- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: FNBO Amex Lifetime 3.5% APR?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FNBO Amex Lifetime 3.5% APR?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FNBO Amex Lifetime 3.5% APR?

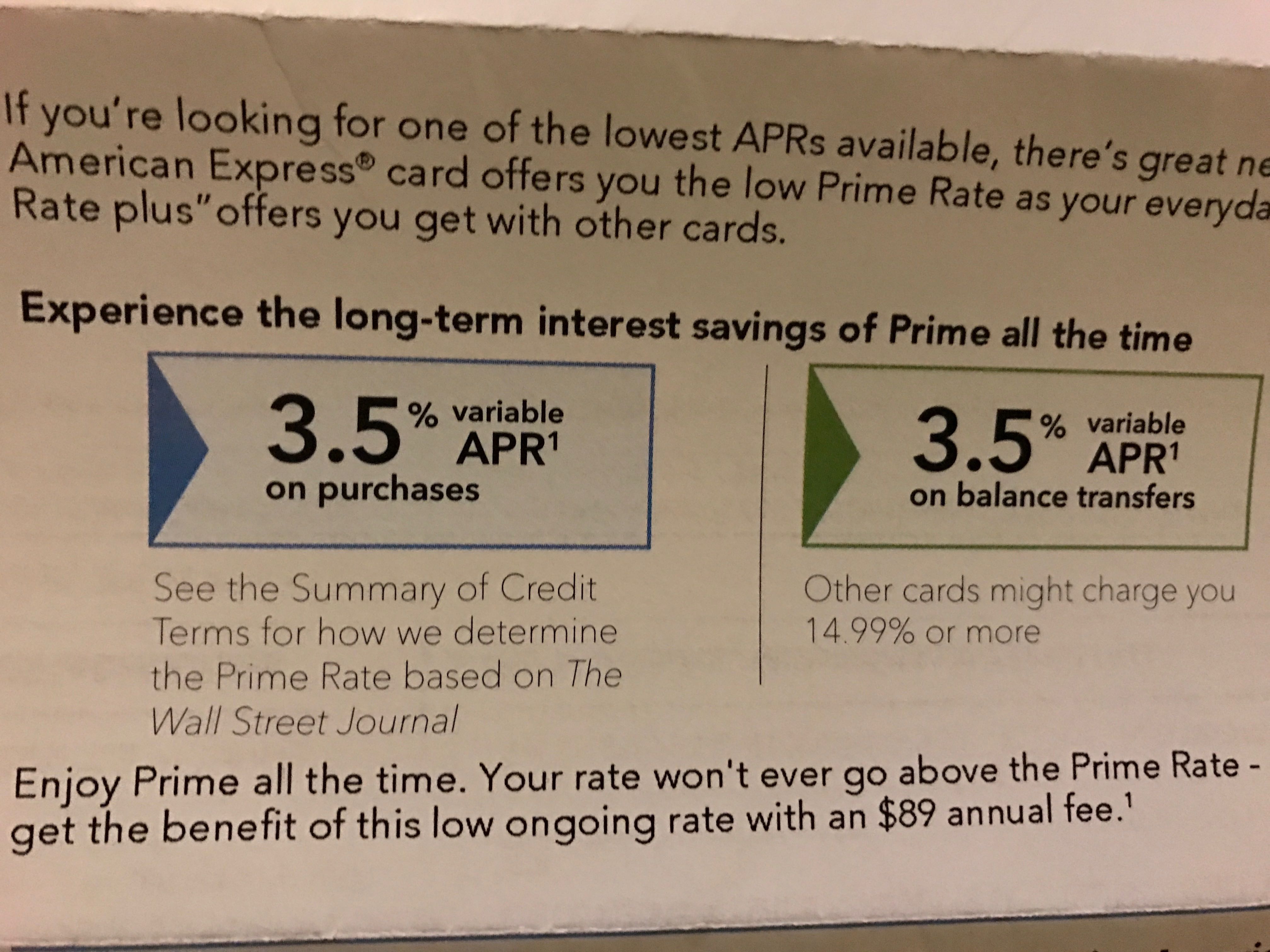

Hey guys, can anyone weigh in on this. I've received mailer for lifetime 3.5% APR but with $89 AF. The APR is awesome but not sure its worth it with the $89 AF. Is it just me?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO Amex Lifetime 3.5% APR?

If you're ever carrying a balance, it could be useful. It depends on how much you're carrying. For example, if you have a $3500 balance at 22% APR, that's $64 in interest a month. This is just one way I could see it working for you.

If you don't carry a significant balance, ignore it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO Amex Lifetime 3.5% APR?

It appears to be a variable based on the prime...so when the prime goes up, so will the rate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO Amex Lifetime 3.5% APR?

Its not so great. here is an old review of the FNBO prime for life card, you can compare to see if all the features are the same:

http://www.magnifymoney.com/blog/consumer-watchdog/first-national-bank-omaha-prime-for-life/

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO Amex Lifetime 3.5% APR?

I don't know what kind of SLs the card comes with. You'd need a pretty big SL to keep utilization reasonable, since it would take a big balance to not have the $89 AF increase the effective interest too much. There are various 8%-10% APR (or lower) alternatives, and possibly very low promotional APRs on other cards.

Also the 5% BT fee would hurt if you didn't just use it for purchases.

I certainly have no interest in it.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO Amex Lifetime 3.5% APR?

By the way, if you are in the Houston area there is a slightly better card:

https://www.houstonfcu.org/loans-credit/credit-cards/visa-primelock

i still don't see the need to pay a annual fee every year for something you might use rarely, if ever. People just ignore the effect of the annual fees on credit cards. Maybe Barbie was right, math is hard...

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO Amex Lifetime 3.5% APR?

@Themanwhocan wrote:By the way, if you are in the Houston area there is a slightly better card:

https://www.houstonfcu.org/loans-credit/credit-cards/visa-primelock

i still don't see the need to pay a annual fee every year for something you might use rarely, if ever. People just ignore the effect of the annual fees on credit cards. Maybe Barbie was right, math is hard...

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO Amex Lifetime 3.5% APR?

It's a teaser rate similar to the teaser rate during the housing boom, we all know how that ended.

Need more info. We need to know what's your monthly carry + what was your previous rate to determine if this is feasible or not.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO Amex Lifetime 3.5% APR?

I received the same offer in the mail OP. I shredded it! I have cards with 0% offers with low BT fees (1% or 2%) so it's better to use one of them then to apply for a new card and pay an annual fee just in case I need to do a BT.

Like folks always say around here, do the math. Run the numbers for yourself. Compare the offer to your current arsenal. Good luck!