- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Derogatory marks with high credit score

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Derogatory marks with high credit score

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Derogatory marks with high credit score

@iced wrote:The next time it goes over 759 I'll send you a screenshot if you like. This month FICO via Citi (Experian?) is showing 753. I wish Vantage scores mattered more; I'm over 800 on TU Vantage. I only have 3 cards + a DCU checking account (which isn't FICO8), so I don't have a good (read: free) way to constantly check all 3 bureau FICO scores. I watch the reports more, which between Experian's free report and CK, I can cover the 3 bureaus for free.

Based on your statement, can I reasonably surmise if all of the 90 day or worse lates fall off, my score would then be over 800? There's two accounts (one open and one closed) showing 90 day or worse late payments in their history.

No question over 800 IMO. My scores about 3 years ago before my 120 and 90 day lates on 2 different accounts were always right above or right below 800 across the board. After my lates hit I hit a low of 619, recovered to low 700's within a year and a half and now am sitting pretty steady in the 744-757 range. If the 120 and 90 day lates came off of my reports I would without question cruise to 800 or just above again as they are the only negative items visible since I possessed these scores 3 years ago. AAoA has increased since that time as well by about 2 years and my utilization now (next to nothing) is considerably less than it was 3 years ago.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Derogatory marks with high credit score

@Anonymous wrote:

@EdMan63 wrote:Well you can say they don't mean anything but I just had 2 inquiries age to a year on my EX and my score went up 10 pts from 793 to 803. That's may not be a huge difference but it can be the difference of Good or Very Good in terms of credit score categories. In my case it went from Very Good to Exceptional. That can mean a lot when applying for a mortgage.

Keep in mind that all of that "good" and "very good" and "excellent" and "exceptional" or whatever terminology is used is all fluff; it's not consistent among different sources. Some places show 720+ as being "exceptional" or "excellent", others 740, some 760, some 800.

I can tell you that anyone with a 793 score can get everything that a person with a 803 score can get, regardless of what words are assigned to their score.

I agree its semantics. I was just making a point that inquiries can keep your score down. Could make a difference. In my case I had a major CO on all 3 bureaus and the highest my score got was 730 on EX. When it dropped off this year all 3 shot up 70 pts or more. It was my only negative. My EQ wouldn't move past 706 for months. It went from lowest to highest.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Derogatory marks with high credit score

@iced wrote:

@Anonymous wrote:

@iced wrote:Do major derogs also hurt less over time (as the article states) or do they significantly hurt a score for the full 7 years they're on it (as the "not given for major derogatory" infers from the Fed doc)? This has caused me some consternation as I have seemed to have hit a glass ceiling at 750-775 (my worst baddie is a 150 day late from 2012), but I also find it hard to believe I'm going to wake up one morning in 2019 to a 50+ point jump into the mid 800s.

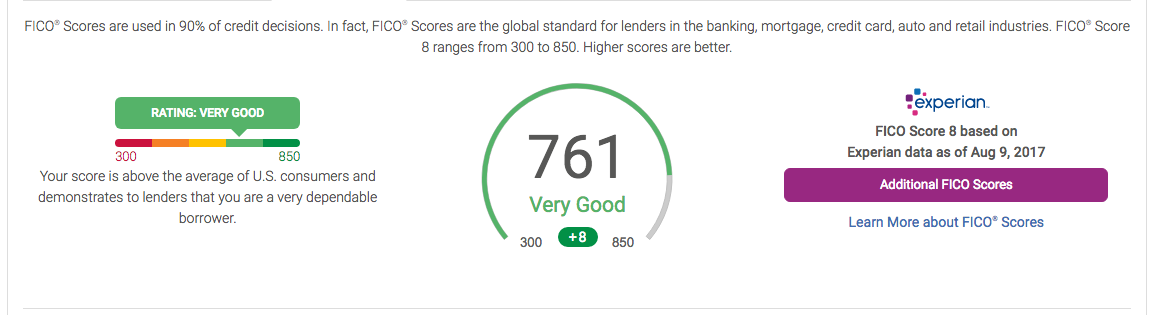

You've achieved over a 759 FICO 08 score with a major delinquency (120 day late)? That's worthy of discussion, as from what I understand no one has reported over a 759 score with the presence if a major on their report. Minors yes, but not majors. This is great news for others (like myself) with majors

The next time it goes over 759 I'll send you a screenshot if you like. This month FICO via Citi (Experian?) is showing 753. I wish Vantage scores mattered more; I'm over 800 on TU Vantage. I only have 3 cards + a DCU checking account (which isn't FICO8), so I don't have a good (read: free) way to constantly check all 3 bureau FICO scores. I watch the reports more, which between Experian's free report and CK, I can cover the 3 bureaus for free.

Based on your statement, can I reasonably surmise if all of the 90 day or worse lates fall off, my score would then be over 800? There's two accounts (one open and one closed) showing 90 day or worse late payments in their history.

Citi uses the Bankcard Enhanced version of Fico with a scale up to 900.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Derogatory marks with high credit score

@Anonymous wrote:

Citi uses the Bankcard Enhanced version of Fico with a scale up to 900.

This made me curious, so I just paid and pulled a FICO from Experian directly and it's 750 (labeled as Fico Score 8). I guess my report isn't very enhanceable for bank cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Derogatory marks with high credit score

@Anonymous wrote:

@Credit_hawk wrote:I could be wrong but I don't think it's possible to get your credit above 750 with derogatory marks. Though I suppose anything is possible. I mean if it's near falling off I guess you could have high 700s with derogatory marks.

My TU and EQ are 774 and 769 respectively with an old Verizon "collection" that I paid in full. That one account reports in the 5-6 year ago range. The one single time it got me a denial was for a CLI with Citi (and quite honestly the rep I spoke with on the recon call was at a loss for words that they used that as the reason for the denial). Everything else I have applied for has resulted in instant approvals.

Thanks for the info. Can you please confirm your TU and EQ scores are Classic Fico 08.

When I see TU and EQ together it reminds me of Credit Karma - and CK reports VantageScore 3.0.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Derogatory marks with high credit score

@iced wrote:Do major derogs also hurt less over time (as the article states) or do they significantly hurt a score for the full 7 years they're on it (as the "not given for major derogatory" infers from the Fed doc)? This has caused me some consternation as I have seemed to have hit a glass ceiling at 750-775 (my worst baddie is a 150 day late from 2012), but I also find it hard to believe I'm going to wake up one morning in 2019 to a 50+ point jump into the mid 800s.

I would agree. I have been stuck for quite a while first in the 700-730,740 rage, now in the 730-780 range. The range jump I feel was when the cluster of major derogatories became 4 years old. I have found 30% utilization to be a significant line in the sand in my file not to cross without significant drop in score drop.

To the original posters response as my file became thicker and scores were 700 + most credit products became readily available. From here on out once I utilized BT offers even though my score was in the 710-320 range the spigot ran dry. Obtaining credit with low balances is significantly easier in my experience. My experience has also been that balances seem so play a greater role than DTI. I have always kept payments < 25% of income but access to credit became unobtainable past 30%util

Current Score: EX 712 4/28/15, TU 713 4/14/14 lender pull, EQ 723 9/16/15, 740 EQ bankcard 8 6/1/15 lender pull

Current Score: EX 712 4/28/15, TU 713 4/14/14 lender pull, EQ 723 9/16/15, 740 EQ bankcard 8 6/1/15 lender pullLast app 03/12/17

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Derogatory marks with high credit score

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Derogatory marks with high credit score

@iced wrote:

@Anonymous wrote:

@iced wrote:Do major derogs also hurt less over time (as the article states) or do they significantly hurt a score for the full 7 years they're on it (as the "not given for major derogatory" infers from the Fed doc)? This has caused me some consternation as I have seemed to have hit a glass ceiling at 750-775 (my worst baddie is a 150 day late from 2012), but I also find it hard to believe I'm going to wake up one morning in 2019 to a 50+ point jump into the mid 800s.

You've achieved over a 759 FICO 08 score with a major delinquency (120 day late)? That's worthy of discussion, as from what I understand no one has reported over a 759 score with the presence if a major on their report. Minors yes, but not majors. This is great news for others (like myself) with majors

The next time it goes over 759 I'll send you a screenshot if you like. This month FICO via Citi (Experian?) is showing 753. I wish Vantage scores mattered more; I'm over 800 on TU Vantage. I only have 3 cards + a DCU checking account (which isn't FICO8), so I don't have a good (read: free) way to constantly check all 3 bureau FICO scores. I watch the reports more, which between Experian's free report and CK, I can cover the 3 bureaus for free.

Based on your statement, can I reasonably surmise if all of the 90 day or worse lates fall off, my score would then be over 800? There's two accounts (one open and one closed) showing 90 day or worse late payments in their history.

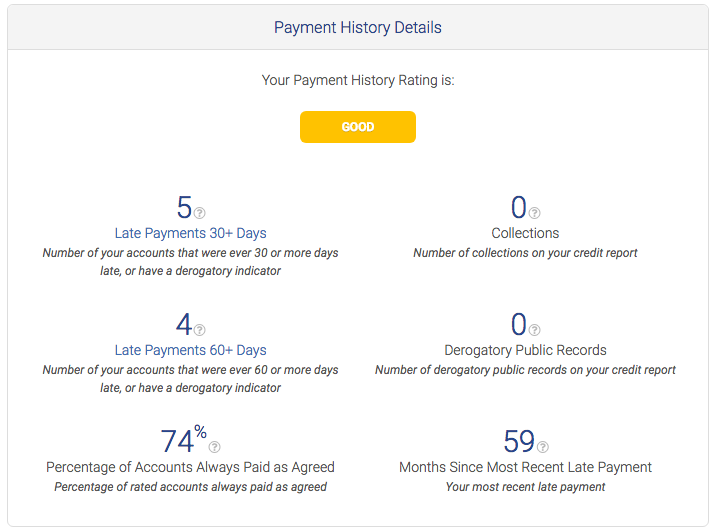

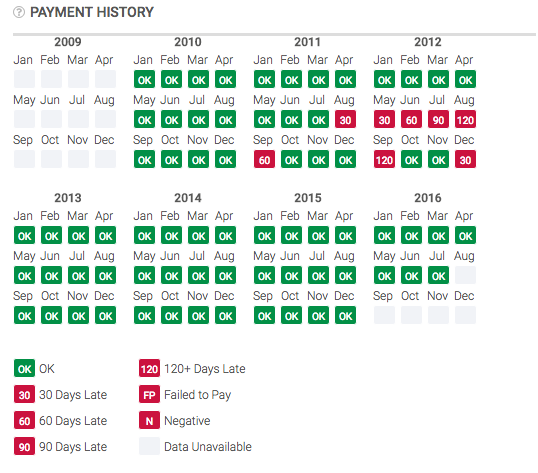

Sorry to resurrect this thread, but a promise is a promise (from experian.com):

The payments 60+ are all also 90+. I couldn't find the section on Experian's site showing me the positive/negative factors, so I went with this screenshot instead.

Either the 760 cap for those with major derogs has changed or the line for a major derog is higher than 120 days.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Derogatory marks with high credit score

Sorry to resurrect this thread, but a promise is a promise (from experian.com):

The payments 60+ are all also 90+. I couldn't find the section on Experian's site showing me the positive/negative factors, so I went with this screenshot instead.

Either the 760 cap for those with major derogs has changed or the line for a major derog is higher than 120 days.

Thanks for the update, as I am trying everything in my power to optimize my scores. I'm officially 1 year post CH13 discharge and my scores just tumbled because of an auto refinance (I'm assuming). I initially purchased my vehicle in 12/16 and before I refinanced in 05/17, my scores were EX-692, EQ-691 and TU-683. Today my scores are EX-652, EQ-673 and TU-670. I've been trying to figure out what happened and only two things stand out (other than the obvious BK): The auto refinance and my utilization reporting at 0%. I hadn't actively planned for the utilization to report at zero, but I since I use my cards sparingly sometimes I forget to let a balance report. I'm hoping to start my early exclusions February 2018. I'm hoping that in the next 6 months my score will break the 700's (the auto loan will age and I will get my utilization up to 1-3%). I'm really exhausted with this but such is the life of a rebuilder! Other than the low scores, my rebuild has been great - minimal bank cards and no store cards or subprime cards, low utilization, high AAoA and 100% on time payment history before and after filing BK. I suspect I'll be golden once the BK falls off next year. Sigh, if I knew then what I know now, I would have never filed BK. I could have worked thru my perceived issues and been just fine.

EQ - 770

EX - 757

TU - 741

Goal: 800