- myFICO® Forums

- Types of Credit

- Credit Cards

- FYI on Citi Payments Policy

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FYI on Citi Payments Policy

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FYI on Citi Payments Policy

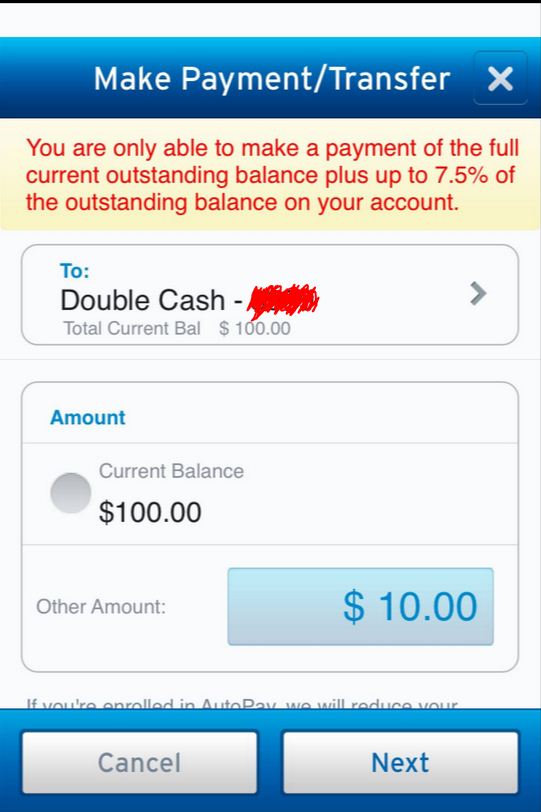

Tried to overpay balance last night so that statement would cut with $0. Had a $105 pending payment and a $8.50 pending charge.

Got this message. Not sure if this is new or not. Hadn't tried to overpay like this before. Just an FYI.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FYI on Citi Payments Policy

Is this your first statement cycle?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FYI on Citi Payments Policy

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FYI on Citi Payments Policy

@lhcole77 wrote:Tried to overpay balance last night so that statement would cut with $0. Had a $105 pending payment and a $8.50 pending charge.

Got this message. Not sure if this is new or not. Hadn't tried to overpay like this before. Just an FYI.

That sounds typical. As for me, I'm only allowed to pay the amount of the statement balance at Citi. Arg.

Start: 619 (TU08, 9/2013) | Current: 809 (TU08, 3/05/24)

BofA CCR WMC $75000 | AMEX Cash Magnet $64000 | Discover IT $46000 | Disney Premier VS $43600 | Venmo VS $30000 | NFCU More Rewards AMEX $25000 | Macy's AMEX $25000 Store $25000 | Cash+ VS $25000 | Altitude Go VS $25000 | Synchrony Premier $24,200 | Sony Card VS $23750 | GS Apple Card WEMC $22000 | WF Active Cash VS $18,000 | Jared Gold Card $16000 | FNBO Evergreen VS $15000 | Citi Custom Cash MC $14600 | Target MC $14500 | BMO Harris Cash Back MC $14000 | Amazon VS $12000 | Freedom Flex WEMC $10000 | Belk MC $10000 | Wayfair MC $4500 ~~

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FYI on Citi Payments Policy

In the event I run into a similar situation for a zero payout (without the balance float), I PIF through Citi and push a payment through my bank for the remaining pending charges.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FYI on Citi Payments Policy

Why would you want to report zero? For optimal scoring you need to report at least 1-2%of your limit minimum.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FYI on Citi Payments Policy

@DrZoidberg wrote:Why would you want to report zero? For optimal scoring you need to report at least 1-2%of your limit minimum.

If reporting on several cards, I (and he) PROBABLY want one card reporting. Unfortunately, I lose out on rewards near cut off date, because I stop purchasing. Hence, the value of more than one reward card (my goal, I'm spoiled with cash back because of grandfathered 1.5% on PayPal debit card for years).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FYI on Citi Payments Policy

This is my first statement cycle. Already have some cards reporting a balance. Didn't want this one to report yet.

Testing effects on scores in general, though I'm not concerned about optimal at the moment due to being in the garden until late 2015.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FYI on Citi Payments Policy

@FinStar wrote:In the event I run into a similar situation for a zero payout (without the balance float), I PIF through Citi and push a payment through my bank for the remaining pending charges.

You. Is. Smart! ![]()

Thanks for that input.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FYI on Citi Payments Policy

You can pay Citi cards with a debit card over the phone.

Best Citi feature.