- myFICO® Forums

- Types of Credit

- Credit Cards

- Difference between Capone and myfico transunion sc...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Difference between Capone and myfico transunion score

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Difference between Capone and myfico transunion score

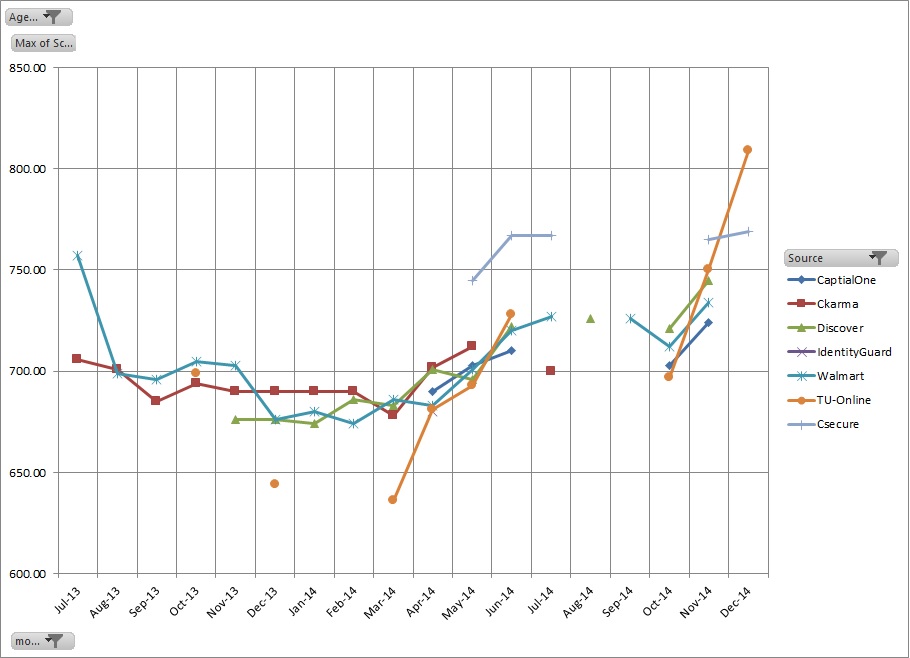

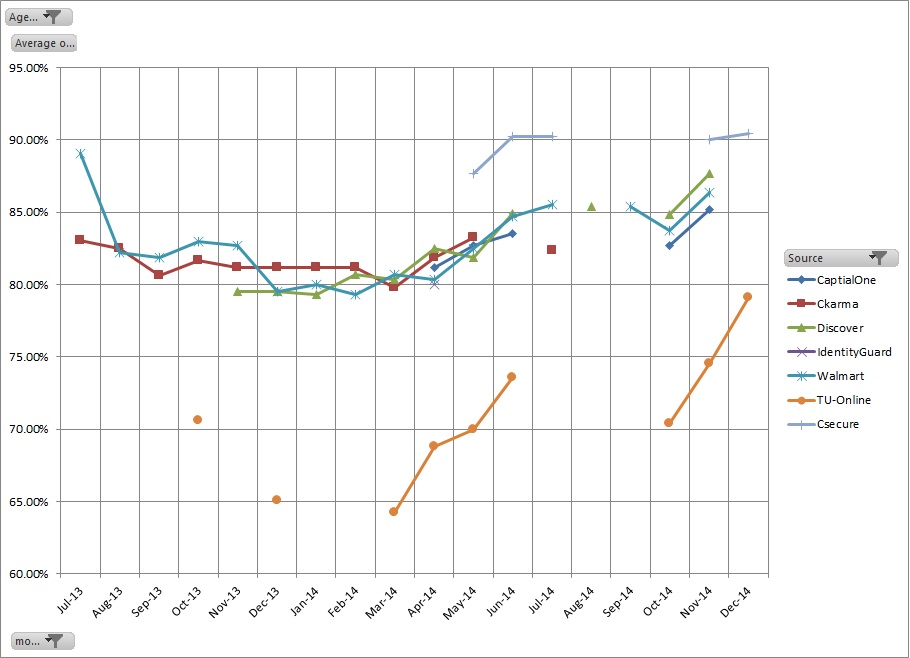

does anyone get their scores from TU directly? any experience whether its 990 max is just another version of FAKO? i couldn't really understand the TU04 vs. TU08 systems and why their scores are not on same scale as others.. if I plot my scores, here is how they look

tu.com always is low for me - so i wonder what lendors would see? i will dig in to my old mail and see if i have any scores from the lendors like WM and Lowes when i opened my credit lines 2 years ago. just to see what scale they are using.

Starting Score:~ 600 all 3 in 2005 - Last App: TU- June 2013; EQFX - May 2014; EXP - Oct 2014;

Starting Score:~ 600 all 3 in 2005 - Last App: TU- June 2013; EQFX - May 2014; EXP - Oct 2014;Current Score: Dec 2014 - EXP: FNBO-778/900; PremierCreditManager-746/850; CreditSecure-746/850; IdentityGuard-729/850;

EQFX: DCU-723/830; CreditSecure-734/850;

TU: WM-734/850; TUonline-809/990; CKarma-749; Discover-745/850; CapOne-724/850; CSecure-769/850;

Goal Score: > 800 all 3

App-Free Target Date:> JAN 2014 (6 months)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Difference between Capone and myfico transunion score

Why would you EVER want to get your scores from TU directly.. NO LENDERS USE THEM!.. They use FICO scores.. please cancel your service if you use it and use the 3 bureau monitoring service from here.. It isn't perfect on updates, but for 20 a month you can't beat it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Difference between Capone and myfico transunion score

CreditCuriosity - i am coming to the same realization - may be i am better off just paying that $ here and get myFICO scores for all 3 CBs.. looks like no one really cares about their scores from tu.com directly..

Starting Score:~ 600 all 3 in 2005 - Last App: TU- June 2013; EQFX - May 2014; EXP - Oct 2014;

Starting Score:~ 600 all 3 in 2005 - Last App: TU- June 2013; EQFX - May 2014; EXP - Oct 2014;Current Score: Dec 2014 - EXP: FNBO-778/900; PremierCreditManager-746/850; CreditSecure-746/850; IdentityGuard-729/850;

EQFX: DCU-723/830; CreditSecure-734/850;

TU: WM-734/850; TUonline-809/990; CKarma-749; Discover-745/850; CapOne-724/850; CSecure-769/850;

Goal Score: > 800 all 3

App-Free Target Date:> JAN 2014 (6 months)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Difference between Capone and myfico transunion score

@sorachepa wrote:CreditCuriosity - i am coming to the same realization - may be i am better off just paying that $ here and get myFICO scores for all 3 CBs.. looks like no one really cares about their scores from tu.com directly..

Definitely do that

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Difference between Capone and myfico transunion score

So I can expect the TU score from my Fico to be in the ballpark(20-30 points normally) with the other two agencies. Also I can forget the Capone number except for direction.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Difference between Capone and myfico transunion score

@Anonymous wrote:So I can expect the TU score from my Fico to be in the ballpark(20-30 points normally) with the other two agencies. Also I can forget the Capone number except for direction.

Not really... My TU score is 40 points or so higher then my EQ score. I know others with lets say TU score being 100 points higher then EQ or EX depending if BK is still showing or a big charge off or other baddies that don't exist on the TU bureaus, but possibly other. My personal opinion is never assume anything in the credit game and get al three reports and know for yourself.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Difference between Capone and myfico transunion score

@sorachepa wrote:so I am thinking to use my free scores and subtract 4 to 5 % points as a ballpark

There is not a linear or even direct relationship. Expect different algorithms to produce different results.

@CreditCuriousity wrote:Even if there scores was a true TU FICO, other bureaus vary greatly on scores as we all know

All depends on how the data differs among the CRA's. My Experian and TU data must be the same since my 08 scores are the same for both. YMMV.

@sorachepa wrote:does anyone get their scores from TU directly? any experience whether its 990 max is just another version of FAKO?

No experience needed. It's documented and known to be a FAKO. If you're getting scores from the CRA's they're FAKO's with one exception IIRC -- I think EQ has an option to provide a FICO somewhere.

@sorachepa wrote:i couldn't really understand the TU04 vs. TU08 systems and why their scores are not on same scale as others.. i

Scales may vary from model to model. Do not rely on one scoring model to determine a score generated by an entirely different model. Again, different algorithms will produce different results. Scoring models are a very common topic here so don't overlook prior discussions and the Understanding FICO Scoring subforum.

@sorachepa wrote:tu.com always is low for me - so i wonder what lendors would see?

They see whatever score they pull. If they don't pull a score using the TransUnion New Account model then it won't have any relevance to the scores you're getting from TU. If they pull a score based on data from a CRA other than TU then it also won't have any relevance to the score you're pulling from TU. Both the scoring model and the CRA data used to generate the score matter.

@sorachepa wrote:CreditCuriosity - i am coming to the same realization - may be i am better off just paying that $ here and get myFICO scores for all 3 CBs.. looks like no one really cares about their scores from tu.com directly..

You also need to keep in mind that myFICO provide 08 scores. Not all creditors use 08 scores. Even if the scores you're comparing are FICO's you can't use one to determine the other if they were generated using different models. Focus on the data in your reports instead of the numbers.

@Anonymous wrote:So I can expect the TU score from my Fico to be in the ballpark(20-30 points normally) with the other two agencies.

Nope. As I mentioned above, it all depends on how the data differs among the CRA's. There's no guarantee that your data will be within 20-30 points. It could be. It could not be. I have no idea since I don't know what your reports look like.

@Anonymous wrote:Also I can forget the Capone number except for direction.

You can not assume that. Again, different models. Take a look at elim's graph posted near the beginning of the thread.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Difference between Capone and myfico transunion score

thanks for the detailed response takeshi74

I am cancelling my service with TU (which gives score and CR report upate everyday - its my 5:00 PM daily routine) and sign up here at myFICO for all 3 scores. i am assuming its once a month update on CR and scores for all 3 CRAs - and monitor for any changes 24x7;

i just need something else interesting to do at 5:00 starting new year ![]()

Starting Score:~ 600 all 3 in 2005 - Last App: TU- June 2013; EQFX - May 2014; EXP - Oct 2014;

Starting Score:~ 600 all 3 in 2005 - Last App: TU- June 2013; EQFX - May 2014; EXP - Oct 2014;Current Score: Dec 2014 - EXP: FNBO-778/900; PremierCreditManager-746/850; CreditSecure-746/850; IdentityGuard-729/850;

EQFX: DCU-723/830; CreditSecure-734/850;

TU: WM-734/850; TUonline-809/990; CKarma-749; Discover-745/850; CapOne-724/850; CSecure-769/850;

Goal Score: > 800 all 3

App-Free Target Date:> JAN 2014 (6 months)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Difference between Capone and myfico transunion score

@sorachepa wrote:thanks for the detailed response takeshi74

I am cancelling my service with TU (which gives score and CR report upate everyday - its my 5:00 PM daily routine) and sign up here at myFICO for all 3 scores. i am assuming its once a month update on CR and scores for all 3 CRAs - and monitor for any changes 24x7;

i just need something else interesting to do at 5:00 starting new year

But make sure you understand what takeshi74 is saying. The numbers here WON'T always match with what an issuer pulls, because there are simply too many types of FICO scores. If you want a mortgage, currently at least most lenders will pull the 04 versions, which are no longer available here, and may, or may not, differ greatly from your score. Some lenders will put the 08 credit card enhanced version, others not. Penfed uses FICO Next Gen (which is helpfully provides to its customers on the website).

Hence takeshi74's advice to focus on reports rather than scores. Baddies will bring down scores in any system, differing only in impact, whereas a long history of ontime payments over a mix of credit types is going to be good everywhere.

The FICO/FAKO distinction is a little overstressed. The difference is a FAKO is used by NO lender, a FICO may or may not be used by your lender, so not really a huge difference.

ETA: and even that is overstated! Some issuers use the non-FICO Vantage score, as at least part of their decision, so some FAKOs are used.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Difference between Capone and myfico transunion score

@longtimelurker wrote:

@sorachepa wrote:thanks for the detailed response takeshi74

I am cancelling my service with TU (which gives score and CR report upate everyday - its my 5:00 PM daily routine) and sign up here at myFICO for all 3 scores. i am assuming its once a month update on CR and scores for all 3 CRAs - and monitor for any changes 24x7;

i just need something else interesting to do at 5:00 starting new year

But make sure you understand what takeshi74 is saying. The numbers here WON'T always match with what an issuer pulls, because there are simply too many types of FICO scores. If you want a mortgage, currently at least most lenders will pull the 04 versions, which are no longer available here, and may, or may not, differ greatly from your score. Some lenders will put the 08 credit card enhanced version, others not. Penfed uses FICO Next Gen (which is helpfully provides to its customers on the website).

Hence takeshi74's advice to focus on reports rather than scores. Baddies will bring down scores in any system, differing only in impact, whereas a long history of ontime payments over a mix of credit types is going to be good everywhere.

The FICO/FAKO distinction is a little overstressed. The difference is a FAKO is used by NO lender, a FICO may or may not be used by your lender, so not really a huge difference.

ETA: and even that is overstated! Some issuers use the non-FICO Vantage score, as at least part of their decision, so some FAKOs are used.

Just curious what lenders do you know that use Vantage? I had no clue.. I do agree score is just a gauge of how the overall report looks, it is more important what is in the report..