- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Discover, you make no sense!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Discover, you make no sense!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Discover, you make no sense!

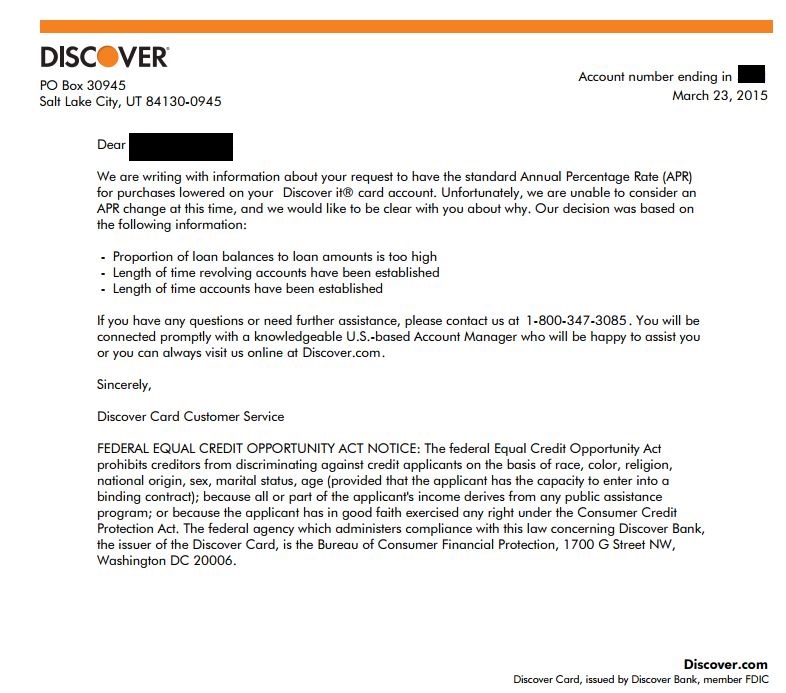

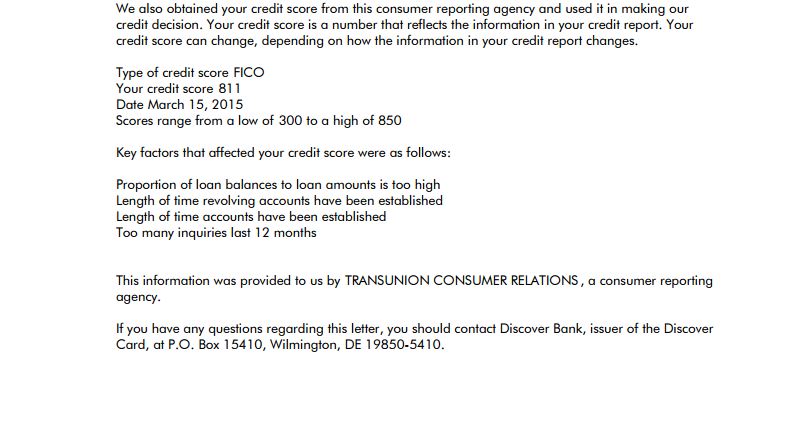

So, Discover hasn't given me any love when it comes to soft CLI since October 2013, but that's understandable given how little I use it but I decided to request an APR reduction from 23.99% to... anything.

Denied... and they sure had a quite a little list on me! ![]()

"Proportion of loan balances to loan amounts too high":

$7500 remaining on a $18,000 auto loan.

4years out of 5 remaining.

"Length of time revolving accounts have been established":

Oldest TL excluding AU accounts: 8 years.

AAoA: 4.5 years.

"Length of time accounts have been established":

See above.

Maybe next time Discover.

TU: 818 EX: 809 EQ: 801

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover, you make no sense!

Did you call, email or chat?

I was able to get it lowered by chat and my DW got a 0% 12months promo instead.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover, you make no sense!

From my own experience I could see the reason 3 as a valid point

"Length of time accounts have been established" (Discover account)

I always wondered if they have standard selections where it would include reasons which did not specifically apply and only some of the reasons applied.

After not coming to a clue I gave up to try to figure out Discover (approvals, CLs) and Chase (APRs) ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover, you make no sense!

@newhis wrote:Did you call, email or chat?

I was able to get it lowered by chat and my DW got a 0% 12months promo instead.

Tried over live chat, barely willing to call in for a recon

TU: 818 EX: 809 EQ: 801

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover, you make no sense!

@lg8302ch wrote:From my own experience I could see the reason 3 as a valid point

"Length of time accounts have been established" (Discover account)

I always wondered if they have standard selections where it would include reasons which did not specifically apply and only some of the reasons applied.

After not coming to a clue I gave up to try to figure out Discover (approvals, CLs) and Chase (APRs)

I think ill join that club ![]()

TU: 818 EX: 809 EQ: 801

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover, you make no sense!

@ksantangelo23 wrote:

@lg8302ch wrote:From my own experience I could see the reason 3 as a valid point

"Length of time accounts have been established" (Discover account)

I always wondered if they have standard selections where it would include reasons which did not specifically apply and only some of the reasons applied.

After not coming to a clue I gave up to try to figure out Discover (approvals, CLs) and Chase (APRs)

I think ill join that club

Wecome to the club...but on the bright side...with Discover persistance pays ..after 15 months of denials all the sudden started to feel the luv and that button came back with results every 3 months. Also I had luck Discover lowered my APR twice in the past 12 months. Keep trying. As for Chase APRs it is a seedless mission...stuck for life of the card!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover, you make no sense!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover, you make no sense!

Banks are often weird, aren't they?

For me, Discover has been one of the most lenient. When I was rebuilding, Discover was the ONLY one who would give me an unsecured card with no AF (I also had an unsecured Capital One card, but they started me with $500 CL and a $49 AF). And Discover gave me periodic CLIs, and I successfully lowered the APR via chat last month. Although something weird happened when I got the APR lowered. I got a SM saying that it was successfully lowered, followed by another SM 30 minutes later saying that they couldn't lower it due to my derog* and too many accounts with delinquency**. But the next month's statement showed the lowered APR.

But by far, Chase has been the most lenient, at least in the past 3 years (after I opened a checking account with them). When none of my cards had over $3000 CL, Chase gave me a $9000 CL and a $5000 CL. And recently, they gave me two cards, each with $12,000 CL. I know have 5 Chase credit cards.

* Derog falling off my report in May 2015. It was $150 bill that I didn't pay out of principle back in 2008 (disputed hospital charges). In hindsight, I should have just paid it and not let it go to COL, but my credit was super terrible back then (low 500s) and didn't care at that time. Obviously, this was pre-myFICO forums.

** 4-5 years ago, I missed 9 payments on my student loans b/c I thought they were under deferment (unemployed), and there are 17 different accounts for the student loans = a ton of 90 days late & 120 days late in my report.

FICO 08 (4/9/2018): EQ 647 EX 609 TU 620

FICO 08 (10/16/2020): EQ 676 EX 659 TU 653

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover, you make no sense!

What a surprise, finally got a CLI to $4,000 19 months after opening date. Better than nothing! Maybe Ill put more than a pizze once a month through it now ![]()

TU: 818 EX: 809 EQ: 801

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover, you make no sense!

@ksantangelo23 wrote:What a surprise, finally got a CLI to $4,000 19 months after opening date. Better than nothing! Maybe Ill put more than a pizze once a month through it now

Congrats. op. but im in total shock you had such a issue with discover. after seeing that 800plus score. but goes to show score not everything. i guess you really have to show some usage. wow. ![]()