- myFICO® Forums

- Types of Credit

- Credit Cards

- Goodbye Sallie

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Goodbye Sallie

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Goodbye Sallie

@Anonymous wrote:

@Themanwhocan wrote:

@Anonymous wrote:

@Brax wrote:Not really a good idea to close a card that gives 5.5% back with no AF.

Maybe it wouldn't be a good idea for you but the OP seems to feel differently. Not all of us have the same spending habits or card needs. I like SM but at the same time I could do fine without it. Aside from Target and Nook purchases I don't really use it much. Groceries...meh. Its easier for me to use BCE once a month for $350-$400 in groceries than break that down into two separate purchases just to max out the $250 cap with SM. Gas...don't need it at the moment. Main reason I'm keeping SM is bc I may buy a car next year to add an auto loan into the credit profile mix. Otherwise it wouldn't kill me to roll the limit over and close.

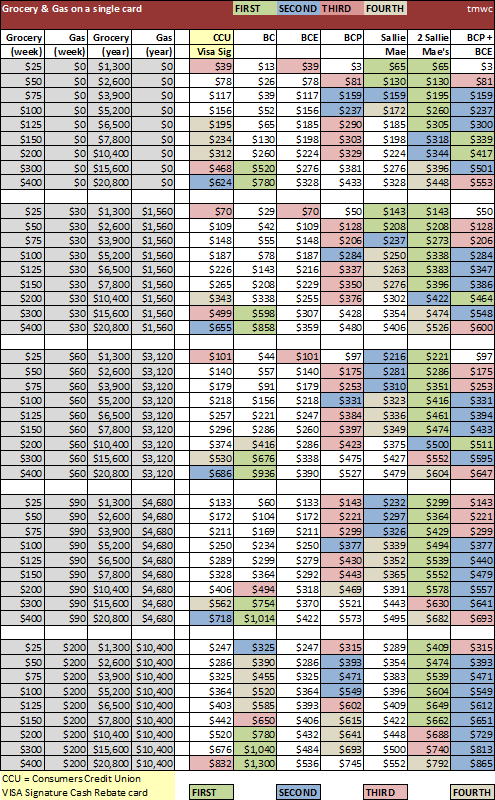

But even if you spend the entire $400 a month on the Sallie mae, you still earn more cash back than using a BCE

I figured this chart would come up sooner or later and I'm aware of it. Again it's just more convenient to use SM on other purchases that aren't groceries vs. splitting payments in two with it. I realize this is against everything most people strive for around here but whatever few dollars I'm losing out on here and there aren't going to keep me up at night lol This is simply what works for me. Not saying its the best strategy for accumulating every possible penny its simply my preferred method

Thanks TMWC

Right, keep it all in perspective. We're only talking about $16 difference per year ![]()

But personally, I just don't like the look of the transparent BCE card. Even though someone once complemented its appearance when I used it.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Goodbye Sallie

@Anonymous wrote:

@NRB525 wrote:If one is not carrying any balance, why does the APR matter?

Doesn't matter much to me. Caps are so low I couldnt see myself ever carrying a balance with this card even if I were inclined to carry any type of balance someday. But everyone is different. Might be a peace of mind thing for some people who knows

Maybe it simply feels good to see a lower APR vs. higher

I'm thinking more along the lines of, if one has to carry a balance on $250 of monthly grocery spend, maybe that person has more significant money management issues that SM alone cannot solve ![]()

(that's a joke, light hearted credit humor, not an aspersion directed at the OP or anyone else)

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Goodbye Sallie

@NRB525 wrote:

@Anonymous wrote:

@NRB525 wrote:If one is not carrying any balance, why does the APR matter?

Doesn't matter much to me. Caps are so low I couldnt see myself ever carrying a balance with this card even if I were inclined to carry any type of balance someday. But everyone is different. Might be a peace of mind thing for some people who knows

Maybe it simply feels good to see a lower APR vs. higher

I'm thinking more along the lines of, if one has to carry a balance on $250 of monthly grocery spend, maybe that person has more significant money management issues that SM alone cannot solve

(that's a joke, light hearted credit humor, not an aspersion directed at the OP or anyone else)

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Goodbye Sallie

@NRB525 wrote:

Of course, to the other side topic in this thread, I can see how SM would get in the way of trying to get through that $6,500 annual spend moat to get to the Old Blue Cash 5% or whatever the reward rate is on the other side

Easy = SM at 5% of the first Grocery/Gas dollar spend each month.

Hard = OBC with $6,500 spend moat to get to the good stuff.

No, the caps are so low on the SM that it really doesn't get in the way of the $6.5K spend We spend a lot of (real) groceries and don't want to have to track that we've spent $250 on this card for the month so switch to.., when the whole thing can be put on one card.

But again, I agree it's a great card for many people, but not everyone is the same!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Goodbye Sallie

OP did 2 things that are very unpopular at myFICO forums:

(1) Closing a card with no AF.

(2) Not loving SM.

I'm with OP. I'm all for closing any card that you're not benefitting from, and I don't care for SM that much (anymore).

GOOD RIDDANCE!

FICO 08 (4/9/2018): EQ 647 EX 609 TU 620

FICO 08 (10/16/2020): EQ 676 EX 659 TU 653

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Goodbye Sallie

@Skye12329 wrote:

I didn't know store cards could reduce the APR.

I see from your sig you have the Sears Mastercard too. I was able to get my APR reduced to 17.24% on mine. Might want to give it a shot if APRs matter to you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Goodbye Sallie

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Goodbye Sallie

@Anonymous wrote:

Also very unpopular is denouncing the SCT.

LOL. Well, that's because:

People think that they are tricking the system to get a card.

In reality, they are getting tricked into getting a card.

But they want to feel smart about it.

Just my opinion.

FICO 08 (4/9/2018): EQ 647 EX 609 TU 620

FICO 08 (10/16/2020): EQ 676 EX 659 TU 653

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Goodbye Sallie

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Goodbye Sallie

@Anonymous wrote:

Also very unpopular is denouncing the SCT.

(Gasps)... You SHUT your mouth right now. How dare you not love the SCT lmao!!!!![]()