- myFICO® Forums

- Types of Credit

- Credit Cards

- Ever feel guilty about using credit cards at store...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Ever feel guilty about using credit cards at stores?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ever feel guilty about using credit cards at stores?

@Anonymous wrote:Today I was thinking about the card system and how much stores have to pay to accept them and I suddenly started feeling bad that I'm costing stores 3% every time I swipe. It seems silly considering that it's already baked into the prices we all pay for stuff and that I've been doing it for years. At the same time, I do have to wonder if I'd be a bit more societally responsible if I used a debit card or at least something that costs less than Visa Signature/Infinite/AmEx.

Anyway, are there specific stores/situatutions where you'll pay with the "cheaper" option?

Thanks for starting this thread. It's a good read.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ever feel guilty about using credit cards at stores?

@longtimelurker wrote:

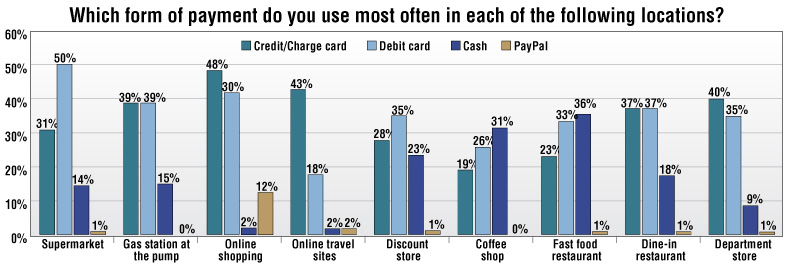

@DrZoidberg wrote:I find it hard to believe the merchant fees are a "major cost to a business" when only 17% of consumers use credit as a form of payment. Cash and debit account for 65% of transaction payment types.

Where is that from? I found a very different breakdown (although this seems to be a small sample):

Where does bitcoin fit in this model????

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ever feel guilty about using credit cards at stores?

I never feel guilty about using a credit card at the store, especially for those small businesses that have most items priced at less than $10.

If you use a debit card there, they'll run it as credit anyways, but the swipe fees technically aren't higher for them when ran as credit vs. debit.

My local mom and pop barber has $7 haircuts, and displays Visa and MasterCard on their window. I know they take Discover, but I also know they don't take AMEX.

When you charge $5 for a haircut, and then say, $2 is added to the tip, totaling $7.... A debit card will cost around 24 cents, while a credit card will cost around 21 cents. Anything over $9 and credit costs more, but don't be fooled by the whole "smaller purchase amount means credit costs them more" thing. It's so funny to see these businesses imposing minimums on credit purchases and not giving the consumer a choice to run their card as debit because they're so cheap they have stupid readers hidden behind the counter so the customer cannot access them.

Personally, I don't feel bad for any business when I swipe my card because they've gotten away with having crappy hardware for years, and haven't ever been forced to upgrade to technology from the 21st century like the rest of the world.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ever feel guilty about using credit cards at stores?

@pipeguy wrote:Seems I'm the only one with the opinion that small business is worth keeping around - there are very few "rich" small businesses.

Anyway it seems the mega bank will or has already won this round since they have most everyone, but me, convinced that they deserve a piece of every transaction. A cashless society just means that banks get a fee every time you spend your money and in the long run that means YOU are actually paying more to cover those costs. Blame the merchants if you like but your blame is misdirected IMO.

you do realize this is a credit card forum right?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ever feel guilty about using credit cards at stores?

@sarge12 wrote:

@longtimelurker wrote:

@DrZoidberg wrote:I find it hard to believe the merchant fees are a "major cost to a business" when only 17% of consumers use credit as a form of payment. Cash and debit account for 65% of transaction payment types.

Where is that from? I found a very different breakdown (although this seems to be a small sample):

Where does bitcoin fit in this model????

Towards the y axis in every category! I also don't know what they mean by using paypal at restaurants or department stores (apart from Paypal debit/credit cards)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ever feel guilty about using credit cards at stores?

I don't feel guilty at all. When I owned a small business, I strongly preferred it when customers paid by credit card. Sure, the merchant fees were no fun, but I'd rather pay Visa or MasterCard than have the hassle of handling cash. With cash, we had to put it in a deposit bag, fill out a deposit slip, go to the bank every night and worry about theft or loss. (One of my employees pocketed some of his cash sales, to boot).

My attitude on credit card payments has changed over the years. When I first started using credit and debit cards in 2000, there were far more businesses that were cash-only than there are today (namely, fast food restaurants and parking garages). Now I very rarely need to pay cash for anything.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ever feel guilty about using credit cards at stores?

@Anonymous wrote:

I think the cottage industry and internet only help if you have an interest in buying what the small business is selling. My husband and I really don't need more "things" cluttering up our house. We travel, eat out, purchase groceries, and buy premium clothing from specific retailers that have brands we like (i..e, Hugo Boss).

I support the idea of small, personal businesses, there just isn't anything they are selling that I want.

Nothing wrong with that IMO! I really only buy from one "small" business because it's specialized (I collect silver bullion and coins) and it's not something I can buy in a big box store!

To answer the question - no I don't feel bad using a card at a store. Merchants should work in the swipe fees in their pricing. I worked for a small business and we did. Swipe fees weren't the issue for us; it was the chargebacks! However, I can understand and respect minimums. One small cafe I used to go to all the time where I used to work had a $5 card minimum (never a problem since lunch was always $10+) and I always spent enough. Likewise, if a merchant doesn't accept one card type (for whatever reason), I would just use another.

I like the idea of small businesses but they have to have something I want. I don't go to small business's for the sake of it but will use them if they have something I will buy.

Quicksilver $10,000 | Better Balance Rewards $2000 | Sallie Mae $3500 | Freedom $3500

Quicksilver $10,000 | Better Balance Rewards $2000 | Sallie Mae $3500 | Freedom $3500Last HP: 9/27/2015

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ever feel guilty about using credit cards at stores?

@longtimelurker wrote:

@DrZoidberg wrote:I find it hard to believe the merchant fees are a "major cost to a business" when only 17% of consumers use credit as a form of payment. Cash and debit account for 65% of transaction payment types.

Where is that from? I found a very different breakdown (although this seems to be a small sample):

Maybe it's area based but when I worked at Super Target as a cashier, the vast majority of transactions were debit card. There were some credit cards too but I feel like a lot of people now are afraid of credit cards and would rather just their debit cards. I would say cash/checks were only about 10-20% of my transactions.

Quicksilver $10,000 | Better Balance Rewards $2000 | Sallie Mae $3500 | Freedom $3500

Quicksilver $10,000 | Better Balance Rewards $2000 | Sallie Mae $3500 | Freedom $3500Last HP: 9/27/2015

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ever feel guilty about using credit cards at stores?

@Anonymous wrote:I don't feel guilty at all. When I owned a small business, I strongly preferred it when customers paid by credit card. Sure, the merchant fees were no fun, but I'd rather pay Visa or MasterCard than have the hassle of handling cash. With cash, we had to put it in a deposit bag, fill out a deposit slip, go to the bank every night and worry about theft or loss. (One of my employees pocketed some of his cash sales, to boot).

My attitude on credit card payments has changed over the years. When I first started using credit and debit cards in 2000, there were far more businesses that were cash-only than there are today (namely, fast food restaurants and parking garages). Now I very rarely need to pay cash for anything.

I wonder if the advent of stuff like Square helped with that. I remember card acceptance being sort of a pain before that point (my parents, for instance, simply didn't bother for a long time when they still owned a store--and then only started accepting debit with those square looking Verifone terminals not too long before they sold).

A fair number of places were also still cash-only around me until a few years ago--In-N-Out being the most famous example. Now they take AmEx, which I never thought would happen. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Ever feel guilty about using credit cards at stores?

@Anonymous wrote:I never feel guilty about using a credit card at the store, especially for those small businesses that have most items priced at less than $10.

If you use a debit card there, they'll run it as credit anyways, but the swipe fees technically aren't higher for them when ran as credit vs. debit.

My local mom and pop barber has $7 haircuts, and displays Visa and MasterCard on their window. I know they take Discover, but I also know they don't take AMEX.

When you charge $5 for a haircut, and then say, $2 is added to the tip, totaling $7.... A debit card will cost around 24 cents, while a credit card will cost around 21 cents. Anything over $9 and credit costs more, but don't be fooled by the whole "smaller purchase amount means credit costs them more" thing. It's so funny to see these businesses imposing minimums on credit purchases and not giving the consumer a choice to run their card as debit because they're so cheap they have stupid readers hidden behind the counter so the customer cannot access them.

Personally, I don't feel bad for any business when I swipe my card because they've gotten away with having crappy hardware for years, and haven't ever been forced to upgrade to technology from the 21st century like the rest of the world.

Eh, it depends re: debit/credit. Some will, some won't--it depends on their merchant agreement and what they're using for hardware. Debit is less common at smaller places in general though.

Also, flat percentage type deals are more common among the smaller shops. If you use Square for example you're paying 2.7% even if everyone uses a debit card.