- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Discover IT Credit Limit

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Discover IT Credit Limit

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover IT Credit Limit

@Jonbuck06 wrote:Hey everyone I have a Discover IT with a $4,000 Credit Limit and I was just curious what everyone elses limit is with them? Whats the highest limit they give out?

Started at $1000, and I'm now at $4250. I've had the card since August 2013.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover IT Credit Limit

Was just approved at beginning of March with initial CL set at $9K.

===============

Starting Scores:

Low 500's

Current Scores:

Equifax: 697

TransUnion: 660

Experian: 652

Goals:

725-750

Wallet:

Capitol One/Quicksilver: $14.5K

Compass BBVA: $9K (Currently secured, but will convert to unsecured in a few more months)

Discover It: $9K

Target: $1K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover IT Credit Limit

I just applied and got a $15k CL, much higher than any of my other cards.

Current score: 721 (Discover Fico)

Goal scores: 761 across the board

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover IT Credit Limit

My card was 3 months on the 7th with a $500 limit. Paid it off last week and went for the cli and on the screen popped up "sorry we cannot grant a limit increase at this time".

Well with a $5000 limit Am Ex, and au cards which I control with $2000 and $3750, Discover card is going in the sock drawer. I don't expect the world they did give me my first card in my name, but could have at least given me a $300 increase.

This limit is WORTHLESS!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover IT Credit Limit

I am at $9.5K, they keep asking for a HP everythime I request a CLI and I keep saying NO. I have been with Discover for 2 Years

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover IT Credit Limit

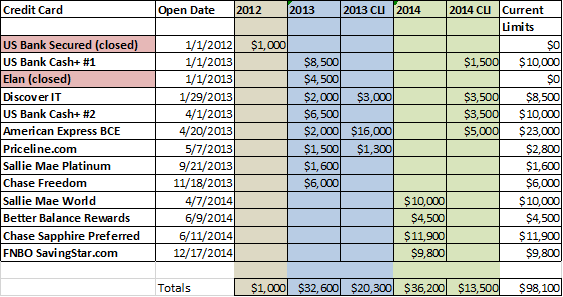

2013 first year with Discover It

Feb: Discover was one of my original unsecured cards. They started me at $2000.

Jul: I had to accept a HP if I wanted a CLI. They increased my limit to $3000.

Nov: I had to accept a HP if I wanted a CLI. They increased my limit to $5000.

2014 second year with Discover It

May: Using automated phone system, I was finally offered a SP CLI. Limit now $6000

Sep: Using computer, requested $1500. Granted via SP. Limit now $7500

Dec: Using automated phone system, SP increase of $1000. Limit now $8500

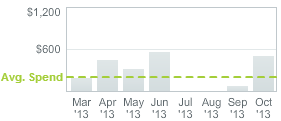

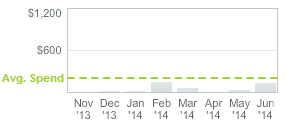

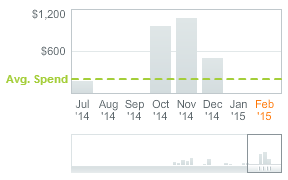

My experience was HP required first year, SP available after that. Was it worth it to use the HP? Yes. HP only affect your FICO scores for a year. 2013 saw a 150% increase due to HP CLI, whereas 2nd year saw 70% increase. And I never wish that I had used fewer HP during 2013 so that i could now brag, or something. You get to use a certain number of HP each year, but you don't get to hoard them for the future. Could I have used the HP to obtain more cards? Well, look at the first image, I DID obtain good cards.

I feel using HP to gain credit limit is all a part of your strategy. Some cards you can get HP via SP, so that should also be a part of your strategy, so that you can strategically use a few HP for the other cards that may need it. And don't do app sprees too close together, the more you hurt your initial credit limits, the more HP you may need to bring them back up, whereas if you had waited a few months you might have started much higher.

That average spend line is about $200, and its that high due to that large 4th quarter 2014 spending ( I threw the rent and such on the card). Note that in 2014 BEFORE the 4th quarter spending, i didn't do much more than spend enough to keep the free FICO scores coming  yet as I stated I had 3 SP CLI requests granted. yes, you need to use the card, but you certainly don't need to overuse it, in order to qualify for a credit increase. Just use it a lot in quarters that you find the 5% useful, and use it a tad bit otherwise, keep your FICO score up, and you'll do fine. Just have patience.

yet as I stated I had 3 SP CLI requests granted. yes, you need to use the card, but you certainly don't need to overuse it, in order to qualify for a credit increase. Just use it a lot in quarters that you find the 5% useful, and use it a tad bit otherwise, keep your FICO score up, and you'll do fine. Just have patience.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover IT Credit Limit

$10k was the intial balance December 2014.

My only current cards at the time were a secured Capital One at $200 and an unsecured at $500.00 and a Kays card $1500 (0% UTI) Had 85% UTI at the time of applying. I had 3 charged offs from 2009/2010; All were paid. Had a closed auto loan and 3 closed installment loans with perfect history. I was very suprised that my intial CL was so high.

Reported FICO at the time was 670.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover IT Credit Limit

Starting Limit: 1500k in 2011

Current Limit: 1500K

No luv for me

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover IT Credit Limit

3500 had card 7 months

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover IT Credit Limit

Started $1000 in 3 years ago.

Still $1000 now.

This is my lowest CL. I called them several times and hit the luv button several times. They want to HP. I said NO.

I don't use it anymore until they raise it.

Credit Cards: Chase Freedom 9.5K | AMEX TrueEarnings 4.5K | Cap1 Venture Visa 3.5K | Cap1 QS MC 3.5K | Discover IT 1K | Cap1 Spark Cash 15K | AMEX SimplyCash 9K

Store: PayPal SmartConnect 10K | JCP 5.2K | Banana 3.3K | Walmart 4.5K | Kohls 1.5K | TargetRED 200