- myFICO® Forums

- Types of Credit

- Credit Cards

- Denied for Chase Sapphire Preferred; Recon for Fre...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Denied for Chase Sapphire Preferred; Recon for Freedom?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied for Chase Sapphire Preferred; Recon for Freedom?

@Anonymous wrote:

@09Lexie wrote:You would not be able to use the same hp for a different product. Up to you if you want to take another hp.

I used the same HP for different Chase products.

Twice.

I applied Freedom first then hours later i applied Sapphire Preferred. They used the same report without the additonal inquiry. If i were to apply Sapphire first they may have pulled EQ and would have used that instead. That's why i applied Freedom first.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied for Chase Sapphire Preferred; Recon for Freedom?

@Anonymous wrote:

"Mod edit fo remove pic"

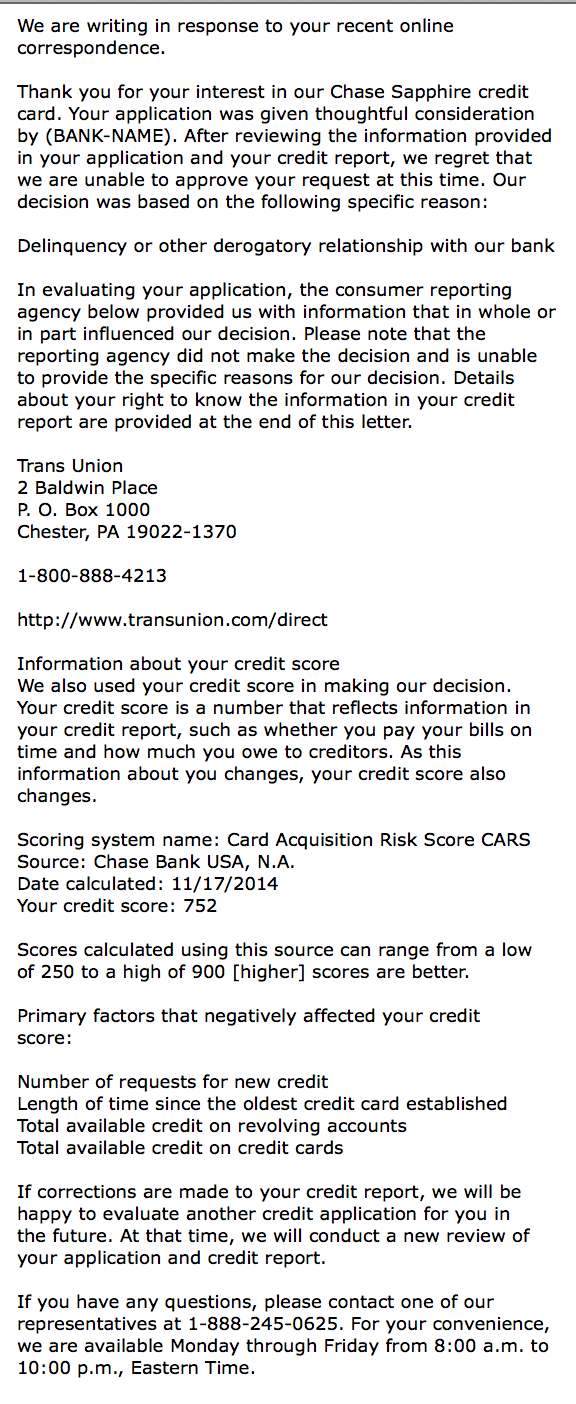

Rejected with a score of 752 ?? How much do they expect then?

Haha I loved that gif.

In a committed relationship with Chase from 12/2012.

Age: 26, Income: $59,240/-, Current score: TU from CK: 750/A (12/24/14), TU Vantage score from CK: 775/C (12/24/14), Experian from Creditsesame: 717, Equifax from myfico: 724, Overall Util: 1% (12/24/14), Total credit limits: $62,150, In the garden from 12/19/2014, AAoA : 7 months, Oldest account: 8 months, Newest account: 1 week, HP: 18.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied for Chase Sapphire Preferred; Recon for Freedom?

This is 752 on a 900 point scale, so not the same as the 850 FICO. Also, the (alleged!) default might have been the bigger reason for rejection.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied for Chase Sapphire Preferred; Recon for Freedom?

@longtimelurker wrote:This is 752 on a 900 point scale, so not the same as the 850 FICO. Also, the (alleged!) default might have been the bigger reason for rejection.

i really dont know they sure didnt have a problem giving me Freedom.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied for Chase Sapphire Preferred; Recon for Freedom?

@Anonymous wrote:

@longtimelurker wrote:This is 752 on a 900 point scale, so not the same as the 850 FICO. Also, the (alleged!) default might have been the bigger reason for rejection.

i really dont know they sure didnt have a problem giving me Freedom.

I got both with a CARS score that's 100pts lower than yours...

It's definitely the "default"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied for Chase Sapphire Preferred; Recon for Freedom?

@Anonymous wrote:

@Anonymous wrote:

@longtimelurker wrote:This is 752 on a 900 point scale, so not the same as the 850 FICO. Also, the (alleged!) default might have been the bigger reason for rejection.

i really dont know they sure didnt have a problem giving me Freedom.

I got both with a CARS score that's 100pts lower than yours...

It's definitely the "default"

Got my internal chase scores and I am at a 712... So tempted so go for the CSP, which I would of done it the same day as the freedom so it would of hopefully been the same TU pull.. Anyways, will give them a few months on my freedom to see my usage and PIF each month and go for the CSP then. Ugh I met my $500 dollar spend requirement the day after I got my card.. Dog had to goto vet.. Yep fun way to spend approx. $500.. least it was done and paying it off once it posts here today or tomorrow.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied for Chase Sapphire Preferred; Recon for Freedom?

@Anonymous wrote:

@Anonymous wrote:

@longtimelurker wrote:This is 752 on a 900 point scale, so not the same as the 850 FICO. Also, the (alleged!) default might have been the bigger reason for rejection.

i really dont know they sure didnt have a problem giving me Freedom.

I got both with a CARS score that's 100pts lower than yours...

It's definitely the "default"

A statute of limitation is the length of time someone can bring a legal suit against you. Below is a state-by-state list of Statue of Limititations.

Statute of Limititation for unpaid Credit Card bills: If you fall behind in your credit card payments, the card issuer can sue you for payment. The start date for the statute of limitations is the date of your last payment. For example, if your last payment was on January 10, 2003, and the statute of limitation in your state for credit card debt is seven years, your card issuer has until January 10, 2010 to sue you to recover the unpaid debt.

Please note: That some states consider credit card agreements to be an oral contract,other states consider it a written contract, and some states have specific laws pertaining to credit card lawsuits. If you have unpaid credit card debt and are concerned about your legal rights, a lawyer can brief you on the specific laws for your state.

|

** Georgia Court of Appeals came out with a decision on January 24, 2008 in Hill v. American Express that in Georgia the statute of limitations on a credit card is six years after the amount becomes due and payable

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied for Chase Sapphire Preferred; Recon for Freedom?

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:

@longtimelurker wrote:This is 752 on a 900 point scale, so not the same as the 850 FICO. Also, the (alleged!) default might have been the bigger reason for rejection.

i really dont know they sure didnt have a problem giving me Freedom.

I got both with a CARS score that's 100pts lower than yours...

It's definitely the "default"

why would anyone pay a default ? that would restart the clock back 7 years or is it 8 ? in my state i think after 4 or 5 years they cannot sue you or make you pay but on credit report i think it stays longer unless you start paying it then resets the clock for another 7 or 8 years. Don't be stupid

athough i don't have any default in my knowledge.

Interesting response. Note the quotes please ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied for Chase Sapphire Preferred; Recon for Freedom?

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:

@longtimelurker wrote:This is 752 on a 900 point scale, so not the same as the 850 FICO. Also, the (alleged!) default might have been the bigger reason for rejection.

i really dont know they sure didnt have a problem giving me Freedom.

I got both with a CARS score that's 100pts lower than yours...

It's definitely the "default"

why would anyone pay a default ? that would restart the clock back 7 years or is it 8 ? in my state i think after 4 or 5 years they cannot sue you or make you pay but on credit report i think it stays longer unless you start paying it then resets the clock for another 7 or 8 years. Don't be stupid

athough i don't have any default in my knowledge.

Interesting response. Note the quotes please

A statute of limitation is the length of time someone can bring a legal suit against you. Below is a state-by-state list of Statue of Limititations.

Statute of Limititation for unpaid Credit Card bills: If you fall behind in your credit card payments, the card issuer can sue you for payment. The start date for the statute of limitations is the date of your last payment. For example, if your last payment was on January 10, 2003, and the statute of limitation in your state for credit card debt is seven years, your card issuer has until January 10, 2010 to sue you to recover the unpaid debt.

Please note: That some states consider credit card agreements to be an oral contract,other states consider it a written contract, and some states have specific laws pertaining to credit card lawsuits. If you have unpaid credit card debt and are concerned about your legal rights, a lawyer can brief you on the specific laws for your state.

Once you began to pay your debt your statutues of limitations resets.

|

** Georgia Court of Appeals came out with a decision on January 24, 2008 in Hill v. American Express that in Georgia the statute of limitations on a credit card is six years after the amount becomes due and payable

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Denied for Chase Sapphire Preferred; Recon for Freedom?

@CreditCuriousity wrote:

@Anonymous wrote:

@Anonymous wrote:

@longtimelurker wrote:This is 752 on a 900 point scale, so not the same as the 850 FICO. Also, the (alleged!) default might have been the bigger reason for rejection.

i really dont know they sure didnt have a problem giving me Freedom.

I got both with a CARS score that's 100pts lower than yours...

It's definitely the "default"

Got my internal chase scores and I am at a 712... So tempted so go for the CSP, which I would of done it the same day as the freedom so it would of hopefully been the same TU pull.. Anyways, will give them a few months on my freedom to see my usage and PIF each month and go for the CSP then. Ugh I met my $500 dollar spend requirement the day after I got my card.. Dog had to goto vet.. Yep fun way to spend approx. $500.. least it was done and paying it off once it posts here today or tomorrow.

vet ? CareCredit ![]()