they needed to be more specific.

I like DCU, I have my payroll direct deposited there, I got their lowest auto refinance rate of 1.74% 9 months ago. Plus I was instantly approved for the Platinum with a 10k credit line at their lowest which was 8.75%, but since has gone to 9%. Can complain, really.

As much as I need the help with the low rates, I don't want a HP for a decline. I haven't learned much here but I do know that HP's and DECLINED are bad. lol So, I wait. I can hold off the wolves until then, I hope.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU - Pre-approved?

@MyLoFICO wrote:

@Anonymous wrote:

@MyLoFICO wrote:

@Anonymous wrote:

@MyLoFICO wrote:When I first joined DCU they showed my score as they calculate it as 610. I apped their Visa back then and got denied. That was back in April 2016. My FICO 8 for EQF is 680 now. On a hunch I logged in and went to their loan application page and they list all sorts of loans. See below. This is the first time I have seen this. I have been in the garden since August and as of 5-1-2016 I only have 1 inquiry between all 3 CRA less than 12 months old. My question is, do these look like guarantees? Like pre-approved? If so, I won't lie, I need this badly right now. I can refi my truck and get a better rate and maybe get a BT card for some of my debt. The rates are static but if I change the loan repayment duration (months to pay back) the rates change.

Yes disregard is right! If you ever become pre-approved the green box where it says apply will say preapproved.

That is good to know. I think I will end up at PenFed to be honest but these caught me off guard so I thought I would ask.

Well I know this for a fact because I applied for a CLI on my DCU visa 8 months ago thinking i was preapproved and got declined. I was pissed that I had a HP thinking I was preapproved and even more pissed I was declined.

But it was my fault, I should have called and asked. During my mini battle with them over it they actually took the time and emailed me a demo picture showing me what a preapproved offer looked like. They also recoded the HP to a soft pull because they believed me when I raised a small argument that they needed to be more specific.

I like DCU, I have my payroll direct deposited there, I got their lowest auto refinance rate of 1.74% 9 months ago. Plus I was instantly approved for the Platinum with a 10k credit line at their lowest which was 8.75%, but since has gone to 9%. Can complain, really.

As much as I need the help with the low rates, I don't want a HP for a decline. I haven't learned much here but I do know that HP's and DECLINED are bad. lol So, I wait. I can hold off the wolves until then, I hope.

Do you know what your current EQ FICO 5 is at?

When I was approved for the auto refinance and the credit card my EQ FICO 5 was 735.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU - Pre-approved?

@Anonymous wrote:

@MyLoFICO wrote:

@Anonymous wrote:

@MyLoFICO wrote:

@Anonymous wrote:

@MyLoFICO wrote:When I first joined DCU they showed my score as they calculate it as 610. I apped their Visa back then and got denied. That was back in April 2016. My FICO 8 for EQF is 680 now. On a hunch I logged in and went to their loan application page and they list all sorts of loans. See below. This is the first time I have seen this. I have been in the garden since August and as of 5-1-2016 I only have 1 inquiry between all 3 CRA less than 12 months old. My question is, do these look like guarantees? Like pre-approved? If so, I won't lie, I need this badly right now. I can refi my truck and get a better rate and maybe get a BT card for some of my debt. The rates are static but if I change the loan repayment duration (months to pay back) the rates change.

Yes disregard is right! If you ever become pre-approved the green box where it says apply will say preapproved.

That is good to know. I think I will end up at PenFed to be honest but these caught me off guard so I thought I would ask.

Well I know this for a fact because I applied for a CLI on my DCU visa 8 months ago thinking i was preapproved and got declined. I was pissed that I had a HP thinking I was preapproved and even more pissed I was declined.

But it was my fault, I should have called and asked. During my mini battle with them over it they actually took the time and emailed me a demo picture showing me what a preapproved offer looked like. They also recoded the HP to a soft pull because they believed me when I raised a small argument that they needed to be more specific.

I like DCU, I have my payroll direct deposited there, I got their lowest auto refinance rate of 1.74% 9 months ago. Plus I was instantly approved for the Platinum with a 10k credit line at their lowest which was 8.75%, but since has gone to 9%. Can complain, really.

As much as I need the help with the low rates, I don't want a HP for a decline. I haven't learned much here but I do know that HP's and DECLINED are bad. lol So, I wait. I can hold off the wolves until then, I hope.

Do you know what your current EQ FICO 5 is at?

When I was approved for the auto refinance and the credit card my EQ FICO 5 was 735.

My DCU score is 645 and I think that is a 5 score. Its hard to tell with all the sub text they have under it. My 8 is 680 and that is the highest my EQF has ever been. Ever. It is coming up with all the inquiries falling off and my UTIL coming down but I don't know how else to get a Fico 5.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU - Pre-approved?

DCU uses the EQ FICO 5 score. If that is what your getting from DCU, then it's the EQ FICO 5 mortgage score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU - Pre-approved?

Actually, that might be my Fico 9. Wells Fargo (my mortgage) shows my FICO 9 at 645 too.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18