- myFICO® Forums

- Types of Credit

- Credit Cards

- HOW WOULD CAPITAL ONE LET THIS HAPPEN!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

HOW WOULD CAPITAL ONE LET THIS HAPPEN!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HOW WOULD CAPITAL ONE LET THIS HAPPEN!

Long story short, got 2 cap one cards for my soon to be ex DW in january. I believe the platinum and QS1 with $300 limit each. 2 months later i logged in and asked for cli, and both was increased to $800. Since beginning of May, we are seperated so i stopped managing and helping her with her credit. She has everything maxed out, some comenity cards such as VS $1K balance / $1400 limit, fingerhut $1250/$1200 (overlimit) Walmart $550/$500 overlimit amazon $1350/$1300 (overlimit) so you get the picture..

Last month her cap one's were both around $850 balance over $800 limit, this month both balances are over $1600 with $800 limit. I was shocked to see that cap one would allow her to go over limit as much as they did, with the fact that since last month she started getting a lot of late payments on her fingerhut, belk, VS, and Cap one's. Has anyone ever gone over limit as much with Cap One, and if so, did they immediately close the account? She is already one month behind on her payment as well.

6/14/15: Equifax 576 Experian 542 Transunion 571

8/17/15: Equifax 626 Experian 619 Transunion 622

9/28/15: Equifax 655 Experian 636 Transunion 641

11/11/15: Equifax 698 Experian 687 Transunion 672

Short Term Goal Score: 720 Across the board

Take the myFICO Fitness Challenge

Are you free Tuesday..?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HOW WOULD CAPITAL ONE LET THIS HAPPEN!

I don't think Cap1 stresses over that small of an amount when they have such a great legal department and will make much more via a law suit and garnishment.

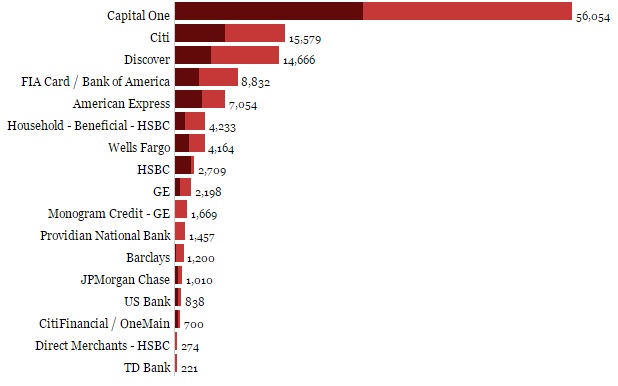

2005 - 2014 lawsuit stats (in Vegas alone)...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HOW WOULD CAPITAL ONE LET THIS HAPPEN!

@elim wrote:I don't think Cap1 stresses over that small of an amount when they have such a great legal department and will make much more via a law suit and garnishment.

2005 - 2014 lawsuit stats (in Vegas alone)...

Give how quickly they let people back in who file bankruptcy this does not shock me at all.

Cool find!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HOW WOULD CAPITAL ONE LET THIS HAPPEN!

I recommended Capital One to a friend. He received a 500 SL. He maxed the card out then stopped paying. I would see his minimum payment double each month but they cut his account off after 3 months or so. I don't think they allowed it to keep going to double his actual limit. I am not certain though because a new message stating the account was restricted and to contact them showed up after a few months had passed. They no longer showed how much was owed. Prior to that happening, they had a message saying they know hard times happen and to contact them while showing the increased balance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HOW WOULD CAPITAL ONE LET THIS HAPPEN!

Several years ago, my AU ran my Cap One over the limit by several thousand dollars with a rental car returned a month late. They confirmed that as long as I paid on time each month, they wouldn't close it. It took me almost a year to pay it off and they never blinked although they did call me constantly. It had no negative impact on my credit once it was paid back down.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HOW WOULD CAPITAL ONE LET THIS HAPPEN!

@KSK1912 wrote:Long story short, got 2 cap one cards for my soon to be ex DW in january. I believe the platinum and QS1 with $300 limit each. 2 months later i logged in and asked for cli, and both was increased to $800. Since beginning of May, we are seperated so i stopped managing and helping her with her credit. She has everything maxed out, some comenity cards such as VS $1K balance / $1400 limit, fingerhut $1250/$1200 (overlimit) Walmart $550/$500 overlimit amazon $1350/$1300 (overlimit) so you get the picture..

Last month her cap one's were both around $850 balance over $800 limit, this month both balances are over $1600 with $800 limit. I was shocked to see that cap one would allow her to go over limit as much as they did, with the fact that since last month she started getting a lot of late payments on her fingerhut, belk, VS, and Cap one's. Has anyone ever gone over limit as much with Cap One, and if so, did they immediately close the account? She is already one month behind on her payment as well.

Is this a joint or AU account? How are you able to follow what she is doing with her cards if you two are separated? If they are not joint or AU accounts, I recommend that you let her dig her own financial grave.

If they are not joint or AU, depending on your state you will not be responsible. I live in CA with the most liberal divorce laws, and spouses are NOT responsible for individual accounts in a divorce (even if they used community property to pay). Believe me I got burned by this rule big time.

Last app 09/21/2021. Gardening Goal Oct 2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HOW WOULD CAPITAL ONE LET THIS HAPPEN!

Anyways to your question, just like a persons fitness. They may eat unhealthy but look healthy. It will eventually catch up with you. So like the person above me said, let her dig her own financial grave.

Good riddance.

Total Credit Line- $89,300| Personal- $78,650 | Biz- $5,650

Current Score [F9]: EX-721 || TU-759 || EQ-768 || AAoA-2yrs7mo || uti- 1% || 100% payment history || 9 inq

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HOW WOULD CAPITAL ONE LET THIS HAPPEN!

Unless these are joint accounts, stay out of them. You gain nothing by keeping track of her finances. Manage your own.

Unless you're a joint account holder, you shouldn't be logging into them anyways. Great way to get yourself into trouble.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HOW WOULD CAPITAL ONE LET THIS HAPPEN!

@Anonymous wrote:Several years ago, my AU ran my Cap One over the limit by several thousand dollars with a rental car returned a month late. They confirmed that as long as I paid on time each month, they wouldn't close it. It took me almost a year to pay it off and they never blinked although they did call me constantly. It had no negative impact on my credit once it was paid back down.

But how did the rest of your credit report look like? Was everything maxed out or was it that one card only?

6/14/15: Equifax 576 Experian 542 Transunion 571

8/17/15: Equifax 626 Experian 619 Transunion 622

9/28/15: Equifax 655 Experian 636 Transunion 641

11/11/15: Equifax 698 Experian 687 Transunion 672

Short Term Goal Score: 720 Across the board

Take the myFICO Fitness Challenge

Are you free Tuesday..?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HOW WOULD CAPITAL ONE LET THIS HAPPEN!

@Random_idiot wrote:

Not to be rude or anything, but why are you following her spending? I get it that you feel entitled because you helped her, but you guys are separated. Its unhealthy.

Anyways to your question, just like a persons fitness. They may eat unhealthy but look healthy. It will eventually catch up with you. So like the person above me said, let her dig her own financial grave.

Good riddance.

Perhaps OP is privy to this info because, well they are going through a divorce and financials are discussed when coming to a divorce resolution. Either way it's not really relevant to the discussion or question. OP was simply asking a question, not for opinions on healthy habits.