- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Help with UT IL ?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Help with UT IL ?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with UT IL ?

@xerostatus wrote:I myself would probably pay off across all cards, in weighted amounts. The reasoning would be, to lower both the overall and individual util across the board, as I do recall there being some word about keeping util under around 90% to avoid getting the "maxed out card" designation.

Based on your numbers, I ran it through a quick excel analysis (I get bored at work =X):

Current Bal Limit Current Utilization Balance req. for goal util of 66% Payment Needed $ 11,680.00 $ 12,000.00 97% $ 7,920.00 $ 3,760.00 $ 2,800.00 $ 3,000.00 93% $ 1,980.00 $ 820.00 $ 4,400.00 $ 4,500.00 98% $ 2,970.00 $ 1,430.00 $ 2,700.00 $ 3,000.00 90% $ 1,980.00 $ 720.00 $ 580.00 $ 800.00 73% $ 528.00 $ 52.00 $ 2,900.00 $ 3,000.00 97% $ 1,980.00 $ 920.00 $ 1,100.00 $ 1,600.00 69% $ 1,056.00 $ 44.00 $ 1,800.00 $ 2,000.00 90% $ 1,320.00 $ 480.00 TOTAL PAYMENT $ 6,930.00 Can you enlighten me on the bol text. This is the first I am hearing of it. This is good to know. Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with UT IL ?

@destine2grow wrote:Can you enlighten me on the bol text. This is the first I am hearing of it. This is good to know. Thanks in advance.

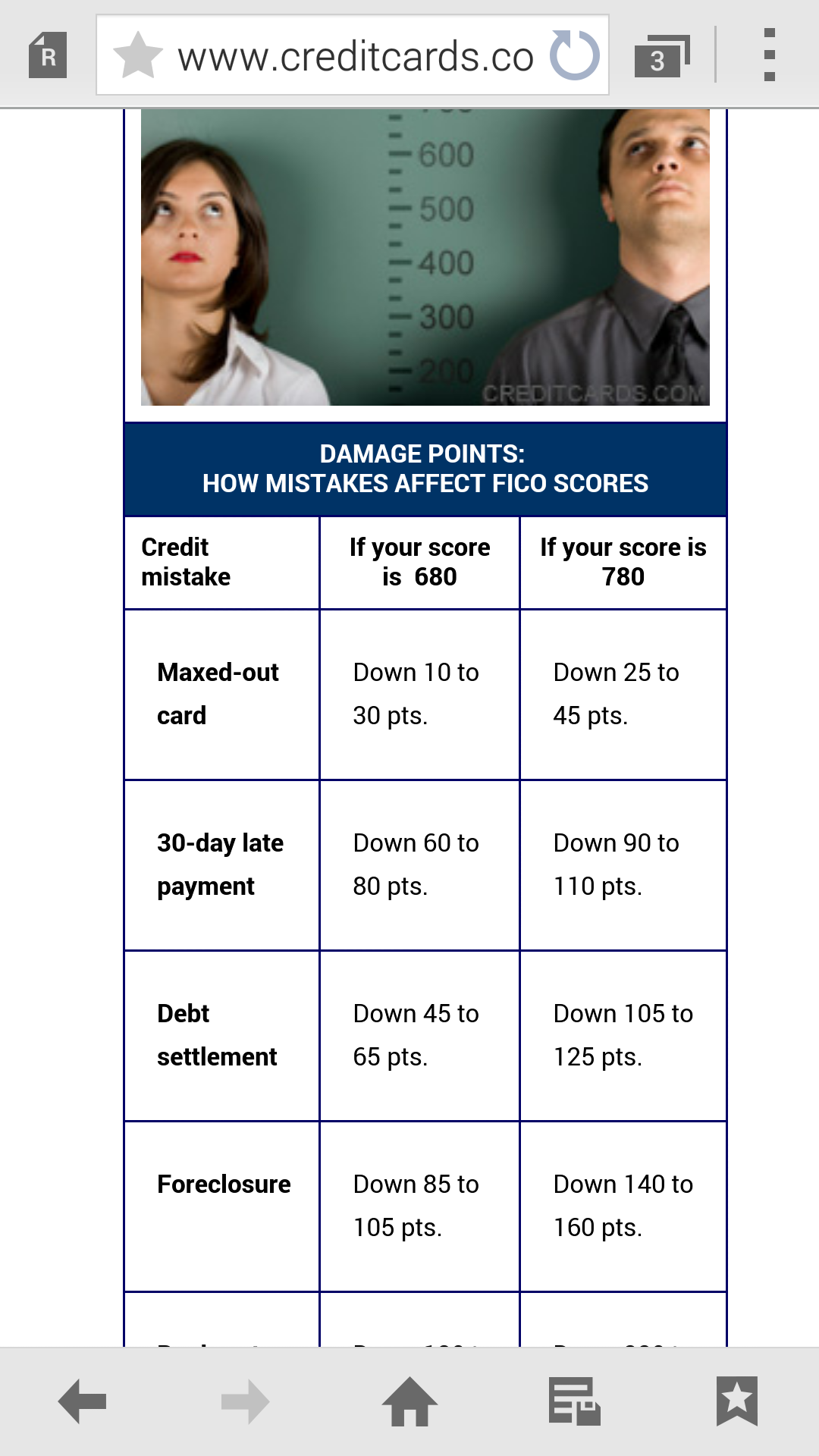

Any balances above 90% in individual account utilization is often viewed as being "maxed out", which would drag down your scores in some way or another. It is often said that this harms your score at a greater weight than otherwise.

i.e.

if you have two cards, $500 each, and you have a $450 balance on one of them.

Then your util would be:

450/500 = 90%

0/500 = 0%

Total: 450/1000 = 45%

The better scenario, solely for scoring purposes, is to spread the balance to avoid the 90% individual util:

225/500 = 45%

225/500 = 45%

Total: 450/1000 = 45%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with UT IL ?

@xerostatus wrote:

@destine2grow wrote:Can you enlighten me on the bol text. This is the first I am hearing of it. This is good to know. Thanks in advance.

Any balances above 90% in individual account utilization is often viewed as being "maxed out", which would drag down your scores in some way or another. It is often said that this harms your score at a greater weight than otherwise.

i.e.

if you have two cards, $500 each, and you have a $450 balance on one of them.

Then your util would be:

450/500 = 90%

0/500 = 0%

Total: 450/1000 = 45%

The better scenario, solely for scoring purposes, is to spread the balance to avoid the 90% individual util:

225/500 = 45%

225/500 = 45%

Total: 450/1000 = 45%

Thank you again! I am still learning and will keep this in mind.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with UT IL ?

@destine2grow wrote:

@xerostatus wrote:I myself would probably pay off across all cards, in weighted amounts. The reasoning would be, to lower both the overall and individual util across the board, as I do recall there being some word about keeping util under around 90% to avoid getting the "maxed out card" designation.

Based on your numbers, I ran it through a quick excel analysis (I get bored at work =X):

Current Bal Limit Current Utilization Balance req. for goal util of 66% Payment Needed $ 11,680.00 $ 12,000.00 97% $ 7,920.00 $ 3,760.00 $ 2,800.00 $ 3,000.00 93% $ 1,980.00 $ 820.00 $ 4,400.00 $ 4,500.00 98% $ 2,970.00 $ 1,430.00 $ 2,700.00 $ 3,000.00 90% $ 1,980.00 $ 720.00 $ 580.00 $ 800.00 73% $ 528.00 $ 52.00 $ 2,900.00 $ 3,000.00 97% $ 1,980.00 $ 920.00 $ 1,100.00 $ 1,600.00 69% $ 1,056.00 $ 44.00 $ 1,800.00 $ 2,000.00 90% $ 1,320.00 $ 480.00 TOTAL PAYMENT $ 6,930.00 Can you enlighten me on the bol text. This is the first I am hearing of it. This is good to know. Thanks in advance.

You keep this up I'll send you some spreadsheets I have to complete by the end of the week!

Super good job on the calculations!

BK 7 Dismissed: 5/2014 AAoA: 6 years Credit Scores (07-02-2015): My Privacy Matters: TU: 633 EX:658 EQ: 651

How to add pics to Signature

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with UT IL ?

@SusieQ wrote:I was in a similar situation recently. I first paid against any that were over 89% utilization to get them out of maxed out. I then started paying lowest to highest balance.

Reducing the maxed out ones gave me the biggest jump in score, followed by zero balances on a few others.

Hope this helps.

This was some helpful info. Thanks!

previously: EQ 578 TU 613 EX 614 - MyFICO 2/2015

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with UT IL ?

@Rlandon87 wrote:

OK I have about 7k cash to pay down balances on my CC'S.

I know this is impossible to know for sure but what is the best way to apply the 7000 on these card balances for the biggest FICO boost. I'm not worried about the interest rate or financial standpoint of things, strictly what will be the most feasible to attain the most FICO points.

11680/12000-

2800/3000-

4400/4500-

2700/3000

580/800

2900/3000

1100/1600

1800/2000

My thoughts were to eliminate as many balances as possible, but what if I applied the amount across all cards and brought as many as possible below 80%?

Congratulations on the new marraige! At this point, i don't see how you can receive much of a FICO boost of anything more than maybe a few points. From talking to credit analysts, anything over 80% is considered maxed. Anything over 60% they really don't like to see. At the moment, you have balances of $27,960/$29,900= 94%

After the 7k payment, can you pay that much monthly between you and your husband? I think that paying off as many as you can might give you more of a score boost than taking them down to 80% because you're getting hit per account being maxed, and for your over all credit having many cards with maxed balances.

It looks like you can pay these off:

2700/3000

580/800

1100/1600

1800/2000

That will cost $6180 and pay off 50% of your cards. Then you can apply the remaining $820 to the card you owe $2800/3000 on bringing that account to $1980/3000 = 66%

I think that if you're looking for a score boost, that might help the most. If you're looking at a home though, I don't know what the lender would tell you, so you might want to ask your questions in the Mortgage sub forum. I don't know that you'll get enough of a boost from any of this to get into that 640-680 range needed, but I might be wrong!

Another good thread to join is this one: The GREAT CC Payoff Challenge!!

Best wishes to you!

Goal Score: 700 Seedling again as of 07/29/14

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with UT IL ?

Loan officer told me to just get utilization to under 50% total, credit score over 640 and we would be good.

Now I'm torn between paying off multiple accounts or spreading the love to all of them and bringing them all down under maxed out...

I can afford 2000 a month towards payments. The issue isn't the long run, it's the next 60 days to get this loan pushed through. Financially I am stable, the only reason I have high balances are due to taking advantage of 0% and the high cost of giving my DW a nice wedding...

I'm a guy BTW ; )

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content