- myFICO® Forums

- Types of Credit

- Credit Cards

- First National Bank's stepping up their game

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

First National Bank's stepping up their game

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First National Bank's stepping up their game

@gdale6 wrote:

@CreditMagic7 wrote:There is posts here in the forums of members that have their CC and that once approved are fairly generous with CLI's? Maybe someone can chime in on that for us.

They are quite generous with CLIs, the limit of their cards can grow very quickly if you treat them right. You can call in every 3 months and see if a pre approved SP CLI is waiting for you or not.

How good are they about upgrading to a Visa Signature card? This is the FNBO card I want, in Visa Signature form:

https://www.firstbankcard.com/newyorklife/001/personal.fhtml

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First National Bank's stepping up their game

@TheFate wrote:Yes, its from Omaha.

All the offers I received in the past never once mentioned free fico scoring. So this is new to me.

Are they a rebuild company? Don't seem like a prime lender

I'm not sure where you get the impression they aren't a good lender, but they are. Also, they do give rewards in the form of cashback, unless that isn't what you meant when you said "CB" rewards. I've not had any issues asking for a limit increase even though I barely use the card. Went from 10 to 15(no hard) and then to 20(hard). They mostly use Experian, but will check another if it is frozen.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First National Bank's stepping up their game

FNBO has some interesting offerings, and I like how they offer Amex, Discover, MasterCard, and Visa... Gotta love options!

But, their rewards seem lackluster. From what I could see it looks like their cards are basically just 1% cashback (that expires if not redeemed).

I take it that people bank with FNBO for non-monetary benefits (CLI policy, starting limits, FICO scores, etc)?

NPSL | $27,600 | $15,000 | $7,000 | $2,800 | $11,000 | $13,530 | $5,200

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First National Bank's stepping up their game

@irrational wrote:FNBO has some interesting offerings, and I like how they offer Amex, Discover, MasterCard, and Visa... Gotta love options!

But, their rewards seem lackluster. From what I could see it looks like their cards are basically just 1% cashback (that expires if not redeemed).

I take it that people bank with FNBO for non-monetary benefits (CLI policy, starting limits, FICO scores, etc)?

The card I have earns 2% on groceries, gasoline, and something else I believe. Their Discover used to offer up to 5% after a certain point, but just for like 2000 in spending or something. They also had another American Express that got 3% on travel or something, but as you pointed out, all of those are gone. There really is no reason now to get them except if you want a score every month. They did give me 10,000 which was my highest at the times, so I would call going higher than other lines good for a starting limit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First National Bank's stepping up their game

@Themanwhocan wrote:

@gdale6 wrote:

@CreditMagic7 wrote:There is posts here in the forums of members that have their CC and that once approved are fairly generous with CLI's? Maybe someone can chime in on that for us.

They are quite generous with CLIs, the limit of their cards can grow very quickly if you treat them right. You can call in every 3 months and see if a pre approved SP CLI is waiting for you or not.

How good are they about upgrading to a Visa Signature card? This is the FNBO card I want, in Visa Signature form:

https://www.firstbankcard.com/newyorklife/001/personal.fhtml

I cant help you with this one I only have their Amex which is an NPSL and reports as flex spend account with the CL and their Discover.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First National Bank's stepping up their game

@TheFate wrote:Yes, its from Omaha.

All the offers I received in the past never once mentioned free fico scoring. So this is new to me.

Are they a rebuild company? Don't seem like a prime lender

I guess how one person percieves prime vs. the next is highly subjective, but no I would definitely not consider FNBO sub-prime.

They can be tough to get in with, but I don't think 4 inq is necessarily a dealbreaker with them (CSRs aren't always the best informed). They also have some co-branded cards; ANA, LaQuinta, Overstock, Sport Chalet to name a few. I think the free EX Fico is worth having them and they're generally good with sp CLI every 4-6 months.

I got the LaQuinta Visa a couple months ago and it was not instant, required an explanation of all my new tradelines and approved. I wasn't holding my breath on that one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First National Bank's stepping up their game

@navigatethis12 wrote:

@irrational wrote:FNBO has some interesting offerings, and I like how they offer Amex, Discover, MasterCard, and Visa... Gotta love options!

But, their rewards seem lackluster. From what I could see it looks like their cards are basically just 1% cashback (that expires if not redeemed).

I take it that people bank with FNBO for non-monetary benefits (CLI policy, starting limits, FICO scores, etc)?

The card I have earns 2% on groceries, gasoline, and something else I believe. Their Discover used to offer up to 5% after a certain point, but just for like 2000 in spending or something. They also had another American Express that got 3% on travel or something, but as you pointed out, all of those are gone. There really is no reason now to get them except if you want a score every month. They did give me 10,000 which was my highest at the times, so I would call going higher than other lines good for a starting limit.

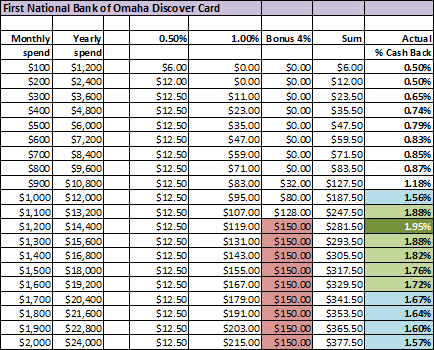

I did a chart for that 5% Discover card they used to have. Worst 5% card ever...

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First National Bank's stepping up their game

@Themanwhocan wrote:

@navigatethis12 wrote:

@irrational wrote:FNBO has some interesting offerings, and I like how they offer Amex, Discover, MasterCard, and Visa... Gotta love options!

But, their rewards seem lackluster. From what I could see it looks like their cards are basically just 1% cashback (that expires if not redeemed).

I take it that people bank with FNBO for non-monetary benefits (CLI policy, starting limits, FICO scores, etc)?

The card I have earns 2% on groceries, gasoline, and something else I believe. Their Discover used to offer up to 5% after a certain point, but just for like 2000 in spending or something. They also had another American Express that got 3% on travel or something, but as you pointed out, all of those are gone. There really is no reason now to get them except if you want a score every month. They did give me 10,000 which was my highest at the times, so I would call going higher than other lines good for a starting limit.

I did a chart for that 5% Discover card they used to have. Worst 5% card ever...

Fun info for us stat junkies. Thanks for sharing.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First National Bank's stepping up their game

@Themanwhocan wrote:

@gdale6 wrote:

@CreditMagic7 wrote:There is posts here in the forums of members that have their CC and that once approved are fairly generous with CLI's? Maybe someone can chime in on that for us.

They are quite generous with CLIs, the limit of their cards can grow very quickly if you treat them right. You can call in every 3 months and see if a pre approved SP CLI is waiting for you or not.

How good are they about upgrading to a Visa Signature card? This is the FNBO card I want, in Visa Signature form:

https://www.firstbankcard.com/newyorklife/001/personal.fhtml

Why this card? On earning, it seems nothing special, 1.5% with 5 year expiration. Are the redemptions special?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First National Bank's stepping up their game

yes they offer free Experian fico and even if you dont have rewards card there are occassionally offers you can click on and add to your card which basically makes it a rewards card.